- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: TurboTax does not recognize the new treatment of Losses per the CARES Act

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

You will not be able to file for free. Go to search and type "jump to nol" and turbo tax will automatically tell you to upgrade to Premier. There you can manually enter any NOL amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

Thanks. Some people have written that I should be able to do this in the Home and Business version. Can you please confirm which one I will be required to use in order to enter the Mutual Fund transactions and the NOL?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

And then it asks for an explanation. Do I need to say "because Turbo Tax can't figure it out so we have to manually compute the NOL", or "?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

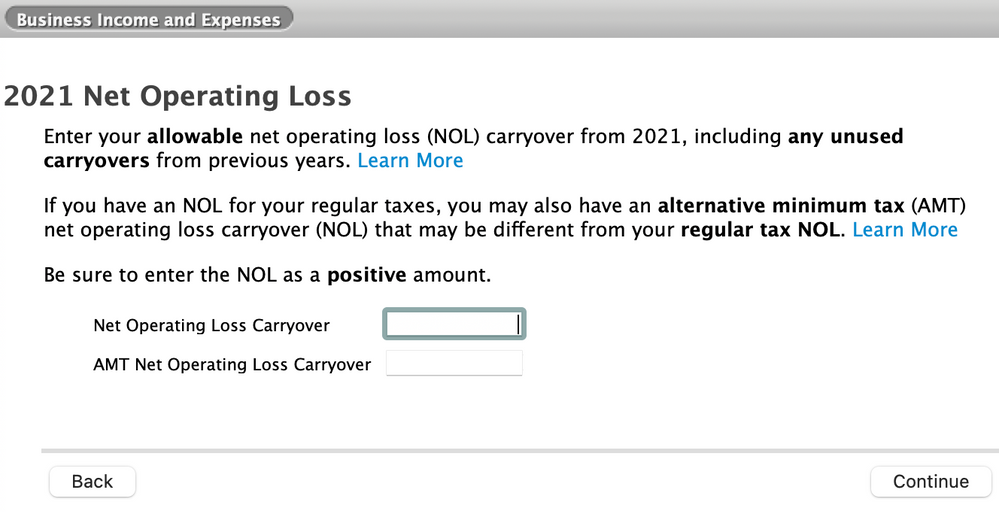

I've been working with Turbo Tax Home and Business.

I"m a sole proprietor with NOL from previous years.

My previous accountant tells me I have a NOL to use this year of -9,661. (I can't seem to figure it out myself using the sample worksheet in the government publication 536.)

I entered -9,661 at the correct space ("Less Common Business Situations" - NOL).

But at the final Review step I'm alerted to two errors on a worksheet that I have no direct access to. The items are Passive Operating Loss and QBI Passive Operating Loss.

For these two items, Turbo tax alerts me that my actual 2021 $-13,795 business loss (Schedule C), which has been automatically entered into these boxes, "cannot be greater than -9,661" and it wants me to correct these boxes in the worksheet.

1. To correct it, should I manually override what the program has done on the worksheet, using the Review

"Errors" screen, and just enter -9,661 (instead of the loss actually it is showing from Schedule C?) for both boxs?

2.If I do this, will I be told what my new carry-forward amount will be for next year?

3.Should I be using a different Turbo Tax edition instead of TurboTax Home and Businessto deal with NOL?

4.If I were to subscribe to the Live Help Deluxe (for a single Sole Proprietorship with NOL and Depreciation) would this be a better option?

