- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Business tax loss safe harbor rule – Does this apply to the entity or business line?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

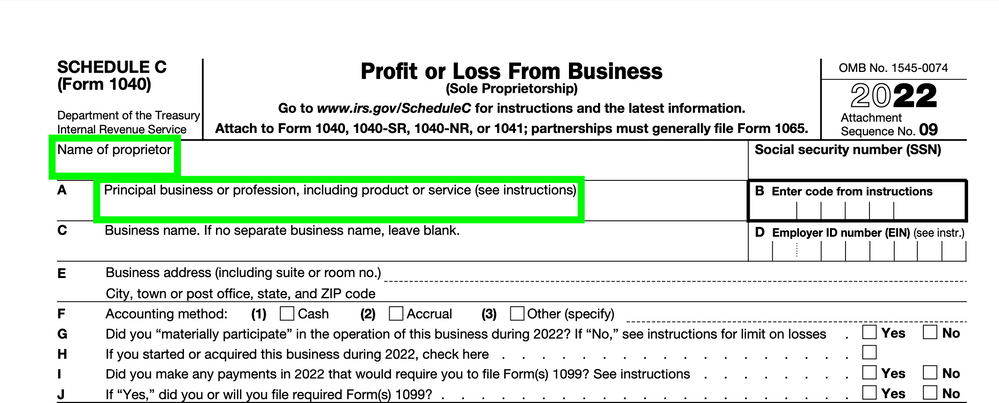

Does the IRS safe harbor rule for business tax loss deductions apply to the Name of proprietor or the Principal business or profession on the Schedule C, Profit or Loss From Business?

TurboTax outlines the safe harbor rule in When the IRS Classifies Your Business as a Hobby:

> The IRS safe harbor rule is typically that if you have turned a profit in at least three of five consecutive years, the IRS will presume that you are engaged in it for profit.

On the Schedule C there are 2 fields that represent a business.

- Name of proprietor

- Principal business or profession, including product or service (see instructions)

Example

- The name of proprietor is the same for 2018, 2019, 2020, 2021, and 2022: Alice Ecila

- The Principal business or profession changes at one point from 2018, 2019, 2020, 2021, and 2022.

- 2018: Hot dog stand (Sole proprietorship)

- 2019: Hot dog stand (Sole proprietorship)

- 2020: Consultant (Sole proprietorship)

- 2021: Consultant (Sole proprietorship)

- 2022: Consultant (Sole proprietorship)

If Alice has net operating losses (NOL) on her hot dog stand in 2018 and 2019, does this mean she may be at risk for her sole proprietorship being labeled a hobby even though the business line is completely different in 2020, 2021, and 2022 as a consultant?

- Outcome 1: Safe harbor rule is based on business entity and the safe harbor rules apply to all years as 1 business.

- Alice's sole proprietorship is viewed as the same business for 2018-2022 because it is the same legal entity (sole proprietorship).

- Outcome 2: Safe harbor is based on the business line and the safe harbor rules apply separately to each of the 2 business lines.

- Alice's hot dog stand and consulting business are viewed as separate businesses for 2018-2020 because these are different types of business.

Much appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

Section 183 is applicable here and the Regulations thereunder are instructive (i.e. activity or business):

Section 1.183-1(d)(1):

Ascertainment of activity. In order to determine whether, and to what extent, section 183 and the regulations thereunder apply, the activity or activities of the taxpayer must be ascertained. For instance, where the taxpayer is engaged in several undertakings, each of these may be a separate activity, or several undertakings may constitute one activity. In ascertaining the activity or activities of the taxpayer, all the facts and circumstances of the case must be taken into account. Generally, the most significant facts and circumstances in making this determination are the degree of organizational and economic interrelationship of various undertakings, the business purpose which is (or might be) served by carrying on the various undertakings separately or together in a trade or business or in an investment setting, and the similarity of various undertakings. Generally, the Commissioner will accept the characterization by the taxpayer of several undertakings either as a single activity or as separate activities. The taxpayer's characterization will not be accepted, however, when it appears that his characterization is artificial and cannot be reasonably supported under the facts and circumstances of the case. If the taxpayer engages in two or more separate activities, deductions and income from each separate activity are not aggregated either in determining whether a particular activity is engaged in for profit or in applying section 183. Where land is purchased or held primarily with the intent to profit from increase in its value, and the taxpayer also engages in farming on such land, the farming and the holding of the land will ordinarily be considered a single activity only if the farming activity reduces the net cost of carrying the land for its appreciation in value. Thus, the farming and holding of the land will be considered a single activity only if the income derived from farming exceeds the deductions attributable to the farming activity which are not directly attributable to the holding of the land (that is, deductions other than those directly attributable to the holding of the land such as interest on a mortgage secured by the land, annual property taxes attributable to the land and improvements, and depreciation of improvements to the land).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

Section 183 is applicable here and the Regulations thereunder are instructive (i.e. activity or business):

Section 1.183-1(d)(1):

Ascertainment of activity. In order to determine whether, and to what extent, section 183 and the regulations thereunder apply, the activity or activities of the taxpayer must be ascertained. For instance, where the taxpayer is engaged in several undertakings, each of these may be a separate activity, or several undertakings may constitute one activity. In ascertaining the activity or activities of the taxpayer, all the facts and circumstances of the case must be taken into account. Generally, the most significant facts and circumstances in making this determination are the degree of organizational and economic interrelationship of various undertakings, the business purpose which is (or might be) served by carrying on the various undertakings separately or together in a trade or business or in an investment setting, and the similarity of various undertakings. Generally, the Commissioner will accept the characterization by the taxpayer of several undertakings either as a single activity or as separate activities. The taxpayer's characterization will not be accepted, however, when it appears that his characterization is artificial and cannot be reasonably supported under the facts and circumstances of the case. If the taxpayer engages in two or more separate activities, deductions and income from each separate activity are not aggregated either in determining whether a particular activity is engaged in for profit or in applying section 183. Where land is purchased or held primarily with the intent to profit from increase in its value, and the taxpayer also engages in farming on such land, the farming and the holding of the land will ordinarily be considered a single activity only if the farming activity reduces the net cost of carrying the land for its appreciation in value. Thus, the farming and holding of the land will be considered a single activity only if the income derived from farming exceeds the deductions attributable to the farming activity which are not directly attributable to the holding of the land (that is, deductions other than those directly attributable to the holding of the land such as interest on a mortgage secured by the land, annual property taxes attributable to the land and improvements, and depreciation of improvements to the land).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

option 2. selling hotdogs and consulting to me are substantially different activities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

@Mike9241 wrote:

option 2. selling hotdogs and consulting to me are substantially different activities.

Agreed: virtually zero organizational and economic interrelationship between the two activities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

I appreciate all of the helpful responses. Here is the IRS Section 183, Activities Not Engaged in for Profit Audit Technique Guide for reference on how multiple activities are treated.

IV. Special Considerations > A. Multiple Activities

- The degree of organizational and economic interrelationship of various activities.

- The business purpose which is served by carrying on the various activities separately or together in a trade or business or in an investment setting.

- The similarity of various activities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

@adamhurwitz wrote:

I appreciate all of the helpful responses. Here is the IRS Section 183, Activities Not Engaged in for Profit Audit Technique Guide for reference on how multiple activities are treated.

Yessir, taken primarily from the Reg.

Good information.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

margomustang

New Member

yibanksproperties

New Member

tomdavey

New Member

tomdavey

New Member

EdT72

New Member