- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

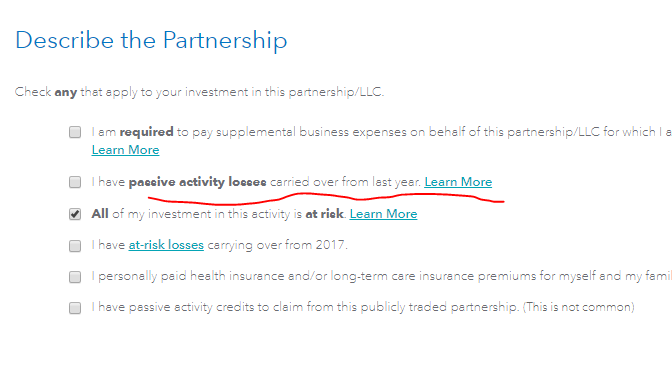

As you complete the K-1 interview you should see this screen ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

is the K-1 from a publicly traded partnership? if so, it's passive losses can not be used to offset profits from other partnerships and the loss carryforward will not appear on form 8582.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

I'm afraid i can't report the loss carryover of company A on company B here. The loss is of A, B has a gain. I put the loss carryover on A here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to change Schedule E line27 to "yes"? One of my K1 has loss carryover(of previous years), another one has gain. I want to report the loss unallowed in a prior year.

No none of them is a public trade partnership.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17524270358

New Member

alex1907

Level 2

mpeachey

Returning Member

ABM3

New Member

Cmora

Returning Member