- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: K-1 entries in boxes 1, 2, & 3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

My question has two parts:

Part 1: From the research I've done, it seems like if I get a K-1 with boxes 1, 2, & 3 with entries in them I have to file 3 separate K-1's, right? And it would look something like this:

First K-1:

ALL info from the K-1 including Part II J, K, & L

Nothing in boxes 2 and 3

Second K-1:

Nothing but box 2 (not even Part II J, K, & L)

Third K-1:

Nothing but box 3 (not even Part II J, K, & L)

Does that look correct?

Now for part 2:

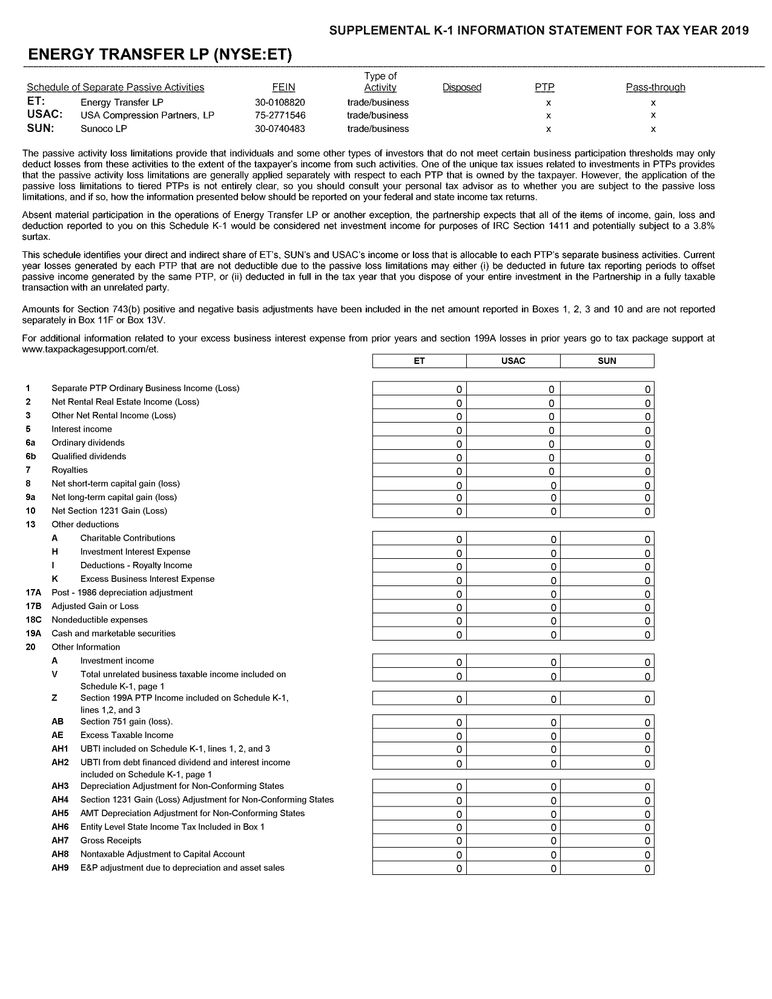

I got a K-1 from Energy Transfer L.P. (ET) and they are evidently 3 different passive entities according to what the Supplemental K-1 Information Sheet shows. So it seems to me I'll have to fill out 9 K-1s based on the above info and what they sent me in my K-1. Please see the attached picture as an example, to understand what I am talking about.

If that assumption is correct then I'm guessing that only the very first of the 9 K-1s would have the info from Part II J, K, & L and then none of the other 8 would have anything but the appropriate "0" in box 1, 2, or 3, right?

Thanks for the help, I appreciate it!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Yes, you are correct that you will need to have the 3 K-1s and the second and third K-1s will only contain information in Box 2 and Box 3 respectively.

Yes, you are correct that you will need to do the same for the additional K-1s you received.

Do not put zeroes in the boxes that do not have a number or for Box 1 and Box 3 when you enter the K-1 with information for Box 2 and the same for any K-1 you enter. Entering zeroes in boxes with no amount may cause issues during the review.

Only enter the amounts in the boxes that have amounts of 1 or more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Thank you so much!

Just to make sure I understand you correctly, besides the first K-1 which should have 0's where shown on the form, the subsequent K-1's should be left completely blank except for the 0's in boxes 2 or 3, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

No, if any box on your K-1 contains a 0, you do not need to enter a 0 for that box. The only boxes you need to enter information for are boxes that contain a number greater than 0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Good to know. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

I went to enter this info and now I'm confused again. If I don't enter any boxes with a 0 in them then why do I need to file multiple K-1s? The only box in the whole K-1 that has anything other than a 0 is box L in Part 2 so how do I enter the other two K-1s and the other 3 K-1s for the other two entities as they would all end up completely blank, including Part 2 box L, right? and if so then why is that necessary?

