- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

You can usually make the de minimis safe harbor election i when you are entering the asset.

However, in a Trust return (1041) you will have to make the election manually, in Forms Mode. To do this, please follow these steps:

- Go into Forms Mode by clicking the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click IRC elections.

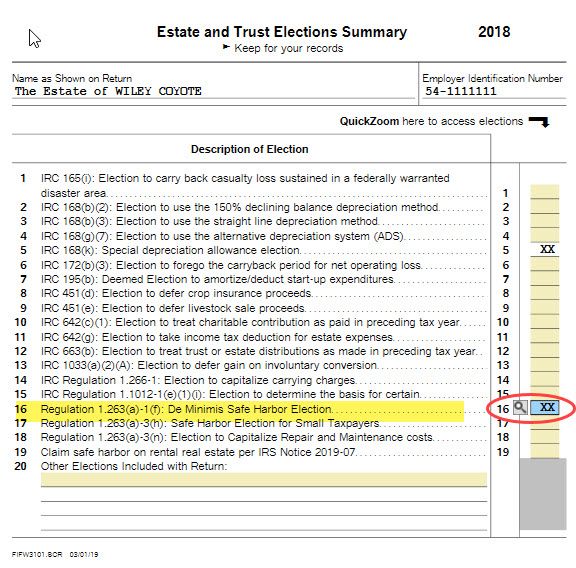

- Click line 16 for the De Minis Safe Harbor Election. [See Screenshot #1, below.]

- Click the magnifying glass to QuickZoom to the election statement.

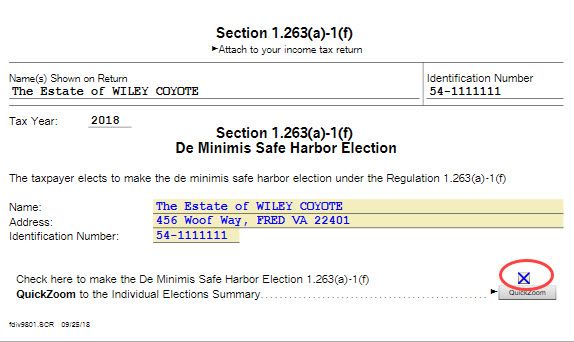

- Mark the box on the election statement to make the election. [See Screenshot #2]

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

[Edited | 3/19/2020 | 11:42 am PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

You can usually make the de minimis safe harbor election i when you are entering the asset.

However, in a Trust return (1041) you will have to make the election manually, in Forms Mode. To do this, please follow these steps:

- Go into Forms Mode by clicking the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click IRC elections.

- Click line 16 for the De Minis Safe Harbor Election. [See Screenshot #1, below.]

- Click the magnifying glass to QuickZoom to the election statement.

- Mark the box on the election statement to make the election. [See Screenshot #2]

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

[Edited | 3/19/2020 | 11:42 am PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

Hi There,

Thanks for these really helpful instructions !

I found the IRC Elections form in the list under Open Forms, rather than Forms in My Return, but after going through your steps to make the election, I'm still not sure where to enter the actual expense amount to claim.

Many Thanks,

Chris

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

Has anyone figured out where to actually enter the expenses after taking the election?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you make the De Minimis Safe Harbor Election on Form 1041 for a trust?

There is not a special section for expenses using the de minimis election -- enter them as you would regular business expenses.

If you are in a business return (S-Corp, Partnership):

- Click the Federal Taxes tab and then Deductions.

- Scroll down to the Business Expenses section and click Start next to the appropriate category.

If you are in a Schedule C in the 1040, please follow these steps:

- In your return, click Income and Expenses and then click the Start/Revisit box in the Self-Employment section.

- On the Your 2020 self-employed work summary screen, click on Edit next to your business.

- Click the box Add expenses for this work.

- On the Tell us about any expenses screen, mark the radio button next to the appropriate category and click Continue at the bottom of the screen.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alec-ditonto

New Member

alec-ditonto

New Member

sunshine39

Level 3

Ihatetaxes56

Level 2

themossops

New Member