- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

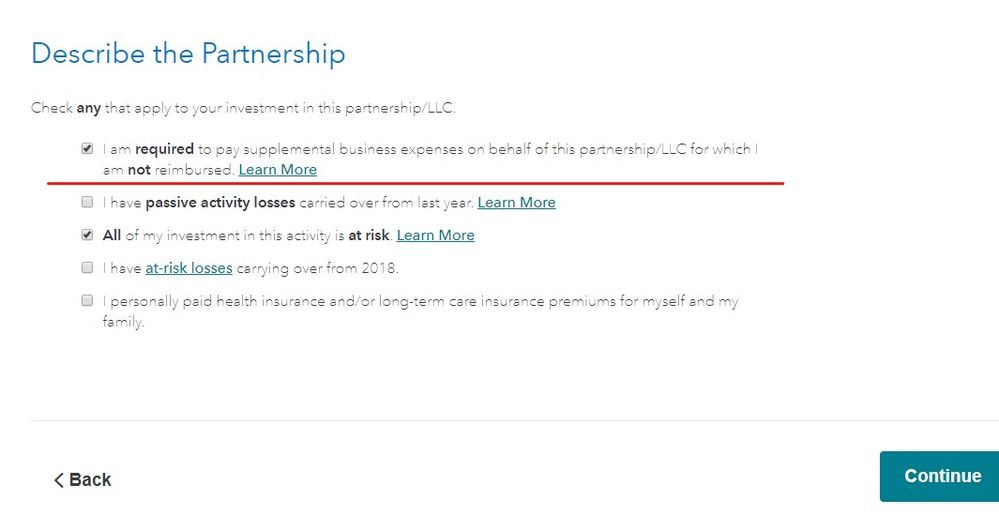

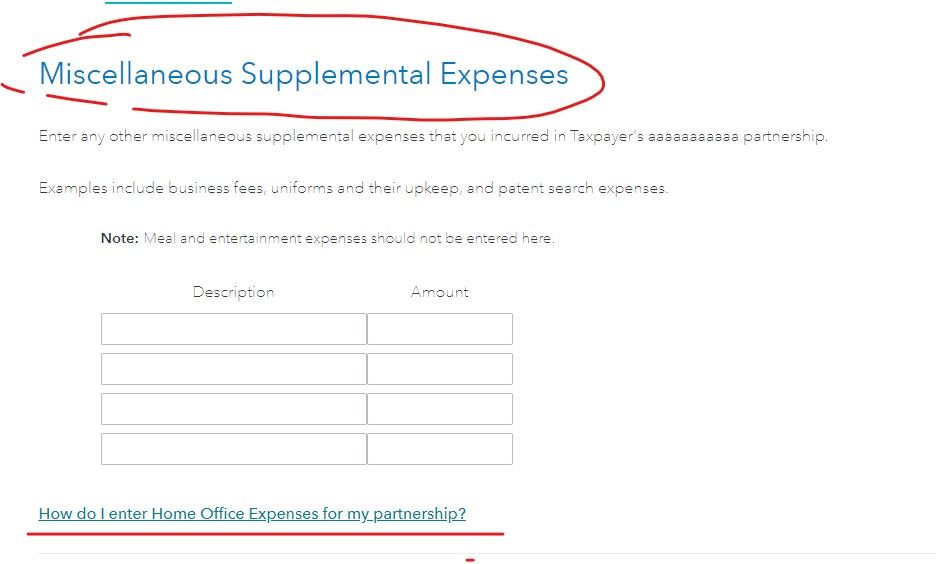

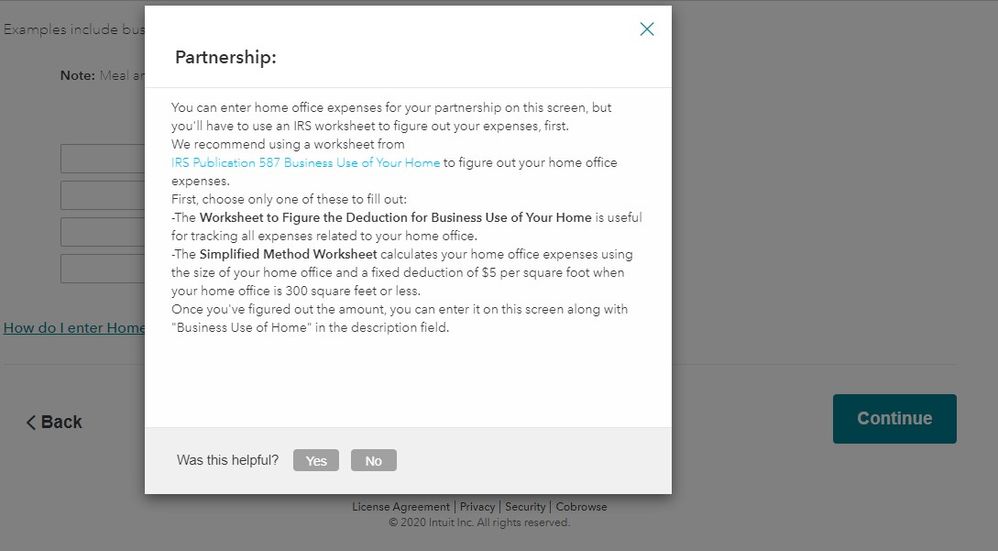

If you have unreimbursed partnership expenses (UPE) check the box on the screen after your K-1 entries (see screenshot below) and enter the expenses on the following screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

If you have unreimbursed partnership expenses (UPE) check the box on the screen after your K-1 entries (see screenshot below) and enter the expenses on the following screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

Hello Critter,

This response is everything we needed and more. Thank you for your helpful answer and screenshots. This seems very simple, and we are clear on how we will report this next year.

All best,

Chug Mama

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am the co-principal of an LLC. Next year I will be filing the Form 1065 we each will submit a Schedule K-1. How we report rent/utilities expenses for our home offices?

This seems very simple,

Wanna bet? 🙂 I suggest you have professional help lined up and scheduled for tax time next year. You'll be glad you did.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17558084446

New Member

Idealsol

New Member

seple

New Member

ekudamlev

New Member

carolynmkendall509

New Member