- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Transferring K1 information to form 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transferring K1 information to form 1040

Using premier do I enter on form 1040 business income or loss (line 1) and line 2 net rental income on 1 K1 form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transferring K1 information to form 1040

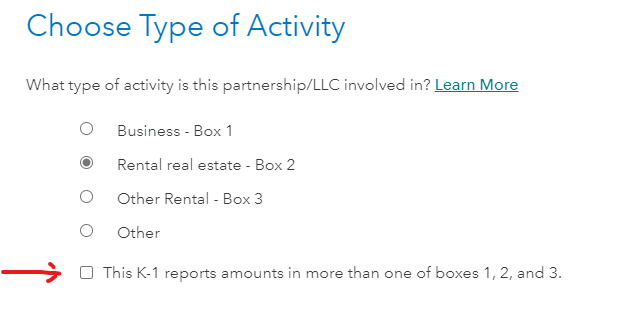

In both TurboTax Online Premium and TurboTax Desktop Premier, at the screen Choose Type of Activity, select This K-1 reports amounts in more than one of boxes 1, 2, and 3.

The instructions read:

Since your K-1 reports amounts in more than one of boxes 1, 2, or 3, the partnership/LLC is involved in more than one type of activity. You should treat each activity separately in TurboTax.

Enter the business activity amount, box 1, on one K-1

Enter real estate rental activity amount, box 2, on another K-1

Enter other rental activity amount, box 3, on a third K-1.

Enter the IRS Schedule K-1 by following these directions.

- Down the left side of the screen, click on Federal.

- Down the left side of the screen, click on Wages & Income.

- Scroll down to S-corps, Partnerships, and Trusts and click the down arrow to the right.

- Select Start/Revisit to the right of Schedule K-1.

- At the screen Tell us about your Schedule K-1, you tell the software which Schedule K-1 you received.

- For several screens, you will be entering data right off the K-1 form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jim-gullen

New Member

Mick88

Level 1

saxymusiclady

New Member

tomc0035

Level 2

mikereynolds72

New Member