- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How can I amend a 1065 return to include the rest of the year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

It appears that you selected a calendar year when you filed the 2021 1065 for the LLC.

If you terminated operations and dissolved the LLC in April of 2022, you can simply file a short tax year return (marked as final) for 2022.

See https://www.irs.gov/instructions/i1065#en_US_2021_publink11392vd0e874

You can use the 2021 version of TurboTax Business for this purpose, but you will have to correct the tax year on several forms manually and then print and mail the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Yes, I did, I should have done the short form. ugh, it's a headache. This seems easier than amending last years correct? would 2021 only work just for that year? would i need to update for 2022 to do file? I think it processes quicker. TIA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

If you filed your 1065 for the 2021 calendar year, then you likely issued 2021 K-1s to the members of the LLC who, in turn, incorporated the figures on those K-1s into their 2021 individual income tax returns.

If you file a final 1065 (and associated K-1s) for the 2022 tax year, the members will include figures on those K-1s into their 2022 individual income tax returns, which would appear to be the best solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

you are correct. I agree, I think I'll do this instead. You've literally made my day! Does turbotax business only work for the one year its purchased? so the 2021 version is only for 2021 taxes?

Thank you, and I love your picture of the manatee. 🙂

I really appreciate your help here!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

@alicefh wrote:

so the 2021 version is only for 2021 taxes?

Yes, but you can use the program for a fiscal (or short) year that begins in 2022 and ends in 2022.

However, since the 2022 forms have not yet been released, you will have to make corrections to reflect the correct tax year (e.g., January 1, 2022 - April 30, 2022).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Okay, I was able to use the software for the year, I have to use the short, but it does say its not within the upper and lower limits.

Do you think it would still be accepted even if the new tax forms aren't released?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

@alicefh wrote:Do you think it would still be accepted even if the new tax forms aren't released?

Yes, but as I stated earlier you will have to print out the forms, manually change the dates, and then mail the entire return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

Ok, I think I'll have to input it on a new form since it shows 2021 on the top. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

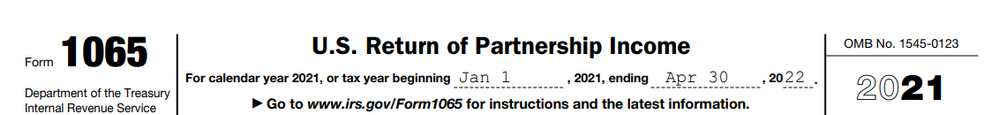

so i see what you mean by the top being date January 2022through April 2022. Does it matter that it shows the large 2021 on the top right of the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

No

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

got it, thanks for all of your help here! I really appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

So, we just needed to add $23 in interest income on our 1065 after we electronically submitted and IRS accepted our 1065. Simple, right? Opened up TurboTax for Business on our PC and proceeded to selected amend a return, we selected our accepted return and went through the steps (even changed the name of the file by doing a save as so as not to change the original TT file that was created, filed, and accepted). We get to the end and it says that we cannot file it electronically because it was already e-filed. OK, glitch in the system? Maybe, but here is the thing, TT created both a 1065-X and an amended 1065. IRS says we can e-file the 1065 amended form and that is what we prefer to do but it seems that TT is not programed to produce just an amended 1065 and let us proceed to e-file it. OK, so I am ready to pull my hair out for $23 (see first sentence). So, HERE is the question Tagteam, should I just print out the amended 1065 (not the 1065X) and mail it? That's what I'm thinking. Or am I doing something wrong in TT that is causing this fine program to jump to a 1065-X and, on top of it, believe that I have already e-file this newly amended 1065?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I amend a 1065 return?

@Kanepete wrote:

So, HERE is the question Tagteam, should I just print out the amended 1065 (not the 1065X) and mail it?

Whatever you do, note that you cannot e-file an amended return with TurboTax Business.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajahearn

Level 1

matto1

Level 2

lauraso

New Member

raymond-leal60

New Member

Th3turb0man

Level 1