- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

For the 2024 1098-T entry, enter the form and continue through the interview.

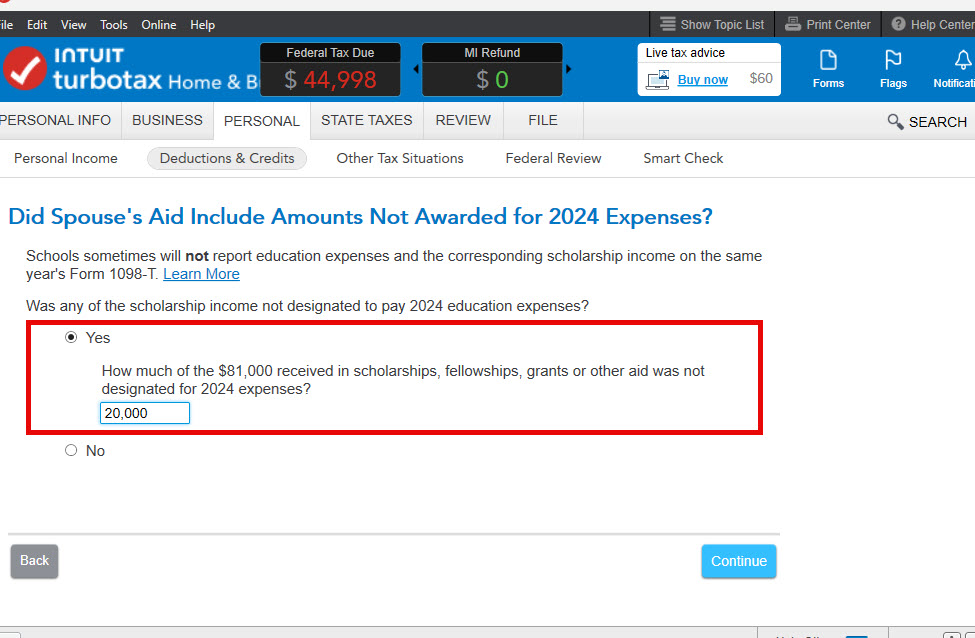

There is a screen that asks "Did your Aid Include Amounts Not Awarded for 2024 Expenses?

Select "Yes" and enter the 20,000 that was applied to 2023.

(If you have difficulty finding the screen after you enter Form 1098-T, return to Deductions & Credits, EDUCATION, Expenses and Scholarships, UPDATE,

Edit for the student, Scholarships/Grants (for all schools) EDIT Continue to the screen)

You used expenses in 2023 to get the Lifetime Learning Credit, but received a scholarship in 2024 to cover those expenses, so you don't pay tax on the 20,000 but you may need to "pay back" some of the credit. I think that is what is reported in Box 4 as an adjustments.

TurboTax will help you determine what you need to claim for the "Credit Recapture".

The Credit Recapture is based on your 2023 return, but reported on your 2024 return.

Because the Lifetime Leaning Credit is NON-REFUNDABLE, the value of the credit (what you need to pay back in 2024) will be limited to your tax liability in 2023. In other words, if you did not work and did not have taxable scholarships, you would have had no tax liability and therefore, even if you were eligible for that credit, it would have been useless.

Keep that in mind as you go through the calculations.

IN TURBOTAX type education recapture into the search-box

Click the "Jump to education recapture" link

Have a copy of your 2023 tax return on hand.

**Mark the post that answers your question by clicking on "Mark as Best Answer"