- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: turboxtax doesn't validate Employer Match for solo 401(k)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turboxtax doesn't validate Employer Match for solo 401(k)

When figuring out the maximum employee and employer match for solo 401(k), I entered a huge number, like $500, 000, turbotax doesn't seem to catch this error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turboxtax doesn't validate Employer Match for solo 401(k)

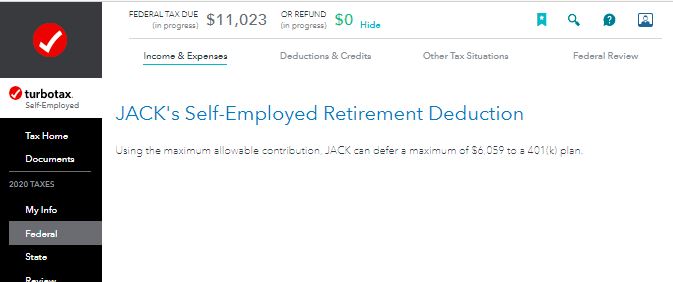

TurboTax will calculate the maximum amount you can deduct if you check the box for the Maximizer. If your entry is too big, you will be prompted of the excess contribution. See Below,

If you overcontribute to a retirement plan in any tax year, you have put more money into the plan than you are allowed to based on the circumstances of your return. You must withdraw any excess contribution by the due date of your return, or else you may have to pay a penalty. Adjust the contributions on your tax return by any amount withdrawn.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turboxtax doesn't validate Employer Match for solo 401(k)

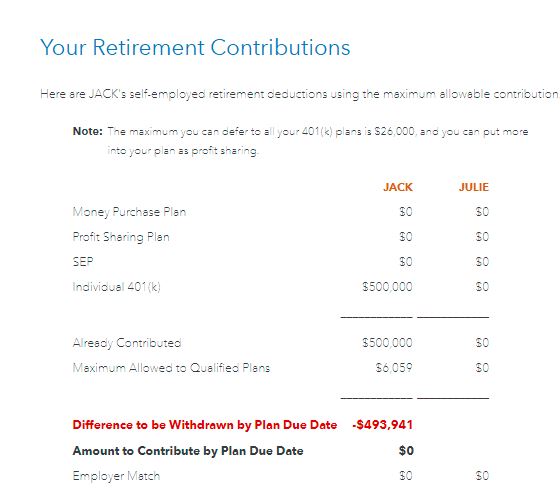

@MaryK4 Thank you for your response. What I was reporting is about "Employer Match". I uploaded a screenshot so you can see TurboxTax allowed me to enter $500,000 as Employer Match without any warning or error. I was trying to figure out based on the net business profit, what is the maximum employee contribution and max employer match. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turboxtax doesn't validate Employer Match for solo 401(k)

@liesheng As @Mary1101's screenshot indicated above, on the next screen TurboTax should tell you what your Max Contribution Amount is, and what amount needs to be withdrawn from the $500,000 entered.

In the Maximize function TurboTax assumes a base contribution rate of 25% which results in the rate from the Rate Table for Self-Employed of 20%.

However, if you contribute to an employer plan at work, or make other IRA or Roth contributions, you may need to calculate the Max Contribution Amount yourself.

If this applies to you, this link gives info on Calculating Self-Employed Max Retirement Contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

turboxtax doesn't validate Employer Match for solo 401(k)

@naru Thank you for your reply. I saw @MaryK4 's screenshot. In her screenshots, Turboxtax warns you if you entered excessive contribution for your Elective Deferrals (or Catch-up Contribution). The problem I was reporting is for "Employer Match" part as you can see in my screenshot. If you enter excessive amount in "Employer Match", turnbox doesn't warn you at all. My screenshot is the last screen for "Your Retirement Contributions".

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Abhishek Bhatia

New Member

abbasmomin786

New Member

sarabhenshaw

New Member

melissa-allysa

New Member

Dan_Iles

New Member