5.Is this something Turbo Tax simply cannot do, should I forget TurboTax and keep paying big fees to a CPA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

Well, your statement regarding "or should I forget about Turbo Tax and just keep paying a CPA to do my taxes" is the single most intelligent thing I have seen in these comments. Turbo Tax did absolutely NOTHING but keep referencing "UPGRADE TO..." with every question I posed with regards to NOL. Turbo Tax CANNOT figure and does NOT carry forward the NOL. I use TT Business for my LLC (taxed as a partnership with two members which Turbo Tax says you can't do but when you read the IRS publications, IT CAN BE DONE). I generate K1's and then use Deluxe to file my personal taxes. I do not have any other income, not stocks or anything else and Turbo Tax's EPERTS still insist I upgrade to Premium, or whatever. You must figure out the NOL yourself using the worksheet from Pub 536. I believe you can also figure out the QBI with that Publication as well but don't quote me on that. It is a pain in the butt, but it is do-able. I only read the publication a dozen times and did the worksheet a couple times until it made sense. Because of their "EXPERTS" and the "You need to UPGRADE" crap, this is my LAST YEAR with Turbo Tax. I am pretty fed up. Cost me $300 bucks AND 3 weeks of precious time (I also had a number of issues with software bugs - Deluxe 2020 would not talk with 2021, Business 2021 kept trying to open Deluxe 2020 and 2021 files, and NONE of their "Tech Experts" could figure that out either. ) Spend the money, do the leg work and have a CPA do your business taxes or move to H& R Block like I will next year. Keep working on your returns. You can figure it out with the Pub 536, but it takes patience. If you have anymore questions, Ill try to answer as best I can. I am NOT and EXPERT, but I was able to do it. Best of Luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

Dear Papa Opah,

WOW! You lost 3 weeks?!? I was angry at 1.5 lost weeks. THANK YOU for letting me know I"m not crazy and incompetent.

I will give the Government NOL publication one more try, but if TurboTax still tells me I have errors, I will get an extension and find another CPA to do it. I hope they will be more careful than the last two who both made major major mistakes that I caught and had to correct when I reviewed the papers -I'm not even talking about NOL, I never did figure that out, just had to trust them... I greatly appreciate your reply. Thank you and good luck for you, too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

Yeah, TT is a POS! $150 for the business edition, another $50 for Deluxe, they don't even talk to each another, and don't help you with NOL! Hopefully H&R Block does a better job... we'll see next year! Good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

