- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

Also, some of the questions it asks about Cryptocurrency on TurboTax don't apply in this circumstance, for example "Date of Purchase" and "Cost Basis". Would like some info on this before going forward, thank you for any advice you can give.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

Even if you "sold" the bitcoin to convert it into cash you do NOT enter it on the Sch D as a sale ... delete what you entered in that section and enter the income received on the Sch C instead ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

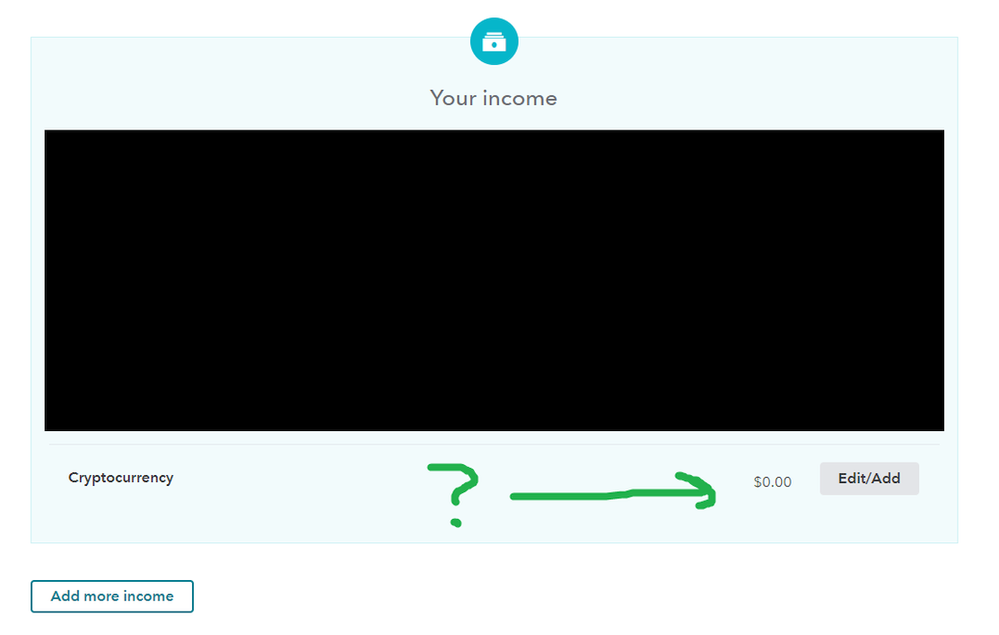

Ok, so just for clarity's sake and to wrap this up. I leave the Cryptocurrency section blank or at $0.00, and don't have to click yes or no in the prompt about having it in the Cryptocurrency section, correct? Inputting it ONLY as additional income on my Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

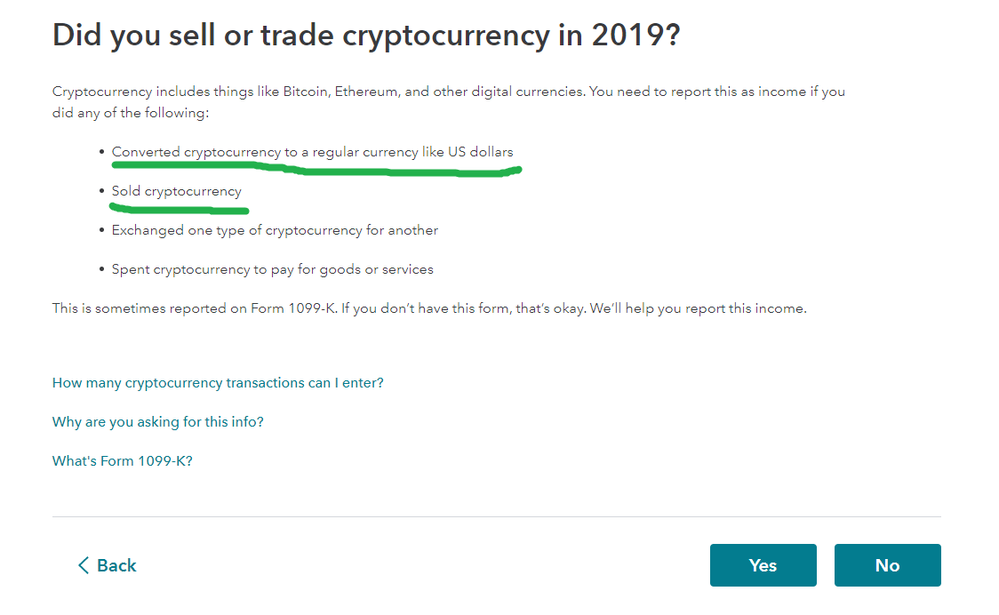

That is not correct. If you sold the crypto back to fiat currency, you DEFINITELY DO need to enter that sale on Schedule D. Per IRS notice 2014-21, crypto is a capital asset. Whenever a capital asset changes character (in this case, changed from BTC to USD), you must report it on Schedule D. Not reporting the sale can cause problems with the IRS.

So first you will convert the .32 BTC to USD to determine fair market value (FMV) on the date of receipt. Then you will report that FMV as self-employed income.

Next, you will enter the sale of the BTC to USD. The cost basis of the BTC you sold can be set at the value of the services you rendered (likely the FMV of the service you rendered), and your transaction records will show the USD value of your proceeds on the date of sale. Any gain or loss on the sale will then flow to Schedule D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

Thank you @GiseleD for clarifying this for me. So I'm pretty sure I understand you correctly here - this is how I'm understanding it:

The FMV of the 0.32 BTC was $1665.09 on the date of RECEIPT (This value goes in as self-employed income - it also goes in as the "Cost Basis" on the Schedule D).

The FMV of the 0.32 BTC on the date of SALE was $1632.40

$1665.09 - $1632.40 = $32.69

So a $32.69 dollar loss is what I would input as "Sale Proceeds", correct?

Would the "Date of Purchase" field be the date of BTC receipt?

And one last question - would the "Sale Proceeds" include fees that I was charged by the exchange?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report my cryptocurrency activity? I am a freelancer whom at one point in 2019, received cryptocurrency in exchange for services rendered.

The $1665.09 is the both the SE income and the cost basis, correct.

The FMV of the BTC on the date of the sale of $1632.40 is the Proceeds of the sale. The proceeds are what you received for the transaction, and the $32.69 is your loss. The software will automatically calculate the gain/loss for you; you don't need to enter the $32.69 anywhere.

The date of purchase is indeed the date you received it for your self-employment services.

The fees charged by the exchange for the sale back to fiat (USD) are actually added to the cost basis ($1665.09). Please keep good notes on how you calculated this in case you are examined by the IRS.

Hope this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cangelopoulos

New Member

ednadodson

New Member

johnlee1356

New Member

Cerinne_03

New Member

AndPhoton

Level 3