- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Box 13 for Code K - excess business interest expense needs Form 8990 - HELP!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 13 for Code K - excess business interest expense needs Form 8990 - HELP!!

Hi,

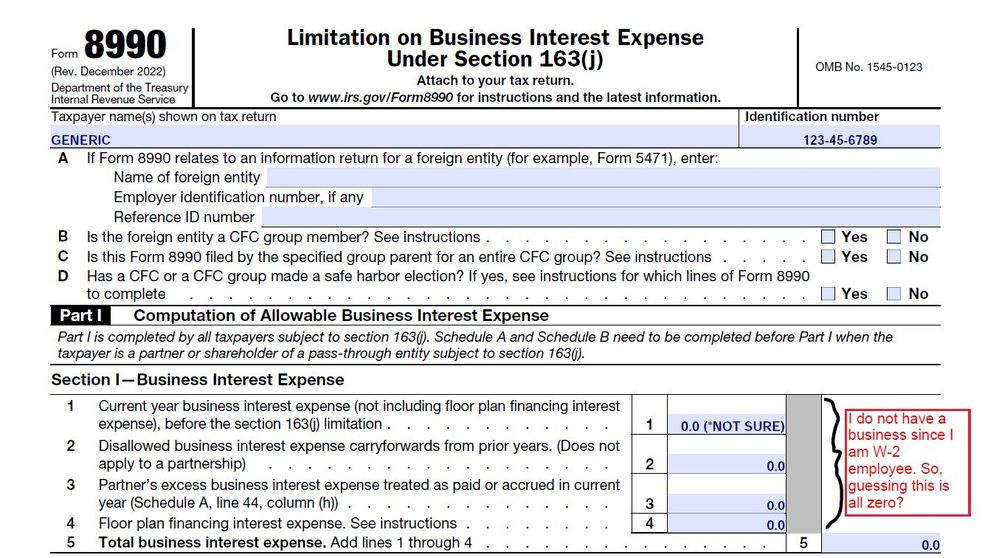

Turbotax does not provide any help for Form 8990 and I have no clue how to do it.

I own shares in a publicly traded MLP, called Plains All American Pipeline.

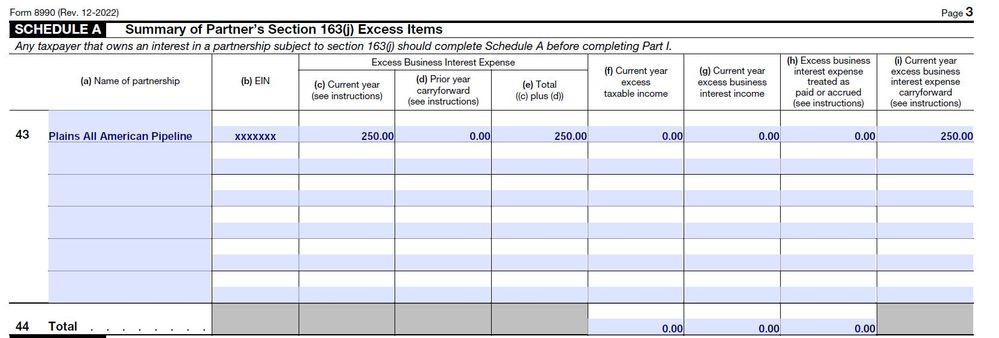

My K-1 for Plains All American Pipeline has Box 13 - with a code K amount of $250.

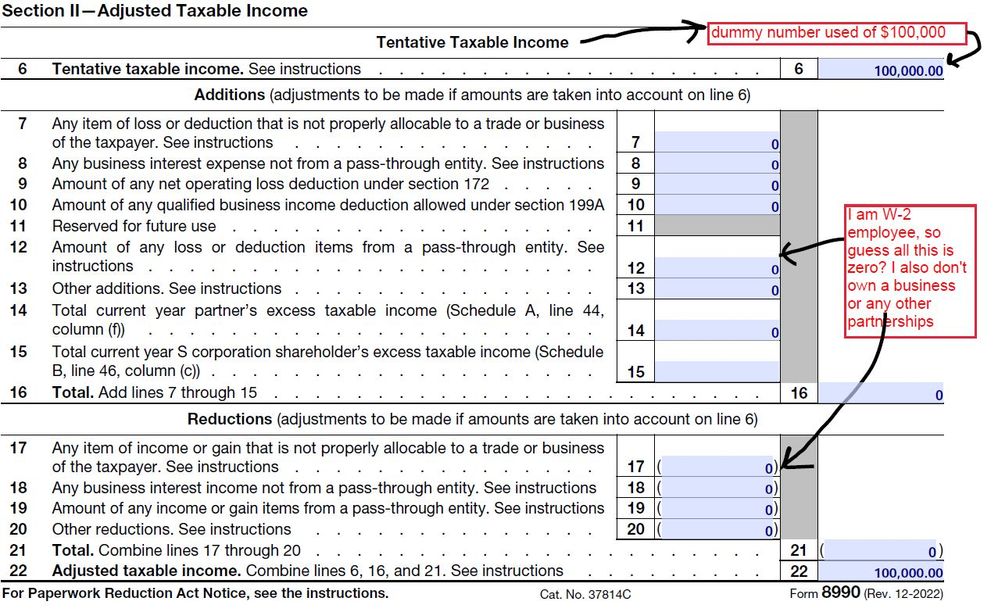

This is the only K-1 that I have. I am a W-2 employee who does not own a business or have any other business interests.