Can I post a screenshot of the K-1 here if I blank out my personal info?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

You don't need to enter the K-1's if they only have the capital account activity in part L. That information will not appear on your tax return and is not needed to process the numbers on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Thank you for the answer and clarification. I got 5 K-1s and on all of them, the only section that has anything other than a blank or "0" is Part II, Section L. So, it is safe to then not enter any of the K-1s at all and I won't get any flack from the IRS?

Here's an example of the relevant info from one of my K-1's with the 1099-B info as well. Just so you can confirm that I am understanding and doing this correctly.

| Black Stone Minerals, L.P. (BSM) | |||||||||

| 1099-B: | |||||||||

| Quantity sold | 0.08541 | 0.12077 | |||||||

| Date Acquired | 11/15/2019 | 11/15/2019 | |||||||

| Date Sold (box 1c) | 12/09/2019 | 12/09/2019 | |||||||

| Procedes/Reported to IRS (box 1d) | $1.01 | $1.43 | |||||||

| Cost or other basis | $1.06 | $1.55 | |||||||

| Accrued Market Discount | $0.00 | $0.00 | |||||||

| Wash Sale Loss Disallowed | $0.00 | $0.00 | |||||||

| Gain/Loss | -$0.05 | -$0.12 | |||||||

| FROM K-1: | |||||||||

| Form 1065 | |||||||||

| J Partner’s share of profit, loss, and capital: | Beginning | Ending | |||||||

| Profit | 0.00% | 0.00% | |||||||

| Loss | 0.00% | 0.00% | |||||||

| Capital | 0.00% | 0.00% | |||||||

| K Partner’s share of liabilities: | Beginning | Ending | |||||||

| Nonrecourse | $0.00 | $0.00 | |||||||

| Qualified nonrecourse financing | |||||||||

| Recourse | |||||||||

| Check this box if Item K includes liability amounts from lower tier partnerships. | x | ||||||||

| L Partner’s Capital Account Analysis | |||||||||

| Beginning capital account | $0.00 | ||||||||

| Capital contributed during the year | $15.00 | ||||||||

| Current year net income (loss) | $0.00 | ||||||||

| Other increase (decrease) | $0.00 | ||||||||

| Withdrawals & distributions | -$3.00 | ||||||||

| Ending capital account | $12.00 | ||||||||

| 1 Ordinary business income (loss) | 0 | ||||||||

| 2 Net rental real estate income (loss) | |||||||||

| 3 Other net rental income (loss) | |||||||||

| 4a Guaranteed payments for services | |||||||||

| 4b Guaranteed payments for capital | |||||||||

| 4c Total guaranteed payments | |||||||||

| 5 Interest income | 0 | ||||||||

| 6a Ordinary dividends | |||||||||

| 6b Qualified dividends | |||||||||

| 6c Dividend equivalents | |||||||||

| 7 Royalties | 0 | ||||||||

| 8 Net short-term capital gain (loss) | |||||||||

| 9a Net long-term capital gain (loss) | |||||||||

| 9b Collectibles (28%) gain (loss) | |||||||||

| 9c Unrecaptured section 1250 gain | |||||||||

| 10 Net section 1231 gain (loss) | 0 | ||||||||

| 11 Other income (loss) | |||||||||

| 12 Section 179 deduction | |||||||||

| 13 Other deductions | |||||||||

| I | 0 | ||||||||

| J | 0 | ||||||||

| K | 0 | ||||||||

| 14 Self-employment earnings (loss) | |||||||||

| 15 Credits | |||||||||

| 16 Foreign transactions | |||||||||

| 17 Alternative minimum tax (AMT) items | |||||||||

| A | 0 | ||||||||

| D | 0 | ||||||||

| * | STMT | ||||||||

| 18 Tax-exempt income and nondeductible expenses | |||||||||

| C | 0 | ||||||||

| 19 Distributions | |||||||||

| A | 0 | ||||||||

| 20 Other information | |||||||||

| A | 0 | ||||||||

| B | 0 | ||||||||

| T* | STMT | ||||||||

| * | STMT | ||||||||

| Supplemental Info | |||||||||

| AMT Item: Oil, Gas & Geothermal-Deductions | 17E | 0 | |||||||

| AMT Item: Excess Intangible Drilling Costs | 17F1 | 0 | |||||||

| Sustained Depletion - Working Interests | 20T1 | 0 | |||||||

| Cost Depletion - Working Interests | 20T2 | 0 | |||||||

| Percentage Depletion in Excess of Cost Depletion - Working Interests | 20T3 | 0 | |||||||

| Sustained Depletion - Royalty Interests | 20T4 | 0 | |||||||

| Cost Depletion - Royalty Interests | 20T5 | 0 | |||||||

| Percentage Depletion in Excess of Cost Depletion - Royalty Interests | 20T6 | 0 | |||||||

