- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

I am running into this same thing. Please fix turbo tax. @Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

We are unable to reproduce this review message when entering Form 1065 Schedule K-1 with Box 20 Code AJ. Please close TurboTax, reopen your return then run Review again.

If the message persists, it would be helpful to have a TurboTax ".tax2023" file to test further.

If you would be willing to send us a “diagnostic” file that has your “numbers” but not your personal information, please follow these instructions:

In TurboTax Desktop, open your return and go to Online in the black TurboTax header (on a Mac, choose Help).

- Choose Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send on this screen and wait for the Token number to appear.

- Reply to this thread with your Token number and tag (@) the Expert requesting the token from you. Please include any States that are part of your return.

We will then be able to see the same experience you are having. If we are able to determine the cause, we'll reply here and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

token #1194810

This should show the error that comes up when you run a Federal Tax review.

Believe workaround is to default to Other and type in Code AJ and then enter the $ amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

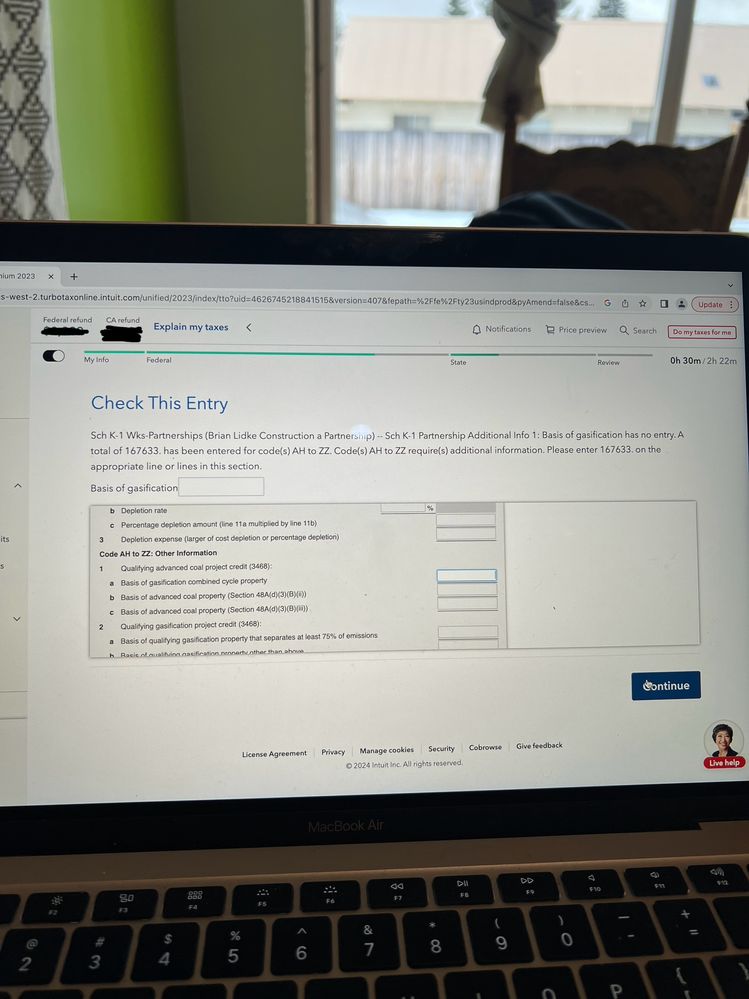

this is what keeps popping up. I took the advice of another turbo tax expert on here and tried entering AJ twice, one for the income and one for the deductions, and I still get this gasification fix screen. Any more advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

I have the same error. I have two AJ entries - one for Income 51,836 and the other for deductions 19,538 both are positive on my K-1. I think I need to enter the 51,836 as a positive and the 19,538 as a negative so it totals box 2 on my K-1. But I am also getting an error message regarding gasification which this has nothing to do with the topic. TurboTax wants me to fill in on the form title Schedule K-1 Partnership Additional Information (For Boxes 4, 9c, 11, 12, 13, 15,16,17, 18 and 20) under Section Code AH to ZZ: Other Information Line 1 a Basis of gasification combined cycle property the sum of the two numbers in this case 32,298 (51,836-19,538). Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

Thank you for the Token number. We will investigate and if we are able to determine the cause, we'll reply here and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

Although the first line in the subform mentions "gasification," this is only the first of several lines available for entry. Note the heading says "Code AH to ZZ: Other Information."

Scroll or tab down to Line 6 "Other" and enter a short description (Code AJ Income, for example) then the amount from your K-1. If there are two amounts, enter each on a separate line under Other. The review message will clear.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

It does not allow you to scroll down and enter anything on line 6 "other". can i just put 0 in basis of gasification?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

This is a known issue. You can sign up here for updates: Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

I'm having the same problem. The K-1 I received has line 17 with code AJ listed. The supplemental Information sheet has under Descriptive information two AJ lines with Agg Busness income and one with Agg Business Activityy Total Deductions. After listing both numbers on the input screen give me the same gasifacation error during review,

I don't believe.they have updated the codes for 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

Mine is also on 1120-S K-1, box 17, code AJ. I can't figure out where to enter that into TurboTax. There are two different amounts -- one for Aggregate Business Activity Gross Income or Gain and one for Aggregate Business Activity Deductions. What do I do with this information -- where does it get entered?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

Nope -- that doesn't work for me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

I have exact same issue. Looking forward to knowing when update is out. This can't be a hard problem to resolve.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 of my K1 use code AJ which is Excess business loss limitation. A TurboTax review it wants me to identify the amount as some type of gasifaction?? Code AG. Help

As CatinaT1 posted earlier, this is a known issue. If you sign up for updates via this link, you will be notified when the Box 20 issue has been resolved: Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gcburke

Level 2

DirtDoc

Level 2