- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Cannot create K-1's for an estate...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

@joejoe1592

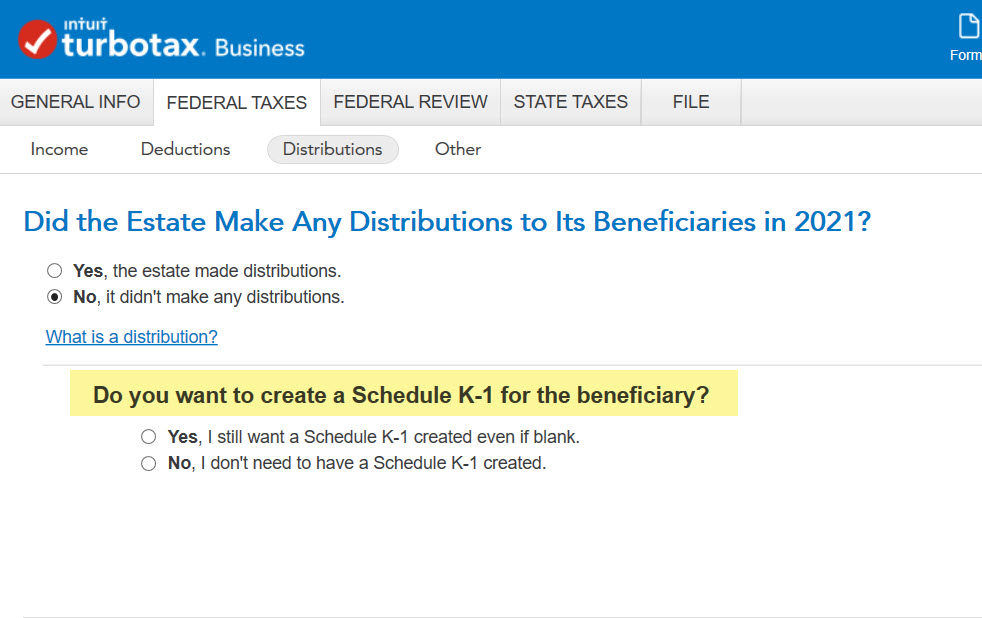

Please ignore the unrelated pop-up message, and go back to review your answers under Federal Taxes >> Distributions.

If you checked "No, it didn't make any distributions," you should see a pop-up asking "Do you want to create a Schedule K-1 for the beneficiary?"

Checking "Yes, I still want a Schedule K-1 created even if blank" will generate this form for you to save or print. Screenshot attached.

Additional info: How do I print a copy of my return filed in the TurboTax CD/Download software?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

The only think under Federal taxes --> Distributions is the question:

How Much Was Distributed To Each Beneficiary?

Enter the amount distributed to each beneficiary in 2021.

There are 5 beneficiaries who all got equal amounts in 2021, which I filled in correctly.

That's it! There is nothing else on the page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

As a test, try clicking "No" to the distribution question then "Yes" for creating K-1s.

Continue to the next topic, then go back to Distributions and enter the actual distributions (if necessary - the info may have been saved).

Continue to the next topic, then go to Forms and see if the Schedules K-1 were created.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

@joejoe1592 wrote:

The only think under Federal taxes --> Distributions is the question:

Enter Forms Mode and inspect your List of Forms.

Look for any red exclamation marks next to each form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

I have been back and forth over this simple return and I do not see the screen you reference above with the questions on it.

This is what I am seeing. A simple form asking me to list the beneficiaries and the amounts they received:

https://drive.google.com/file/d/1AYViemeMiiXndZU3HfjmPOcbyTlXyxg7/view?usp=sharing

I tried going as far along as attempting to e-file and then looking at the printed forms generated. There are no K-1's that I can see.

All I can see is a form titled "Distributable Income for Schedule(s) K-1 2021.

Below that is a form titled "List of Beneficiaries" 2021. This list is the same as what is shown in the link above. The form looks incomplete as the boxes under the heading "General Allocation Percentage" DON'T HAVE ANY PERCENTAGES and the total filed at the bottom showing "Total general Allocation" _______% is blank.

Might my checking the box near the beginning saying that this is the FINAL RETURN possibly contributing to this mess in any way?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

@joejoe1592 wrote:Might my checking the box near the beginning saying that this is the FINAL RETURN possibly contributing to this mess in any way?

