- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

I believe you are trying to enter a K-1 form for a partnership that the LLC you are working on owns an interest in:

That information would be provided to you from the company your LLC has an ownership interest in.

This is different from generating a Schedule K-1 for the LLC you are working on. To do that, you need to go to the Business Info menu tab and work through that section until you come to the page called Partner Summary where you can enter partner information. Once you do that, the K-1 form will be populated automatically as you work through TurboTax.

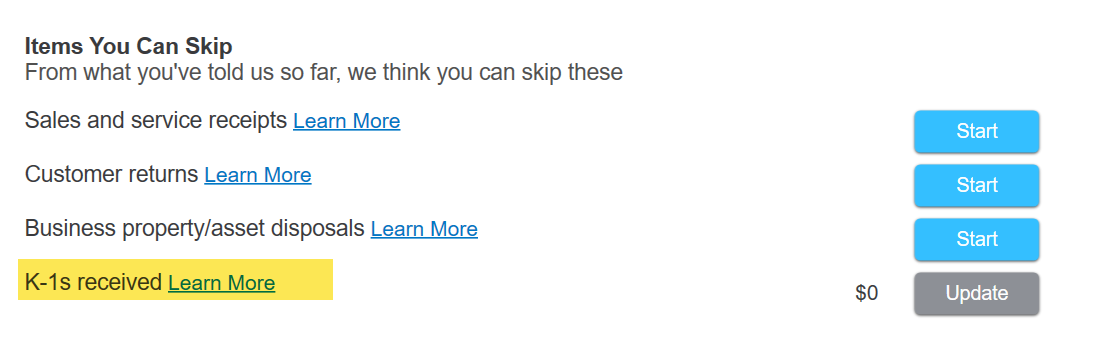

So, if you don't need to enter in a K-1 schedule, go to the Income section to find the page that says Your Total Business Income, and update the K-1's received option, under Items you can skip, and delete any entry in that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"