- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: K-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1

Have entered K-1's before, but this year boxes 1, 2, & 3 all have values. TuboTax states to enter this as 3 separate K-1's. OK, so how do I distribute the values in boxes 4 thru 20, or do I just enter on any one of the 3 separate K-1's?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1

As recommended by Community User AmeliesUncle, enter the first K-1 with the box 1 income and all the other amounts on the "actual" K-1 that relate to box 1 income. Then, do the same with the next two K-1s, i.e., enter the box 2 or box 3 income and then the other amounts on the "actual" K-1 that relate to the "income box" being reported on that K-1. The main thing is to not enter any amount more than once, but make sure every amount is entered at least once, and to match each kind of activity (box 1, box 2, box 3) with the other amounts on the "actual K-1" related to that activity. If you can't tell which of the boxes 4-20 relate to box 1, box 2, or box 3, you will need to contact the source of the K-1 for that information.

If you have box 20, code Z information an associated "Section 199A Information Statement or STMT" you may need to "match up" the Section 199A (QBI) amounts with the box 1, 2, or 3 "K-1" for that information.

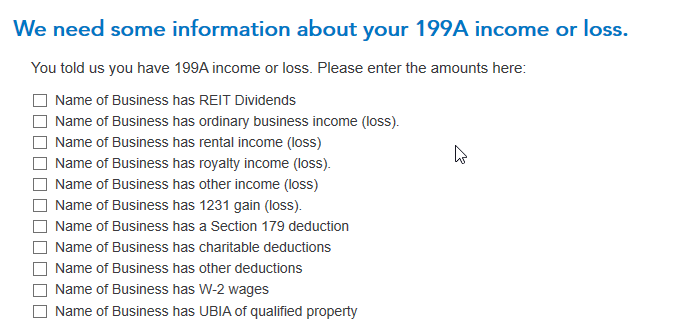

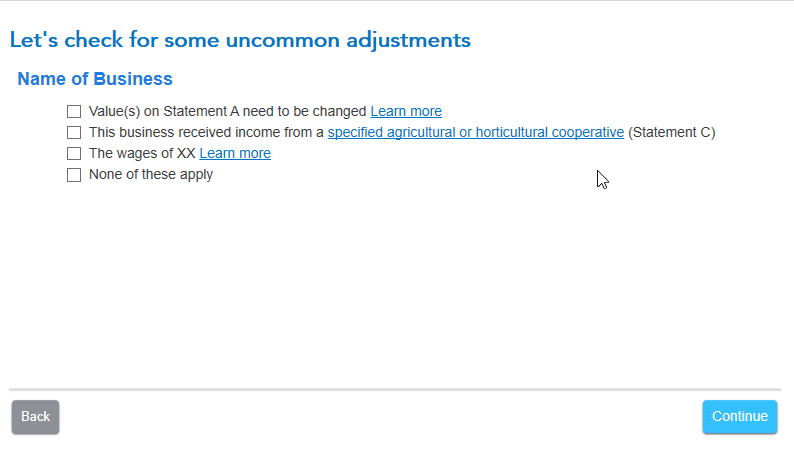

Note that the box 20 code Z information must be entered on a special set of screens. Enter the code Z for box 20 (you don't need to enter an amount) and then Continue until you get these screens for entering the information from that Section 199A Statement or STMT:

[Edited 04/21/2020|2:55pm PST]

@DogCookie

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1

@DavidS127 wrote:Enter the first K-1 with the box 1 income and all the other amounts except box 2 and box 3. Then, enter the next two K-1s with box 2 and box 3, respectively.

No, not necessarily. Some of the entries in the other boxes may be applicable towards the "passive" income in Box 2. Those entries would need to be entered with Box 2.

If the OP does not know which of the other boxes apply to passive versus non-passive income, they need to ask the preparer of the K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1

See edited post, above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scott-ag

Level 1

SpartyOn1521

Returning Member

jadinkent

New Member

micheleconner24

New Member

Lee-Ng

Level 2