No, if you received interest from a British bank account, you can report it as if you had a 1099-INT and a TIN is not required. However, if your State requires a TIN for Efiling, you can also report it as Other Taxable Income.

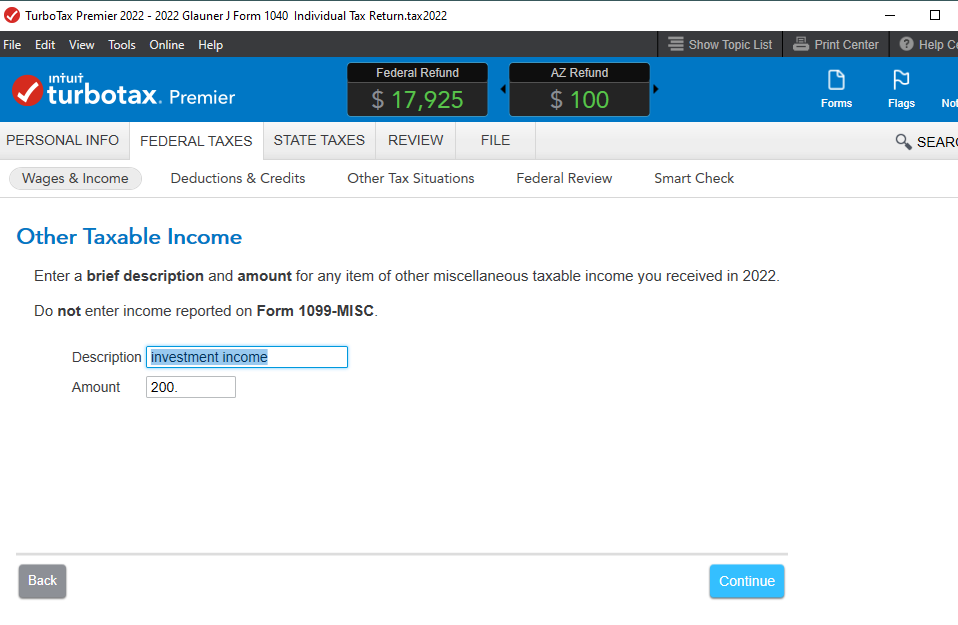

Scroll all the way down on the Income Topics page to Miscellaneous Income, 1099-A, 1099-C. On the next page, scroll all the way down to Other Reportable Income.

Enter a description and amount.

@gomes_f

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"