- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do you tell TurboTax to prorate depreciation of business assets for a partial year when you close your business during the year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you tell TurboTax to prorate depreciation of business assets for a partial year when you close your business during the year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you tell TurboTax to prorate depreciation of business assets for a partial year when you close your business during the year?

Yes, you are correct. It should be a partial year of depreciation.

No, you do not have to do any kind of override.

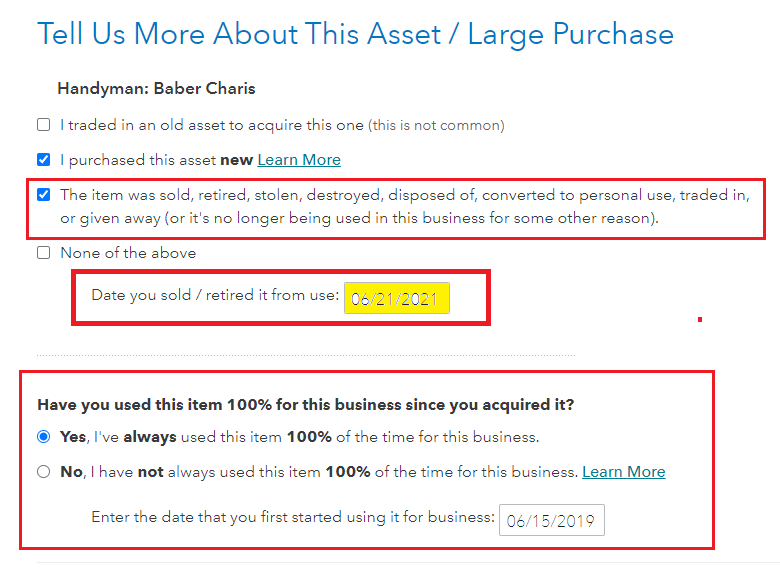

When you are going through the assets there is a screen asking for the date the asset was 'sold, retired, stolen, destroyed, disposed of, ...'. Be sure you enter the date retired and the depreciation will be limited. Click Yes to Special Handling. This will carry the partial year of depreciation to the business activity.

Maintain all of your records because these assets must be included if sold to recapture any depreciation used during the business use period.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you tell TurboTax to prorate depreciation of business assets for a partial year when you close your business during the year?

Thank you for the quick reply. Your suggestion did the trick. Since I had answered the general TurboTax question about when I closed my business in 2021, I had assumed that TurboTax would stop depreciation all business assets as of that date. As you suggested, I still have to "retire" each asset separately to get the partial year depreciation for each. I suppose that gives flexibility in the event someone were to close down their business "incrementally" over the course of a year, i.e. "retire" assets on different dates throughout the year. I will be selling the office condo itself this year, and as you suggested, will need to recapture related depreciation as income (to the extent that I have a gain) when I file my 2022 return next year. Thanks again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

risman

Returning Member

evltal

Returning Member

fieldsmichelle70

New Member

Viking99

Level 2

abarmot

Level 1