- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business tax loss safe harbor rule – Does this apply to the entity or business line?

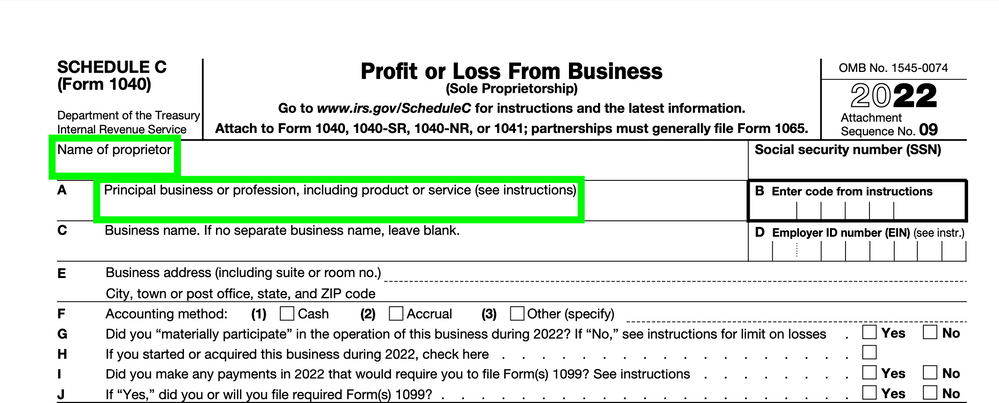

Does the IRS safe harbor rule for business tax loss deductions apply to the Name of proprietor or the Principal business or profession on the Schedule C, Profit or Loss From Business?

TurboTax outlines the safe harbor rule in When the IRS Classifies Your Business as a Hobby:

> The IRS safe harbor rule is typically that if you have turned a profit in at least three of five consecutive years, the IRS will presume that you are engaged in it for profit.

On the Schedule C there are 2 fields that represent a business.

- Name of proprietor

- Principal business or profession, including product or service (see instructions)

Example

- The name of proprietor is the same for 2018, 2019, 2020, 2021, and 2022: Alice Ecila

- The Principal business or profession changes at one point from 2018, 2019, 2020, 2021, and 2022.

- 2018: Hot dog stand (Sole proprietorship)

- 2019: Hot dog stand (Sole proprietorship)

- 2020: Consultant (Sole proprietorship)

- 2021: Consultant (Sole proprietorship)

- 2022: Consultant (Sole proprietorship)

If Alice has net operating losses (NOL) on her hot dog stand in 2018 and 2019, does this mean she may be at risk for her sole proprietorship being labeled a hobby even though the business line is completely different in 2020, 2021, and 2022 as a consultant?

- Outcome 1: Safe harbor rule is based on business entity and the safe harbor rules apply to all years as 1 business.

- Alice's sole proprietorship is viewed as the same business for 2018-2022 because it is the same legal entity (sole proprietorship).

- Outcome 2: Safe harbor is based on the business line and the safe harbor rules apply separately to each of the 2 business lines.

- Alice's hot dog stand and consulting business are viewed as separate businesses for 2018-2020 because these are different types of business.

Much appreciated!