- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

To indicate that your earnings are from self-employment, there must be an entry in box 14 of your K-1 with Code A - Net earnings (loss) from self-employment. Then your income will flow to Schedule SE.

Health insurance premiums paid by the law firm should appear on line 13 of the K-1P with code M, they will automatically flow to line 29 of form 1040. You don't have to do anything else.

If you paid the premiums out of pocket and were not reimbursed by the partnership, please follow these steps to enter the information:

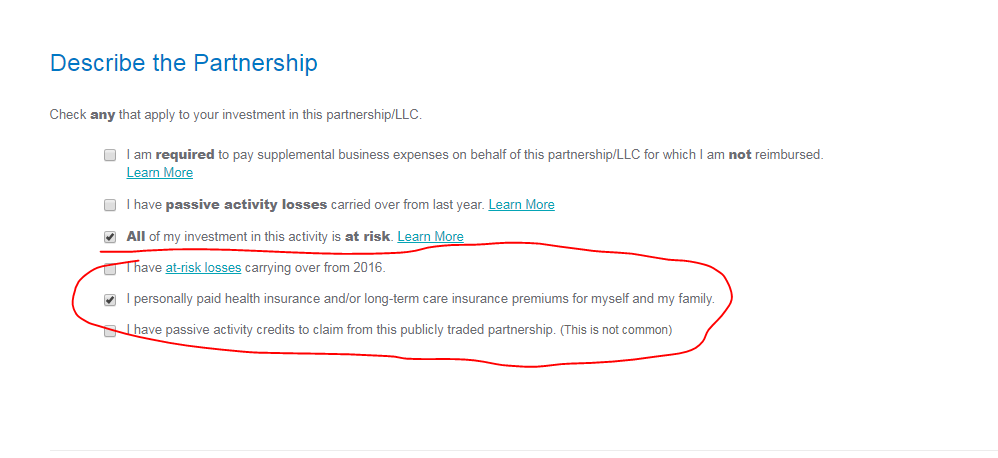

- After you've entered the information from all the boxes on the K-1, you will see a screen, Describe the Partnership. Mark the box I personally paid health insurance . . . and click Continue. [See Screenshot #1, below.]

- On the Any Self-Employed Insurance Costs enter the Health Insurance Premiums you paid that were NOT included in Box 13M. Click Continue. [Screenshot #2]

- On the next screen, you will have the opportunity to enter any long-term care insurance costs.

- You will be brought back to the Partnership/LLC K-1 Summary. Click Done if you have no additional K-1s to enter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

I have the same problem. Basically, the software doesn't seem to be able to handle the K-1 entries correctly. When I look at the generated schedule 1, none of the adjustments to income are correct that originate from the K-1:

1. Line 27: The deductible part of self-employment tax is off by 5 figures;

2. Line 28: the retirement plan deductions are capped at 15,500. Makes no sense - the IRS limit for people under 50 is 18,500 and 24,500 for people over 50. It doesnt account for additional retirement deductions that it should.

3. Line 29: the self employed health insurance deduction is not there, even though I selected the box mentioned above.

Was anyone able to get this to work?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

I should add that the K-1 info did not flow properly to Schedule SE as far as I can tell, since the self-employment income value listed on 14A is not reflected in the Short Schedule SE generated by the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

Schedule A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

@kphillips8 Per @TurboTaxIrene:

"To indicate that your earnings are from self-employment, there must be an entry in box 14 of your K-1 with Code A - Net earnings (loss) from self-employment. Then your income will flow to Schedule SE.

Health insurance premiums paid by the law firm should appear on line 13 of the K-1P with code M, they will automatically flow to line 29 of form 1040. You don't have to do anything else.

If you paid the premiums out of pocket and were not reimbursed by the partnership, please follow these steps to enter the information:

- After you've entered the information from all the boxes on the K-1, you will see a screen, Describe the Partnership. Mark the box I personally paid health insurance . . . and click Continue.

- On the Any Self-Employed Insurance Costs enter the Health Insurance Premiums you paid that were NOT included in Box 13M. Click Continue.

- On the next screen, you will have the opportunity to enter any long-term care insurance costs.

- You will be brought back to the Partnership/LLC K-1 Summary. Click Done if you have no additional K-1s to enter."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

Found it on the second screen that asks for a description.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

As a partner at a law firm I get a k-1. I have entered the k-1, but it doesn't seem to add self-employment tax. Also where can I deduct health insurance premiums I pay.

The question shows up after you enter the partnership general info. @JimS57

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

adm

Level 2

kfbtax2023

New Member

elizabethturner1

New Member

kapsel55

New Member

swnakim

New Member