- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- TurboTax doesn't seem to offset my taxes owed when I lost money in my business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax doesn't seem to offset my taxes owed when I lost money in my business

I have a job where I get W-2, investment income with capital gains, and single-member LLC. After submitting my W-2, investment income I owe about $1k in taxes. After submitting my business income and expenses my business incurred a lost of $4k from consultation, fees, advertisement, etc. I was expecting the taxes owed to drop significantly but to my surprised it was unchanged. What's going on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax doesn't seem to offset my taxes owed when I lost money in my business

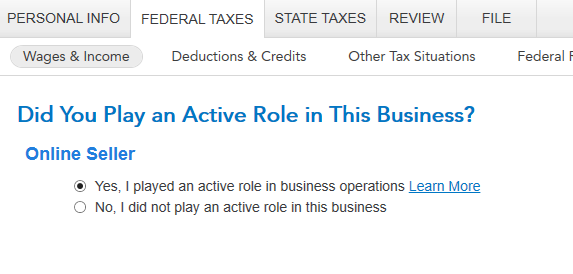

Thanks for the tip. I went back to the Business section where Sch C is. I figured the Active Role might be cause so I change the answer from "No" to "Yes". Right after I selected "Yes" it was able to offset my entire tax owed with some tax return back. The reason I selected "No" before was because I really don't spend much time on this business because its automated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax doesn't seem to offset my taxes owed when I lost money in my business

A couple of thoughts:

- Have you actually looked at your return to understand what your Schedule C looks like?

- You need to go through the TT questions and make sure you answer the question about at-risk correctly. You need to make sure you check the box where it asks if all of your investment is "at-risk".

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax doesn't seem to offset my taxes owed when I lost money in my business

Thanks for the tip. I went back to the Business section where Sch C is. I figured the Active Role might be cause so I change the answer from "No" to "Yes". Right after I selected "Yes" it was able to offset my entire tax owed with some tax return back. The reason I selected "No" before was because I really don't spend much time on this business because its automated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joebisog

New Member

amyonghwee

Level 4

MaxRLC

Level 3

MaxRLC

Level 3

scatkins

Level 2