No, indicating that the return is final would have no impact in this matter.

Do you not see any K-1s in Forms Mode?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

As I wrote above:

"There are no K-1's that I can see. "

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

I asked if you could see K-1s in Forms Mode (click the Forms icon in the upper right side of your screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

@joejoe1592 wrote:"There are no K-1's that I can see. "

You should see K-1s in Forms Mode (even if they are blank) provided you entered beneficiaries in the General Info tab.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

Ok, I was able to see the K-1's in forms view. I still can't print them as above. That is some kind of bug that needs to be fixed.

But I was able to hack this dumb program by print previewing each form and then saving it. This gave me a copy although it doesn't look the same as a regular IRS form but looks more like a worksheet. But whatever. I have the copies I need to send to the beneficiaries so no need to keep beating this sorry horse.

Other related questions before I e-file:

1. The beneficiary distributions are entered on 1041 Schedule B/Line 9 as "Income required to be distributed currently" totaling $60,430. Are beneficiary distributions considered income??? I did not think so but somehow the program led me to fill out info that results in the distributions being listed as so. Is it correct or do I need to go back and change something?

2. On 1041 Other Information (near the end) Line 8 states "If the decent's has been open for more than 2 years, attach an explanation for the delay in closing the estate, and check here".

I checked this box but was not provided an opportunity by TT to compose the required explanation. How do I fix this?

3. As the executor, I earned a mandatory fee on work done on the estate per the state of NJ schedules. Does the estate need to generate me a 1099 form for the earned amount or can I just file that amount as part of my personal 2021 tax return? If I need to generate a 1099, how do I go about doing that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

1. It isn't saying that the distributions to shareholders are income (they're not). It's saying that the income that the estate has is required to be either distributed to the beneficiaries or taxed to the estate. As long as that $60,430 is what the estate made then everything is correct.

2. If you attach an explanation to the return you are required to print it out and mail the return. How much longer do you plan to keep the estate open? If you plan on shutting it down soon then you can forgo the explanation.

3. Yes, the estate needs to issue you a 1099-NEC if it paid you more than $600. You can create 1099s using TurboTax here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

@joejoe1592 wrote:The beneficiary distributions are entered on 1041 Schedule B/Line 9 as "Income required to be distributed currently" totaling $60,430. Are beneficiary distributions considered income???

What is the source of the income?

All distributions to beneficiaries are not income. For example, distributions from corpus (principal) are not income and not subject to federal income tax.

However, if the income is on the line you indicated, the source is likely to be interest, dividends, gain, et al, and, therefore, subject to federal income tax.

@joejoe1592 wrote:Does the estate need to generate me a 1099 form for the earned amount or can I just file that amount as part of my personal 2021 tax return?

If you are a professional fiduciary, then the estate should issue you a 1099-NEC if you were paid $600 or more.

If you are not a professional fiduciary, then the estate should issue you a 1099-MISC with the amount you were paid in Box 3 if you were paid $600 or more. This income would be miscellaneous income for you and would not be subject to self-employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

The $60,430 is just the estate cash assets remaining after final bills were paid that are left to be divided. If I put that number in the wrong place, where is it supposed to go?

I want to close this estate, which is why I I checked the box that says "This is a final return".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

You do not have to report distributions of corpus (principal).

No matter where you enter it in the program, the amounts will not appear on your K-1s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cannot create K-1's for an estate...

Here is the root of the question:

https://drive.google.com/file/d/13DQZw1HOLHgHvN6GZ5668KkGJuyDRp6z/view?usp=sharing

As you can see and as I mentioned previously, I am trying to understand what this schedule B is and why line 9 says "INCOME required to be distributed currently" distributed.

BTW: TT did a program update on me Thursday evening. In doing so, it deleted the tax return I was working on. Luckily, I take regular image backups of my system, so was able to retrieve the tax file and not start all over again. Perhaps I was just "lucky" to have this occur to me. Hopefully, others are not experiencing the same problem of lost returns no longers in the Documents\Turbotax folder.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

admin

New Member

hung05

Level 2

thisblows

Returning Member

jacelynwillis

New Member

ekudamlev

New Member