- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Yes, you are correct. It should be a partial year of depreciation.

No, you do not have to do any kind of override.

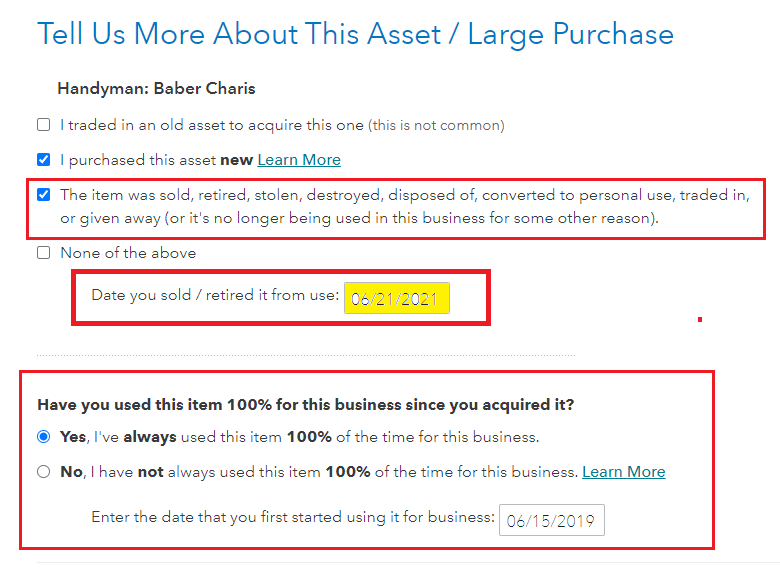

When you are going through the assets there is a screen asking for the date the asset was 'sold, retired, stolen, destroyed, disposed of, ...'. Be sure you enter the date retired and the depreciation will be limited. Click Yes to Special Handling. This will carry the partial year of depreciation to the business activity.

Maintain all of your records because these assets must be included if sold to recapture any depreciation used during the business use period.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 11, 2022

12:25 PM