- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- 2022 TurboTax Business math issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

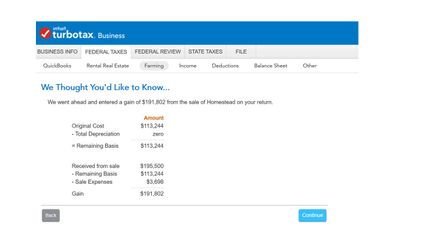

2022 TurboTax Business math issue?

Have a multi-member LLC which separated and sold the homestead (house and outbuildings) from the remainder of the farmland. As you can see from the screen shot above, for some reason TurboTax Business 2022 is not subtracting the original cost basis (only the sales expenses) from the gross amount reported on form 1099-S for the sale.

Thanks for your assittance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 TurboTax Business math issue?

Thanks for the suggestion.

Since the homestead was not technically used as part of the business and wasn't used as a rental (although closest option for type of asset was 'residential rental real estate' and it had never been depreciated. Thus had 0% for 'Percentage of business use' on the "Federal Asset Entry Worksheet". When changed that to 100% the basis was subtracted correctly from the sales price.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 TurboTax Business math issue?

Check Forms Mode (your asset worksheet(s) for accuracy). Below is the result I got which appears correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 TurboTax Business math issue?

Thanks for the suggestion.

Since the homestead was not technically used as part of the business and wasn't used as a rental (although closest option for type of asset was 'residential rental real estate' and it had never been depreciated. Thus had 0% for 'Percentage of business use' on the "Federal Asset Entry Worksheet". When changed that to 100% the basis was subtracted correctly from the sales price.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

highstream

Returning Member

In Need of Help

New Member

alec-ditonto

New Member

alec-ditonto

New Member

LizaJane

Level 3