- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- TurboTax Form 3800 - Business Credit Allowed is Zero?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Form 3800 - Business Credit Allowed is Zero?

Good afternoon!

I worked with CPA last year, and this year I've decided to come back to TurboTax for my tax filing. In 2021, I had a carryover from business R&D Credits that I was wanting to apply to this year's filing; unfortunately, after filling out the Form 3800 details within TurboTax, I'm receiving a message within TurboTax saying:

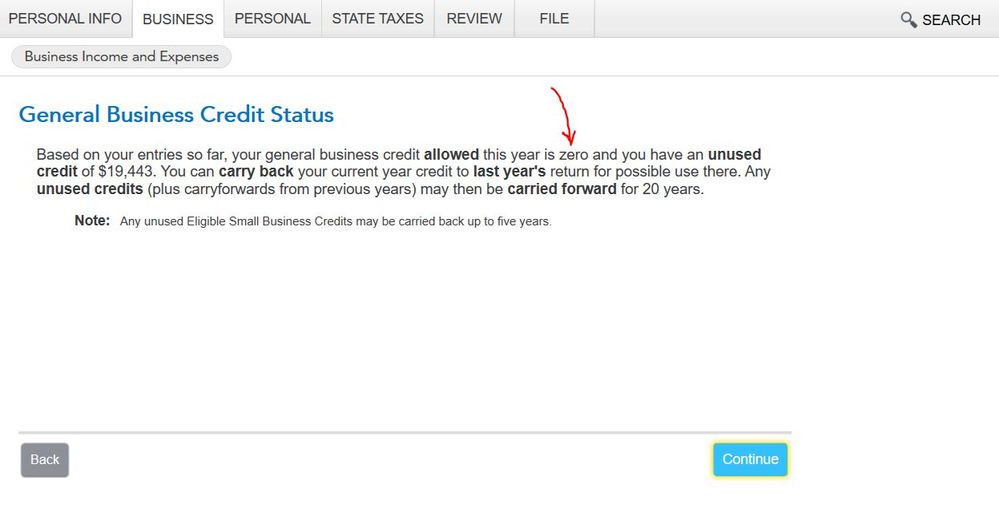

"Based on your entries so far, your general business credit allowed this year is zero and you have an unused credit of $19,443. You can carry back your current year credit to last year's return for possible use there..."

I'm a little confused what this is referring to. From 2021, I had a fairly substantial credit to be carried over to 2022 due to federal and state credit limits (meaning that these values would carry over to 2022). I am not sure why TurboTax is indicating that I am allowed zero credits for this year. The only thing that I can think is that TurboTax doesn't have a history of my Form 3800 and Form 6765 from last year as a reference, and as such it doesn't know what to do how or to attribute my Form 3800 documentation.

I'd love to hear from any of you that may have some insight into this Form 3800 limitation, and maybe suggestions for how it may be remedies so that I don't lose this credit in moving back to TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Form 3800 - Business Credit Allowed is Zero?

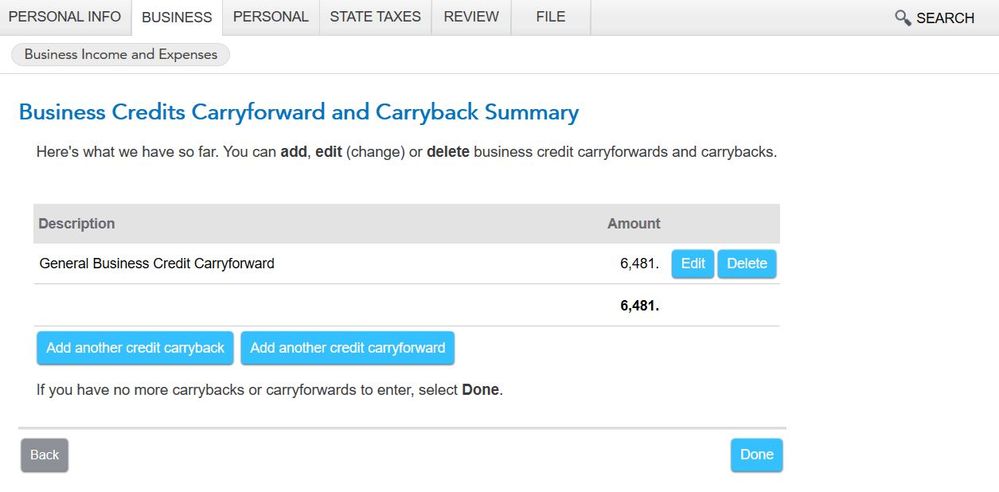

If you enter the business credit carryforward it should give you the credit. Did you enter under General Business Credits? See screen below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Form 3800 - Business Credit Allowed is Zero?

Thank you so much for your response here. I did add the carryforward in this location.

In addition these details, the TurboTax guide continues with additional questions, including the actual Form 3800 sheet where I have this same value indicated as a carryforward.

After completing that sheet, it then shows that I have "zero" credit allowed this year.

It all seems rather strange. The only thing I can think of is that because I filed with a CPA last year, TurboTax doesn't have the 2021 record of the Form 3800 and Form 6765 where the allowed credit was applied to 2021 and the carryforward amount was referenced.

If you have any suggestions as to why TurboTax would be indicating that I have "zero" allowed credit based on what's described above, I'd love to hear it.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Form 3800 - Business Credit Allowed is Zero?

The General Business Credit can only be applied to your tax liability. It is possible that you do not have a tax liability so the business credits can't be used in the current year so they will carry forward. This credit is considered a "nonrefundable credit" so it can only reduce your tax liability to $0, so before the credit is applied you are already at $0 tax liability, so the credit can't be used.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margomustang

New Member

yibanksproperties

New Member

Mary625

Level 2

risman

Level 2

evltal

Returning Member