- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

As recommended by Community User AmeliesUncle, enter the first K-1 with the box 1 income and all the other amounts on the "actual" K-1 that relate to box 1 income. Then, do the same with the next two K-1s, i.e., enter the box 2 or box 3 income and then the other amounts on the "actual" K-1 that relate to the "income box" being reported on that K-1. The main thing is to not enter any amount more than once, but make sure every amount is entered at least once, and to match each kind of activity (box 1, box 2, box 3) with the other amounts on the "actual K-1" related to that activity. If you can't tell which of the boxes 4-20 relate to box 1, box 2, or box 3, you will need to contact the source of the K-1 for that information.

If you have box 20, code Z information an associated "Section 199A Information Statement or STMT" you may need to "match up" the Section 199A (QBI) amounts with the box 1, 2, or 3 "K-1" for that information.

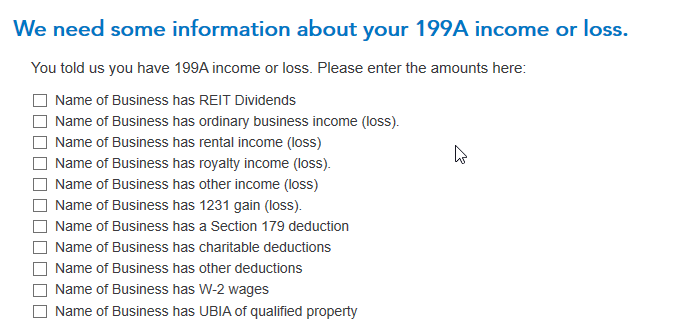

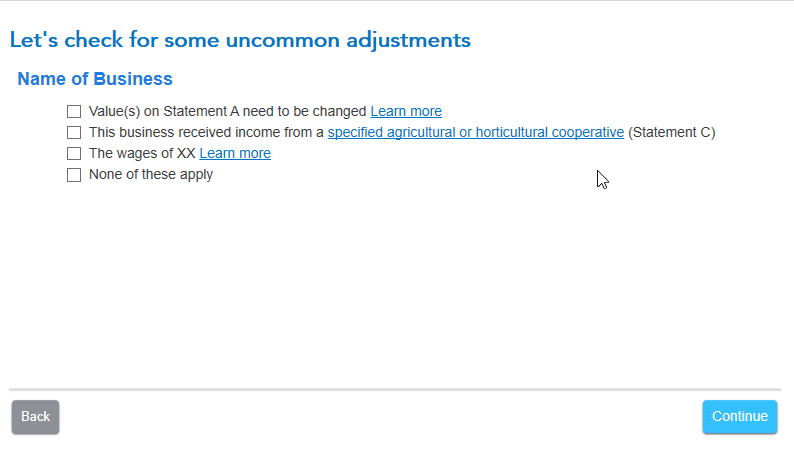

Note that the box 20 code Z information must be entered on a special set of screens. Enter the code Z for box 20 (you don't need to enter an amount) and then Continue until you get these screens for entering the information from that Section 199A Statement or STMT:

[Edited 04/21/2020|2:55pm PST]

@DogCookie

**Mark the post that answers your question by clicking on "Mark as Best Answer"