- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

TurboTax is working to resolve the issue. Workaround: If the income was from self-employment you can enter it as a 1099-NEC or other cash income and you can file with no error. Form 1099-MISC and Form 1099-NEC go to the same place on Schedule C, so there will be no difference on your tax return. If you want to wait until it is fixed, you can sign up for notifications through this link.

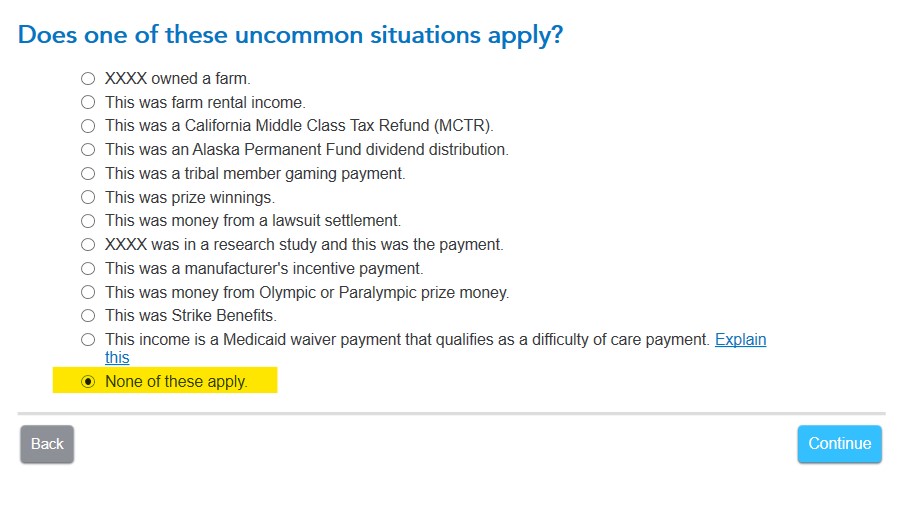

If the income is not from self-employment, you should go back and edit your entries so the income is not linked to any Schedule C. If the income is from something other than self-employment, mark the appropriate box in the ''uncommon situations'' follow-up question. If you choose None of these apply, make sure you answer the 3 follow-up questions properly. Depending on your answers there, the income may be considered self-employment. And if it is self-employment, you will either need to use the workaround above or wait until the issue is fully resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"