- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- while filing my taxes, l received notice the l have an underpayment penalty of $292. How did l get this notice and how do l make this extra payment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

while filing my taxes, l received notice the l have an underpayment penalty of $292. How did l get this notice and how do l make this extra payment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

while filing my taxes, l received notice the l have an underpayment penalty of $292. How did l get this notice and how do l make this extra payment?

If you have filed your tax return through TurboTax and it indicated that you have an underpayment penalty, the program will automatically compute and add that amount to your return, and reduce any refund or increase your tax liability as applicable. You do not have to file anything additional.

If you have not filed yet, you may be able to go to Federal Taxes tab or Personal tab, under Other Tax Situations and select Start by the Underpayment Penalties. You will answer a series of questions that may reduce or eliminate the penalty.

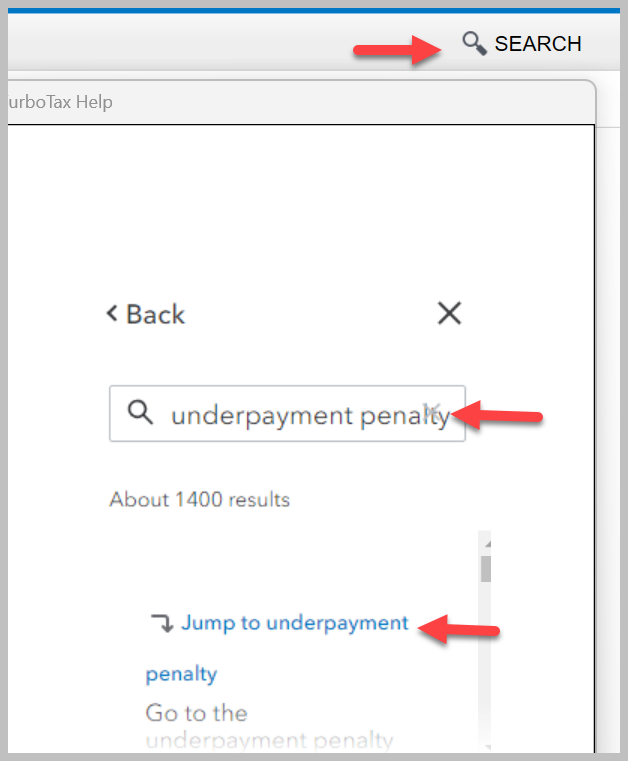

If you need to get back to the TurboTax entry screens that are related to the underpayment of taxes, to review your entries, you can do the following:

- Click on the search icon at the upper right of your TurboTax screen

- Type "underpayment penalty" in the search bar and hit "Enter"

- Click on the link "Jump to underpayment penalty"

- If you can answer yes to all three questions you may be able to avoid some or all of your penalties.

Your screen will look something like this:

Click here for information on entering your estimated tax payments.

Click here for "How Do I Make Estimated taxes"

Click here for additional information on "How to Determine What to Pay and When"

Click here for common questions on Estimated taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xcom747

New Member

douglasjia

Level 3

johntheretiree

Level 2

garne2t2

Level 1

PGW1

Returning Member