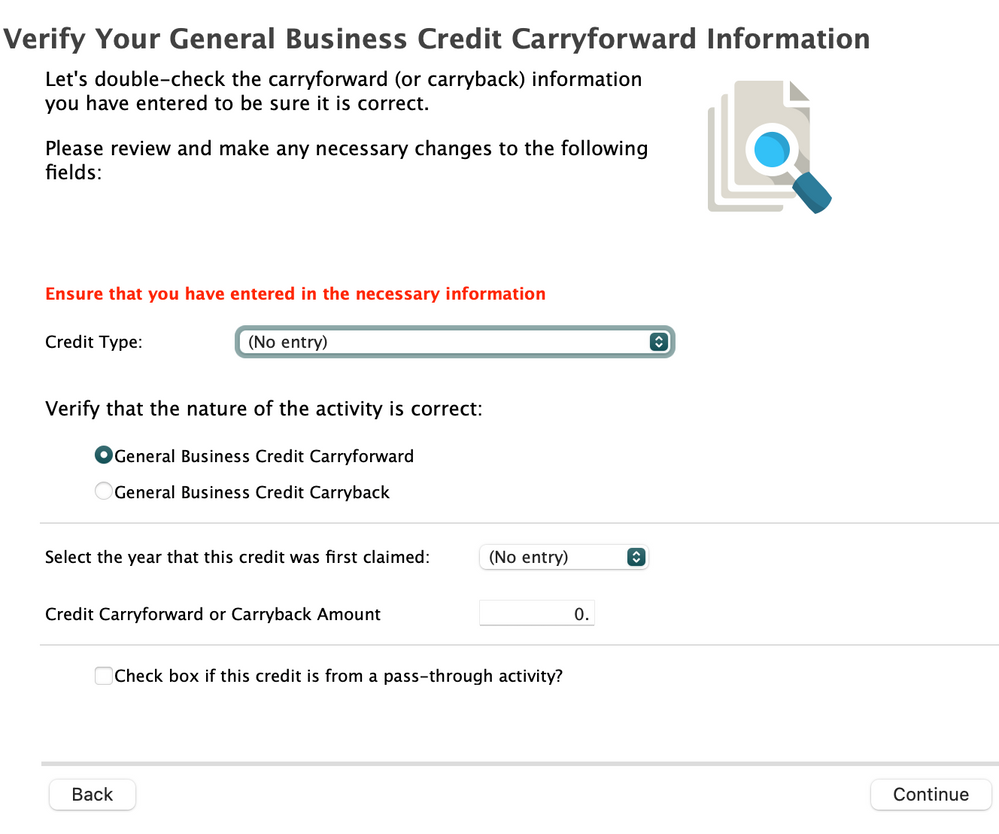

I have a similar issue. I thought the NOL was the AGI, but its not.

I cannot figure out the NOL. When I go back and put in a zero, the Smart Check - Fix Errors won't let me put in Zero, and move forward without selecting something from the dropdown lists.

I do not have an answer for those dropdown lists.

I went back to the Business NOL and it doesn't allow for delete either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

Assuming you don't have NOL or General Business Credit Carryforward, then follow the steps below to delete these carryforward schedules from your return:

Before deleting, review your 2021 tax return to confirm that you did not have either NOLs or General Business Credit (GBC) Carryforward. The GBC would have been reported on Form 3800.

Click on the Tools Center,

- Tax tools (on the left menu bar)

- Tools

- Delete a form

Find form 3800 in the list and delete the form.

Repeat these steps to delete the NOLS carryforward if they are not applicable.

Once you have finished deleting the desired form(s) click the Continue with My Return box (in the lower right of your screen).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

@HopeS ,

Thank you so much for your clear answer.

My 2021 TurboTax return does not have a Form 3800, so I guess I don't have a NOL.

I have the Mac Desktop version of TurboTax Home & Business.

I cannot find (even in Help) Tax Center, Tax Tools, or Delete Form.

I hope someone can help me Delete Form 3800 on my 2022 taxes.

Thanks in Advance,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

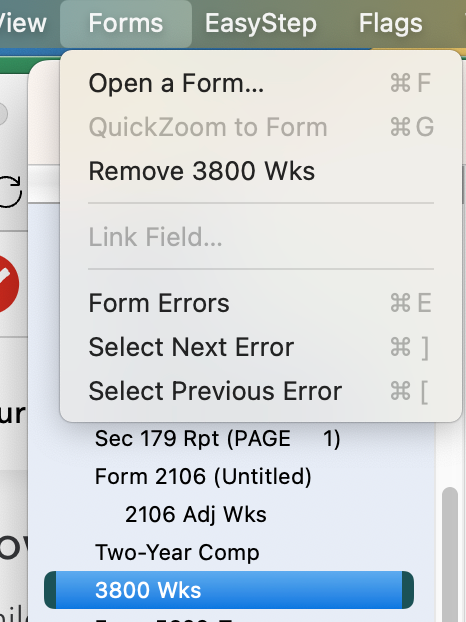

I found How to Delete Form

How do I delete a tax form in the TurboTax CD/Download software? (intuit.com)

Delete Form is called Remove Form

You have to select the Form that you want to delete/remove then go up to the top menu bar Forms, and Remove Form now appears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NOL Carryforward worksheet or statement

@lizzygee wrote:

My 2021 TurboTax return does not have a Form 3800, so I guess I don't have a NOL.

I hope someone can help me Delete Form 3800 on my 2022 taxes.

Form 3800 has nothing to do with a NOL. That is for a business/rental tax credit.

If you have negative AGI, you might have a NOL.

Why do you want to delete Form 3800? It seems to indicate you might have a business or rental tax credit.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noodles8843

New Member

hung05

Level 2

xiaochong2dai

Level 3

jeannnie

New Member

rodiy2k21

Returning Member