| Percentage Depletion in Excess of Basis | 20T7 | 0 | |||||||

| Net Equivalent Barrels | 20T8 | 0 | |||||||

| Unrelated Business Taxable Income or Loss | 20V | 0 | |||||||

| Section 199A Publicly Traded Partnership (PTP) Income | 20Z1 | 0 | |||||||

| Qualified PTP Item - Section 1231 Gain (Loss) | 20Z2 | 0 | |||||||

| Qualified PTP Item - Ordinary Income on Sale of Interests | 20Z3 | 0 | |||||||

| Section 751 gain (loss) | 20AB | 0 | |||||||

| Excess Taxable Income | 20AE | 0 | |||||||

| Excess Business Interest Income | 20AF | 0 | |||||||

| Gross Receipts | 20AH1 | 0 | |||||||

| Ownership Schedule | |||||||||

| TRANSACTION | |||||||||

| DESCRIPTION | DATE | UNITS | |||||||

| BEGINNING OF YEAR UNITS | 0.00000 | ||||||||

| AC Buy | 11/11/2019 | 0.07300 | |||||||

| AC Buy | 11/15/2019 | 0.08500 | |||||||

| AC Buy | 11/18/2019 | 0.04700 | |||||||

| AC Buy | 12/9/2019 | 1.00000 | |||||||

| DA Sell | 12/9/2019 | -0.20600 | |||||||

| Sales Schedule | |||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| Units Sold | Sale Date | Sales Proceeds | Purchase Price / Initial Basis Amount | Cumulative Adjustments to Basis | Cost Basis | Gain Subject to Recapture as Ordinary Income | AMT Gain/Loss Adjustment | Percentage Long Term | |

| 0.206 | 12/9/2019 | 3 | 0 | 3 | 0 | 0 | 0.00% | ||

| Totals | 0.206 | 3 | 0 | 3 | 0 | 0 | |||

| References | Form 8949 Column D | Form 8949 Column E | Form 4797 Part II Line 10, Form 8949 Column G | Form 6251 Line 2k |

Thank you so very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

The 1099-B reports a $1 sale, so technically it should be reported, but would not raise concern if it wasn't reported due to the materiality of it.

The K-1 reports no income or deductions that I can tell, so it wouldn't need to be reported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Yes, I will definitely report the 1099-B and there are other sales on there as well from other activity so I'd have to anyway. I will not file the K-1s then as they are all essentially like this one with blanks or zeros in all boxes other than Box L.

Thank you for your help and input, I really appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

I got energy transfer stock too without realize how complicated the tax filings are. So, if we file separate entries for box 1, 2 and 3, and also for each tiered PTP (3 of them: ET, USAC, SUN), it means 9 total k-1. That is fine but how to enter the sales information? The sales info can't be split. Anybody can help shed some light here? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Please clarify - you are asking about how to report the sale of this PTP? The entire interest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Hi, @ToddL99 , thanks for trying to help!

I did partial sale.

So, on sales worksheet, there is one line describes unit sold, sale date, initial base, adjustment to basis, gain subject to recapture as ordinary income, and some other information. But this PTP ( I bought ET) is a tiered PTP combined by ET, USAC and SUN. So I have to report them separately as I understood. But if I report them separately in TT, how do I enter the sales record? I can't enter the same sales info for all 3 of them. But I can't just put the sales under ET too, that seems not right to me. Ideally, the sales schedule should be split for this 3-tier too, but they did not. So I don't know how to proceed here. I hope you do understand what I meant, any help is appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

Please clarify - you only received one K-1, correct?

For "Part 1" of your question - If the "master K-1" reported income in more than one line, then you have to complete a separate K-1 interview for each line - just as you described above.

For "Part 2" of your question - You do not need to make separate K-1 entries for lower-tier partnerships reported in the supplemental information; that information is already in the "master K-1".

If selling a partial interest, you can report that sale in any one of the K-1 interviews you had to do because of multiple types of income.

Reporting the sale of a PTP is complicated. The following post provides detailed instructions on how to accomplish this. Look at the first answer for instructions, and then look at the follow-on replies for additional information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 entries in boxes 1, 2, & 3

@ToddL99 thank you so much! Yes, I did not know what I am running into when I bought ET. So much to learn, but with the help from you and the TT community, I think I will nail this down eventually :-). I am reading through all the posts :-).

Yes, I only got 1 k-1 from the master PTP, I wish it is ok not to split to sub-ptp level, it is so much easier and less confusing! But other posts had different opinion. Even on my k-1 form, it said "However, the application of the passive loss limitations to tiered PTPs is not entirely clear, so you should consult your personal tax advisor as to....". Sigh, seems like it is NOT something that is straightforward.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sierrahiker

Level 2

atlg8or

New Member

CghLzh

Level 1

kj111124

New Member

K1 form multiple boxes checked

Returning Member