- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do I enter 1099s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

What kind of 1099? 1099S, 1099Misc, 1099R etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

I passed by the opportunity to have TurboTax fill in my 1099 forms and cannot get back to that page. Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

1099 misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Do you need to report 1099s that you received or do you want to create 1099s for business's contractors? And are you using TurboTax Online or the desktop program? @cwesp

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

I have sold the family farm and have a 1099S. How do I get to the entry location in Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

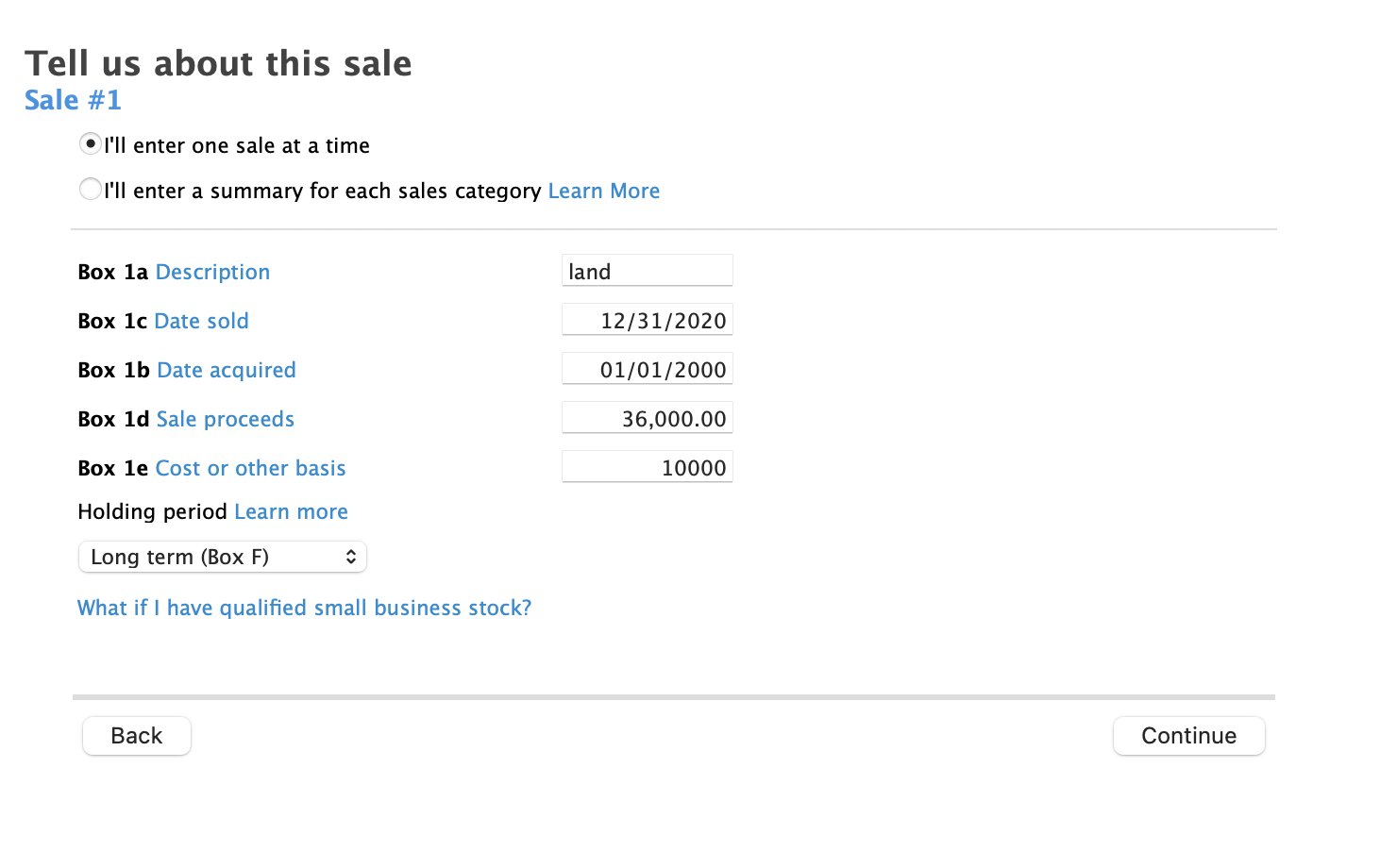

Enter the 1099-S in the Stocks, Mutual Funds, Bonds and Other interview in Personal > Personal Income > Investment Income - the interview assumes you will have a Form 1099-B, but this is where you enter a Form 1099-S.

There is no special interview in TurboTax for Form 1099-S - it is entered in the Stocks, Mutual Funds, Bonds and Other interview of Investment Income and is not a Form 1099-B.

In the Stocks, Mutual Funds, Bonds and Other interview, answer "No" when asked "Did you get a 1099-B or other brokerage statement for these sale?" Then, enter the "farm" sale information from the 1099-S.

In desktop versions of TurboTax, the screen looks like the following:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

1099s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Please provide clarification on exactly what you might need assistance with.

- Do you need to complete a Form 1099S for the IRS and buyer?

- Do you need to add the sale of real estate you had and received a 1099S?

- Do you need to include income on your tax return that is from various 1099s (1099-INT, 1099-DIV, 1099-DIV)?

Once we have the information to help you one of our tax experts is ready to provide the answers. Some of the article below may be helpful.

- Where do I enter 1099-DIV?

- Where do I enter 1099-INT?

- Where do I enter 1099-B?

- Where do I enter 1099-S?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

I have a 1099s from state for a eminent domain sale of a small piece of my farm do I enter it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

one I received

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Yes. Compensation received through an eminent domain proceeding is subject to the same tax treatment as the proceeds of any other sale of real estate. It's unlikely their is a cost basis for the parcel you received the eminent domain proceeds. You can try to arrive at a cost basis by figuring out the land value and then dividing by acreage. The value of the land and buildings could be obtained from the Tax Assessors office for your county. Once the percentage is found for the land then use that on the total cost of the land portion of the property.

The entry will be a sale of Investment. Per the IRS instruction for holding period: Holding period. IRS Publication 544

- Long term: held more than one year (one year plus one day)

- Short term: held one year or less

- Open or continue your return (you can choose the Search box and type 'sale of second home' then use the Jump to link to enter your inherited sale) or follow the menu.

- Under Wages & Income scroll to Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Answer Yes on the Did you sell any stocks, mutual funds, bonds, or other investments in 2021? screen

- If you have other sales on the Your investment sales summary screen, select Add More Sales

- On the OK, let's start with one investment type screen, select Other, then Continue

- On the Tell us more about this sale screen, enter the name of the person or institution that brokered the sale

- On the next screen, select Other, then continue to enter your sale.

An article that may be helpful is included also.

Please update here if you need further assistance.

[Edited: 02/27/2022 | 12:12p PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Sale of Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

Please see my answer here for entry help. It has the pictures and instructions. Each asset must be disposed of individually. All other assets will be sold for $0 since only the house and land sold for money.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter 1099s?

I received a 1099S for sale of rental property but do not find where to input this information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

h_c2021

New Member

marcusschell

New Member

kllee2022tbt

New Member

dlipps

Level 3

sturbo44

Returning Member