in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 1098-T Scholarship funds applied to last year's tuition

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

I paid a full year of my graduate program's tuition and then was awarded a full scholarship that back-paid my tuition. The scholarship also includes a hefty award for living expenses. Therefore, this year my 1098-T reported $20,000 paid toward tuition and related expenses, $4,200 adjustments made for a prior year (Box 4), and $81,000 paid in scholarships or grants. This amount includes crediting me for the $20,000 I paid in last year's tuition as well.

I am trying to file appropriately and reduce my tax burden as much as possible. I am confused about the adjustments for the prior year as the scholarship applied this year was directly used to refund my student loans that I had taken out to pay for the first year of the program, refunding the full cost of tuition. I know that I can reduce the amount I have spent on required books/supplies for the program, but am confused how best to approach the Box 4 adjustments and the prior year's tuition. Would it be best to file an amended return for last year showing what amount of the scholarship was applied to last year's tuition, or do I deduct the amount from the scholarship that went to tuition and related expenses manually from my own records and accounting and file it all on this year's return since it is when the funds were awarded? Any advice for handling the Box 4 adjustments?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

Please clarify which years you're referring to.

Did you pay in 2023 or 2024?

Is this what is on your 2024 Form 1098-T

Box 1 20,000

Box 5 81,000

Box 4 4,200

Is the 20,000 in Box 1 20,000 ADDITIONAL Paid in 2024 for classes in 2024 or 20,000 that you originally paid?

When you say "back-pay" did it back pay for expenses you paid in the same year or a previous year?

I THINK you're saying you paid in 2023 and the scholarship posted on the 2024 Form 1098-T is including the 20,000 that was reimbursing you for the 20,000 you paid in 2023.

If yes, then was there was another 20,000 tuition for 2024?

Did you get an education credit for tax year 2023?

And what is the 4,200 adjustment for?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

Yes, for 2024, my 1098-T has the following:

Box 1 20,000

Box 5 81,000

Box 4 4,200

Box 1 refers to the tuition paid in 2024. However, part of the scholarship funds reported in Box 5 were used to pay my tuition from 2023, another $20,000. So, a total of $40,000 went directly toward tuition from the $80,000 reported in Box 5.

I don't know what the $4,200 adjustment was for. My financial aid office said they can't tell me details on how it is calculated.

I claimed Lifetime Learning credits in 2023.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

Ok, so of the 81,000 20,000 went for 2023 tuition and 20,000 for 2024 tuition.

Did you only have 20,000 2023 tuition?

Are there additional expenses like books and supplies for 2023 and also for 2024?

Do you know how much expenses you had for the lifetime learning credit?

You can look at your 2023 Form 8863 Part II line 10

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

Yes, $20,000 is the full tuition for 2023. There were additional expenses for books and supplies, around $1000 in 2023 and $2000 in 2024 (I'm rounding for discussion purposes here but I have the exact amounts in my records for filing).

The expenses for the Lifetime Learning Credit in 2023 were $9,197.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T Scholarship funds applied to last year's tuition

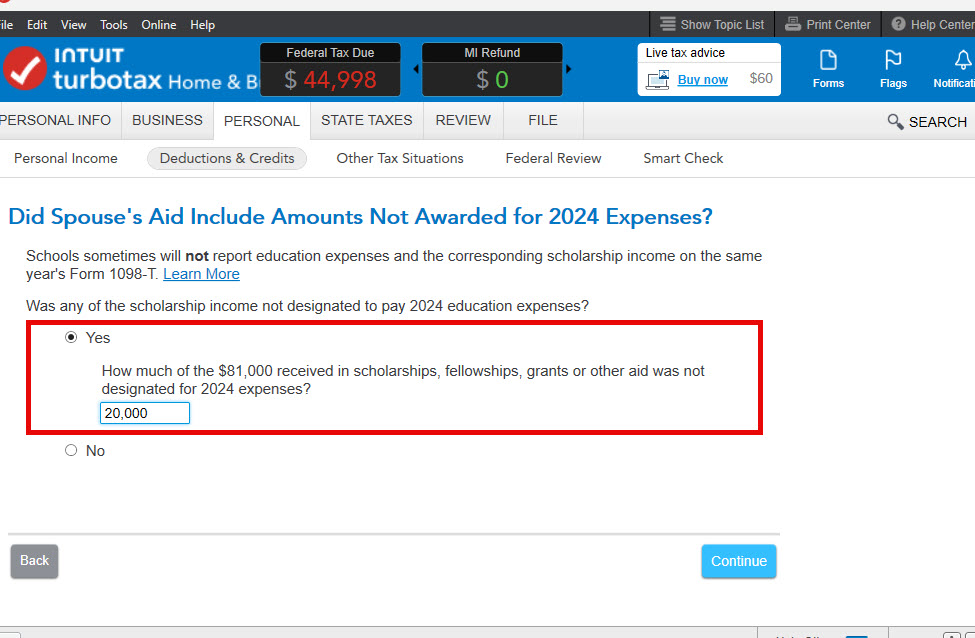

For the 2024 1098-T entry, enter the form and continue through the interview.

There is a screen that asks "Did your Aid Include Amounts Not Awarded for 2024 Expenses?

Select "Yes" and enter the 20,000 that was applied to 2023.

(If you have difficulty finding the screen after you enter Form 1098-T, return to Deductions & Credits, EDUCATION, Expenses and Scholarships, UPDATE,

Edit for the student, Scholarships/Grants (for all schools) EDIT Continue to the screen)

You used expenses in 2023 to get the Lifetime Learning Credit, but received a scholarship in 2024 to cover those expenses, so you don't pay tax on the 20,000 but you may need to "pay back" some of the credit. I think that is what is reported in Box 4 as an adjustments.

TurboTax will help you determine what you need to claim for the "Credit Recapture".

The Credit Recapture is based on your 2023 return, but reported on your 2024 return.

Because the Lifetime Leaning Credit is NON-REFUNDABLE, the value of the credit (what you need to pay back in 2024) will be limited to your tax liability in 2023. In other words, if you did not work and did not have taxable scholarships, you would have had no tax liability and therefore, even if you were eligible for that credit, it would have been useless.

Keep that in mind as you go through the calculations.

IN TURBOTAX type education recapture into the search-box

Click the "Jump to education recapture" link

Have a copy of your 2023 tax return on hand.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

Vermillionnnnn

Returning Member

in Education

Liv2luv

New Member

in Education

Taxes_Are_Fun

Level 2

Taxes_Are_Fun

Level 2