- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where is the Depreciation deprecation section for business Start Up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the Depreciation deprecation section for business Start Up?

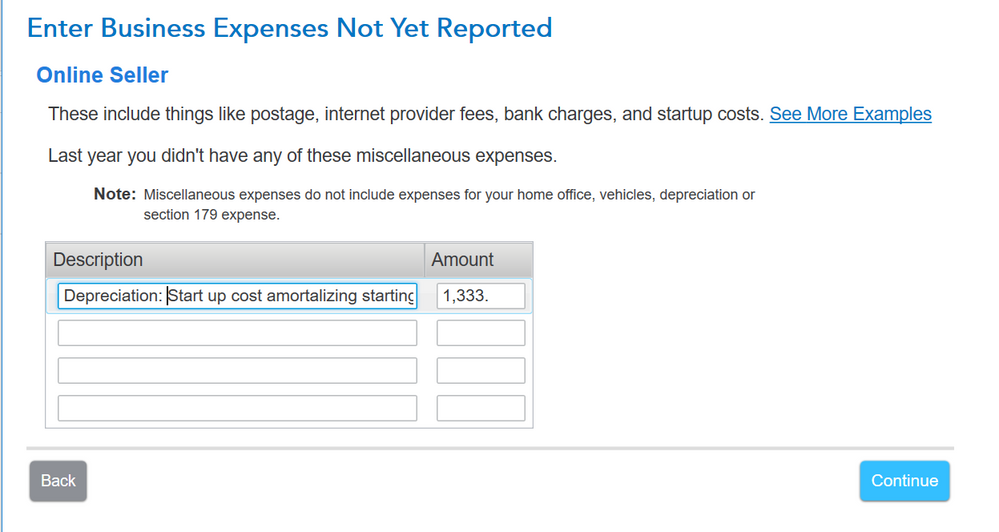

I'm trying to amortize my Start-Up cost, which is $25000. I understand I'm supposed to use the Depreciation to report the remaining cost over a period of 180 months. I can't seem to find the Depreciation section to report that. Do I just use the "Enter Business Expenses Not Yet Reported" for it and just label it "Deprecation"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the Depreciation deprecation section for business Start Up?

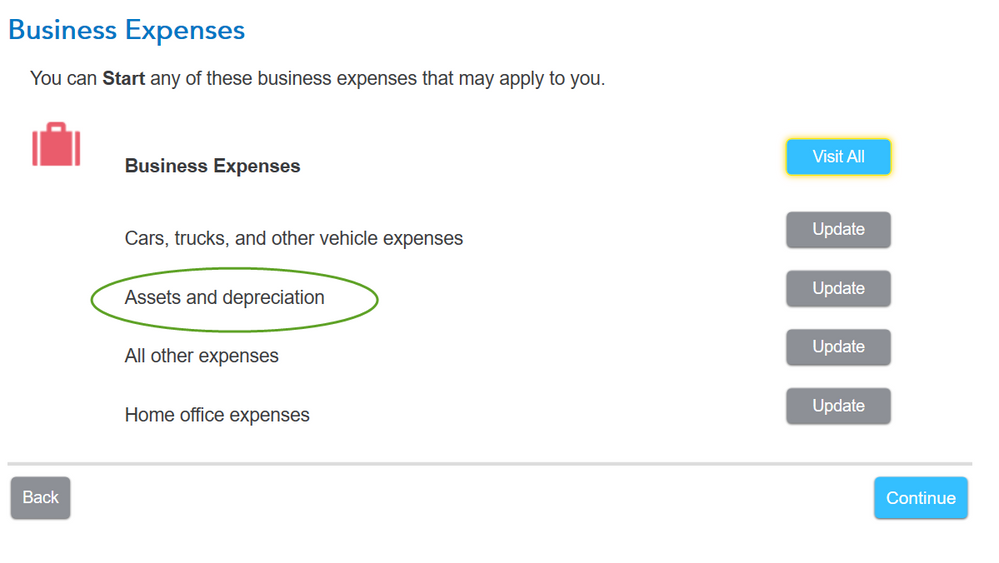

Just blindly following the walkthrough didn't lead me to it. So I kept hitting "Visit All" but it didn't hit me that one of the walkthroughs questions had depreciation. It's not until I read through each thing under "Visit All" that I noticed "Assets and depreciation". Just click on the "Update" button next to it and say "Yes" and you'll be walked through to enter the depreciation for the start-up cost and it'll automatically calculate it for you for 180 months.

It's under Business Expense > Assets and depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the Depreciation deprecation section for business Start Up?

Just blindly following the walkthrough didn't lead me to it. So I kept hitting "Visit All" but it didn't hit me that one of the walkthroughs questions had depreciation. It's not until I read through each thing under "Visit All" that I noticed "Assets and depreciation". Just click on the "Update" button next to it and say "Yes" and you'll be walked through to enter the depreciation for the start-up cost and it'll automatically calculate it for you for 180 months.

It's under Business Expense > Assets and depreciation

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

Kenn

Level 3

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

zakladams

New Member

justine626

Level 1