- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do I create a K-1 Form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I create a K-1 Form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I create a K-1 Form?

IRS form K-1 (1065) is created within the IRS form 1065 partnership tax return.

TurboTax has several options available to you. They may be found here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I create a K-1 Form?

Thanks but I need specific guidance - the HOW. The links you provided are simply options that Turbotax provides for tax prep. I want to do this myself.

I am in TurboTax, trying to complete info required for the 1065 and it is asking for details contained within the K-1 but I do not have one yet. I need TurboTax to generate the K-1. Where specifically do I go to do that or what are the steps if I want to do this for myself?

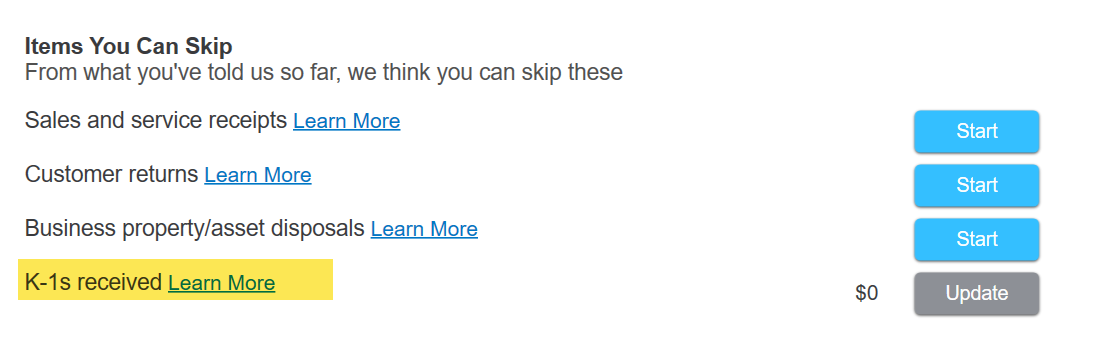

Attached is a screenshot of the first info that TurboTax is asking for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I create a K-1 Form?

I believe you are trying to enter a K-1 form for a partnership that the LLC you are working on owns an interest in:

That information would be provided to you from the company your LLC has an ownership interest in.

This is different from generating a Schedule K-1 for the LLC you are working on. To do that, you need to go to the Business Info menu tab and work through that section until you come to the page called Partner Summary where you can enter partner information. Once you do that, the K-1 form will be populated automatically as you work through TurboTax.

So, if you don't need to enter in a K-1 schedule, go to the Income section to find the page that says Your Total Business Income, and update the K-1's received option, under Items you can skip, and delete any entry in that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DennisK1986

Level 2

garne2t2

Level 1

user17522541929

New Member

user17515348256

New Member

user17520191032

New Member