- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@nexchap

Thanks for clarifying. Just couple more questions -

1. While changing the actual Cost basis in 1099-B entries from RobinHood for USO, in Turbo Tax should I also change the Sales section of this transaction entry from "Long term basis reported to IRS (covered)" to "Long term basis not reported to IRS (non-covered)"?

2. About K1 form, I have entry in Part III, Line 13 as W-Other Deductions as 17 USD. The K1-form instructions describe it as - "Line 13w Other deductions – Trader expenses. For individuals, combine the values from lines 11i and 13w to determine whether you have a nonpassive income or loss. Reported on Schedule E, Line 28, (i) or (k)".

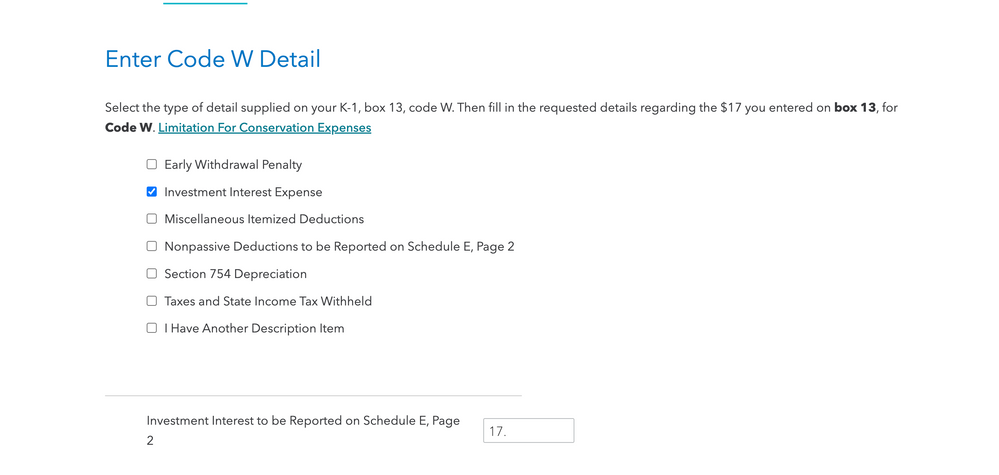

So while entering this in Turbo Tax, what I should write in "Enter Code W Detail" ? Check the below pic for all the options. I'm thinking as 'Investment Interest Expenses' or should it go in "I have another Description Item"?

EDIT - Also 1 more thing, while I leave everything in K-1 Sales section as blank. Later on while reviewing all the tax info, Turbo Tax complained about the missing Sales price and Partnership Basis in K1-Sales section. So I had to enter both as 0 mentioning actual assest acquired date and disposed date. I guess this will make an entry for this in 8949 form with buy, sell dates and both proceeds, cost basis as 0. That should be fine I guess.. right?