- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: MWP error - link to schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MWP error - link to schedule C

Why am I getting the error message, " A link to schedule C should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MWP error - link to schedule C

TurboTax is working to resolve the issue. Workaround: If the income was from self-employment you can enter it as a 1099-NEC or other cash income and you can file with no error. Form 1099-MISC and Form 1099-NEC go to the same place on Schedule C, so there will be no difference on your tax return. If you want to wait until it is fixed, you can sign up for notifications through this link.

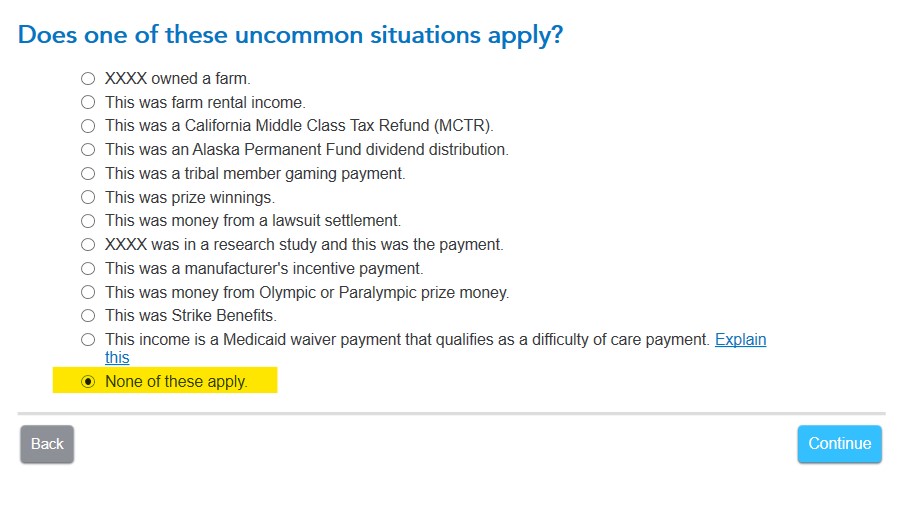

If the income is not from self-employment, you should go back and edit your entries so the income is not linked to any Schedule C. If the income is from something other than self-employment, mark the appropriate box in the ''uncommon situations'' follow-up question. If you choose None of these apply, make sure you answer the 3 follow-up questions properly. Depending on your answers there, the income may be considered self-employment. And if it is self-employment, you will either need to use the workaround above or wait until the issue is fully resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MWP error - link to schedule C

I appreciate the workaround, but I don't like the idea of indicating income was reported on 1099 NEC when in fact it was reported on 1099 MISC. I will wait for the bug to be fixed - can you provide any insight as to when this might occur?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MWP error - link to schedule C

You are not being advised to enter the 1099-MISC as a 1099-NEC. As @DawnC posted, you need to review your 1099-MISC entry to ensure it is not marked as self-employment or related to a job.

You can see Why am I getting a 1099-MISC error? to get updated or you can follow these steps to delete and re-enter your 1099-MISC:

- Within your return, click on Tax Tools in the black menu on the left side of the screen.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your Schedule C and click Delete.

- Under Federal in the black menu bar click Wages & Income to get back into your tax returns

- Open or continue your return

- Select the magnifying glass and search for 1099-misc. Select the Jump-to link

- Answer Yes to Did you get a 1099-MISC?

- If you already entered a 1099-MISC, you'll be on the 1099-MISC Summary screen, in which case you'll select Add Another 1099-MISC

- Enter the info from your form into the corresponding boxes

- If you need to enter boxes 4–6 or 8–17, check My form has other info in boxes 1–17 to expand the form

- Continue answering the following questions (paying close attention to the Does one of these uncommon situations apply screen as DawnC posted)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

miranda-ku-paly

New Member

rjayne1

Level 1

larid

New Member

Angieb059

New Member

R117

Level 2