in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 1098-T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

My wife did a online program. We received a 1098-T with line 5 filled in. We did not receive any grants or scholarships and paid for it all. However, payment was through a third party. Why are we being taxed on that amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

If you received a 1098-T, and BOX 5 shows a scholarship there would seem to be money that she did get.

Based on the IRS: IRS on Scholarships

If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

- You're a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

- The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

So two questions:

- Was she a candidate for a degree?

- Were the tuition and fees greater than the "scholarship"?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

Thank you so much for the response. I’ll try to best explain the situation and the answers we’ve received from the parties involved and hopefully you can shed some more light on it. My wife took grad clasees online. The online company paid a university for the grad credit. Thus the university put a number in box 5 indicating that they received money from a third party (the online program). Box 1 and Box 5 match. Though the number is less than what we actually paid. The university even stated that they did not receive grant or scholarship monies but per the IRS if money is received from third party they have to put something in Box 5. As of now they are unwilling to amend the 1098-T. That being the case when reporting these numbers on turbo tax our taxes due go up by over $300. Box 1 and Box 5 are identical. Is there a way to correct this or contact the IRS indicating that no scholarship or grant money was received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

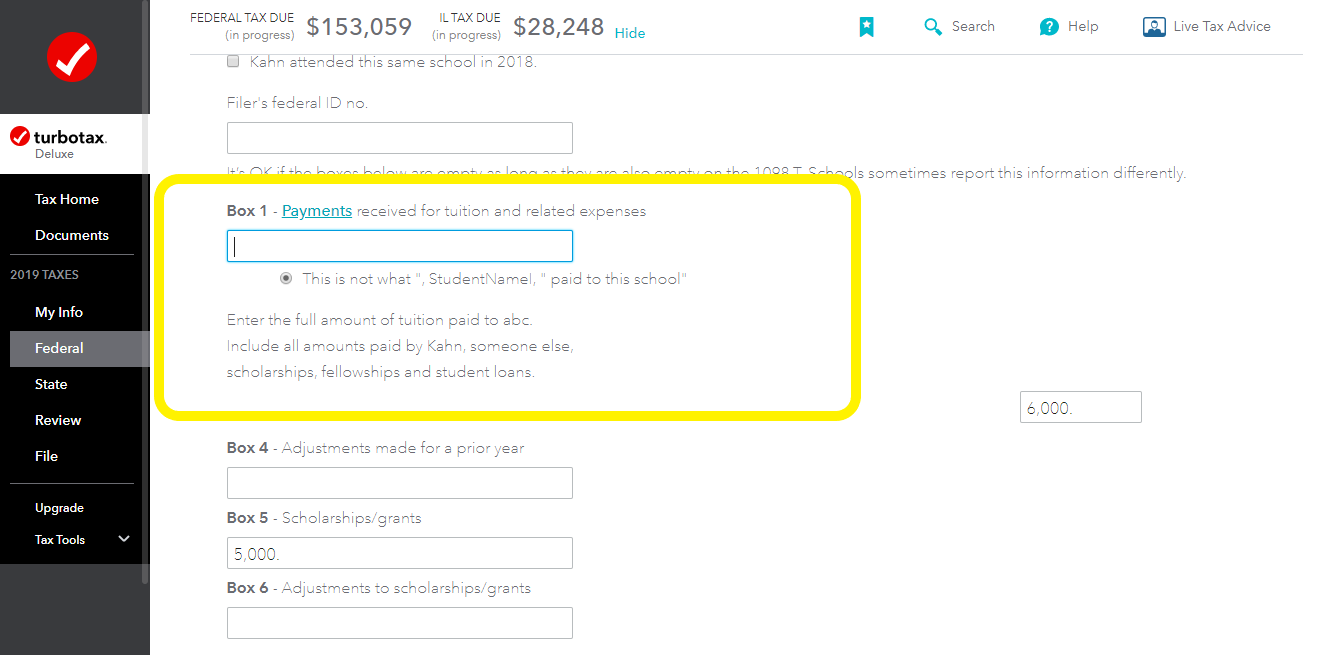

Yes, you can adjust the information on the Form 1098-T. If you believe the Form 1098-T is not reported correctly, you can adjust the tuition amount in box 1. Just make sure you will keep all records upon IRS's request for the substantiation. Here are the steps in TurboTax online:

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "1098t" and Enter

- Select Jump to 1098t

- Follow prompts

- On the screen, Type in the info from your 1098-T, check the box This is not what," Student' Name paid to school"

- Enter the actual amount you paid

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T

Thanks so much for that informative reply; I surely appreciate your able assistance. Please know that my effort to click on the icon did not result in a count, so I don't know whether it was accepted or not (sorry if it wasn't).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

twoenough

Level 2

aculyer

Level 1

in Education

Beautifulbrownsugar

New Member

in Education

j0mike1993

Returning Member

in Education

hhp94001

New Member

in Education