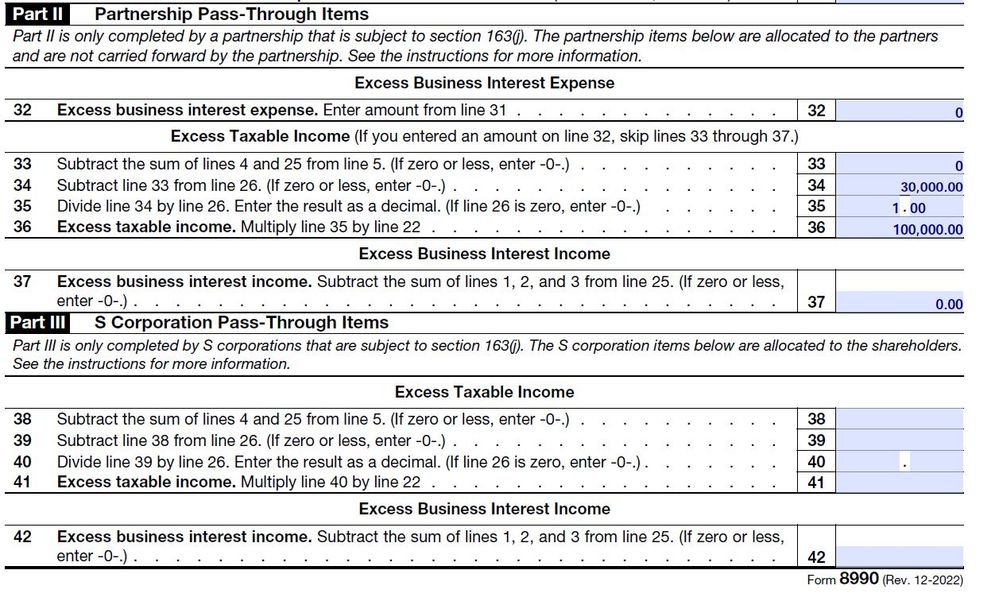

I downloaded the Form 8990 from the IRS website and am trying to fill it. I have attached some pictures and was wondering whether what I have filled in makes sense....

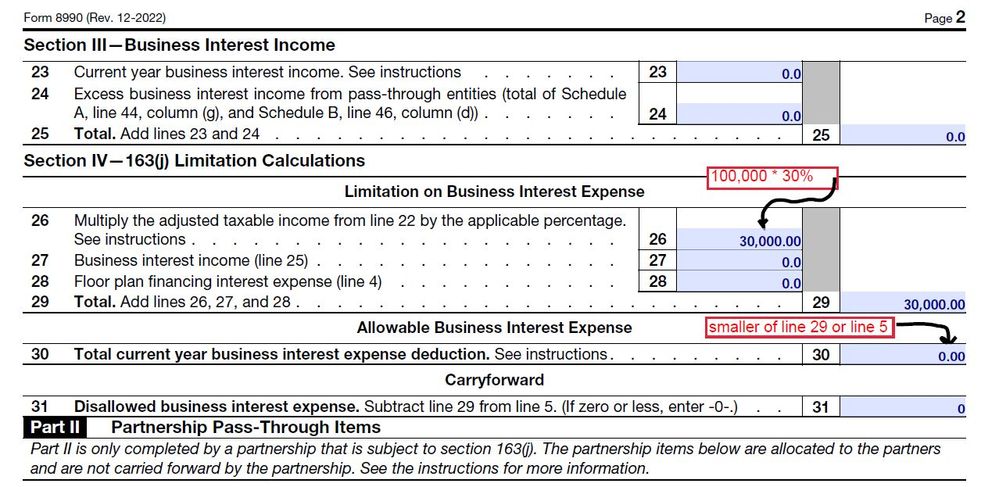

The Excess Business Interest Expense of $250 does not seem to appear anywhere except in Schedule A!!

Is this even correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 13 for Code K - excess business interest expense needs Form 8990 - HELP!!

If there was no additional information reported in the K-1 statements, I believe the way you have filled out the form is correct. If they reported any "Current Year Excess Taxable Income", you would enter that in column f of Schedule A. You might want to go through the Instructions for Form 8990

You don't report this on your tax return, but you have to reduce your basis in Plains All American Pipeline (but not before zero) by the amount of the excess business interest. This could affect non-taxable distributions deemed a return of basis. If you dispose of your interest in the partnership, you add back to your basis any unused excess interest expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mike1127

Level 3

LizaJane

Level 3

Alex012

Level 1

atn888

Level 2

bradley-e-stark

New Member