- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Puzzled by depreciation calculation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Puzzled by depreciation calculation

I have a business asset that I've been depreciating with TurboTax since 2017. Every year, the amount of depreciation TurboTax calculates has been exactly what I expected... until now. Here are the details TurboTax has in the forms view (form 4562):

- Asset in-service date: 7/27/17

- Cost 16,148

- 100% business use

- Depreciable basis 16,148

- Life 7.0

- Method 200DB/HY

For my 2022 taxes, it reports prior deprecation of 12,545 (as expected) but current depreciation of 1,441 (unexpected).

I plugged my parameters into the depreciation calculator here: https://www.calculatorsoup.com/calculators/financial/depreciation-declining-double.php

And got these results:

2017, $2,307

Every year from 2017 to 2021, TurboTax's calculation has exactly matched this web calculator, but this year, it wants to depreciate $1,441 again instead of the expected $1,029. Any idea why?

Thank you.

P.S. On a related note, saying this asset has a salvage value of zero (i.e. worth nothing after seven years) is incorrect. I'm not sure I was asked to provide a salvage value. Would it be better to continue depreciating it to zero and then report a gain if the day ever comes to sell/dispose of the asset? Or would it be better to somehow 'abort' the depreciation at this point?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Puzzled by depreciation calculation

The calculation in TurboTax is correct. And you would not be asked about a salvage value under our current depreciation system.

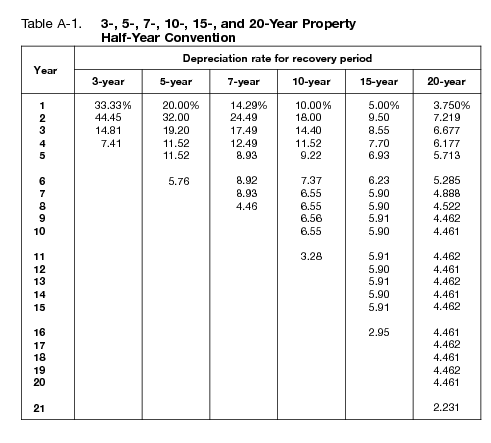

- The rates under 7 Year depreciation are almost exactly the same for year five and six (8.93% and 8.92% respectively). For this reason the depreciation is exactly what it was for 2021.

I have placed the chart below for your convenience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DHennessy

New Member

sglewis1485

New Member

AWK9876

New Member

_John__

Level 2

user17618569045

New Member