- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Status still Pending

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

From speaking to Intuit exec crew, it sounds like there were no reports of issues sending Tax Returns to the IRS. So perhaps the IRS is sitting on their hands or they have some issue(s). What people really needed to know from Intuit is whether the transmission of their return to the IRS was successful before any processing begins. Pending Status could be clarified further - i.e. IRS received return from Intuit, but didn't begin processing. Maybe say, "received by IRS, not processed".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Return is now in Rejected status.. Looks like a bug on the TurboTax side. Why?? I e-filed Feb 10, both Federal and State in Pending Status... rejected 1 whole week later! I feel there is a lack of honesty until last minute when a bug is found.

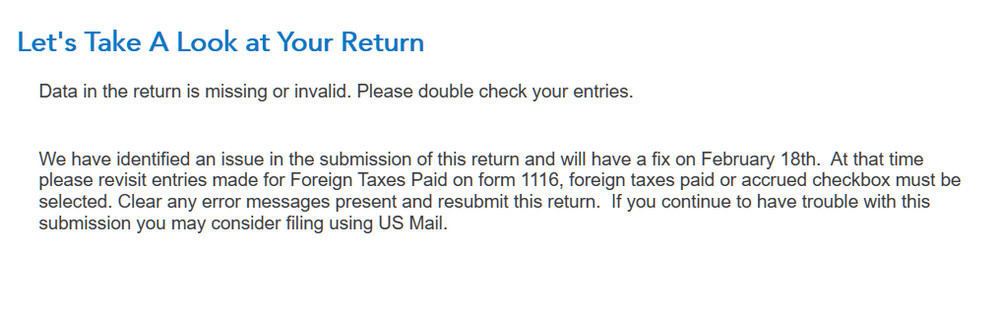

"We have identified issue in the submission of this return and will have a fix on February 18th. At that time please revisit entries made for Foreign Taxes Paid on form 1116, foreign taxes paid or accrued checkbox must be selected."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

What date did you e-file? And is it both federal/state returns that were stuck in pending status?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

See above. Maybe TurboTax should have an automated test suite that they use to test different kinds of returns and file them with the IRS *before* others do and see if they get rejected. Easier said than done, but whatever.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

I just emailed [removed]. I e-filed my federal and CA state returns on 01/28 and my federal return got accepted on 02/11. My CA return is still pending. Will keep you all posted re: his reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

@T-u-r-b-o-Taxing thank you for information, I did use form 1116 but only to report carryover from last year. I had to actually wait few days to e-file my return due to the message from TT that "form 1116 was not finalized by IRS for 2020 year". After the form was approved I was able to e-file on 2.5.21. I checked form 1116 that part of my return and foreign taxes paid or accrued checkboxes and neither of the two are selected.

Edited: I just rejection notice exactly the same as @T-u-r-b-o-Taxing . I am not sure if I will get another notice from TurboTax the fix had been applied and only then I am to make changes to form 1116? My rejection notice is below

I am not happy with TurboTax...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

In reference to Form 1116, I had filed my Tax Return after TurboTax released this form. I have marked Foreign Tax Paid.

My Tax return is still pending and I had filed on 2/10/2021. May be there is unresolved problem/bug with this form. Anyway I will wait and see what happens after they correct the bug on 2/18/21.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

I just spoke with someone from the CA FTB through chat and this is what she said. There CLEARLY is an issue with TT:

Manuela[3:47 PM]: As I have explained and mentioned above, we accept returns but not processing them so the returns in pending status |

Manuela[3:48 PM]: Is there anything else I can assist you with today? |

MC[3:48 PM]: Ok, TY. What does "pending" mean exactly? Because I got an email that my federal return was accepted but I have not received that message for my CA return. So it is not accepted yet. |

Manuela[3:49 PM]: If you efiled your CA return to us and you have not received an email stating we received or accepted the return, you may want to contact your software provider |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

UPDATE:

Just checked my bank account and I have a Federal refund pending for deposit showing....2/19/21 deposit date but my bank lets me see future ACH deposits.

So yeah, something is def wrong here on the state return, somehow Turbotax did not send or make accessible the state return e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Lol! I wouldn’t that be funny if you actually got it!?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

*Currently researching this

Hey everyone. We're aware of your concerns.

We're working to confirm if there's an error between state e-filing and TurboTax. Once I learn more, I'll update this thread.

Thank you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Both my state and federal had been pending since jan. 10, i finally received 2 text messages, both said that they had been rejected to see emails and follow the directions to fix and resubmit them. I checked my emails, the issue was with my federal, it said that i had miscalculated and software issue, i needed to log back into my account so thw software could update and recalculate my refund and then resubmit both. So i did. About 10 minutes later, both came back saying they have both been excepted. Now the wait to receive into my direct deposit account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

I filed my returns early and the IRS accepted my return on 2/10/2021. As of today my state, Georgia, return is just Pending. In every previous year my returns have been accepted within a day of each other. I have verified that Georgia is accepting returns. Something is up and needs to be looked at.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

And now my VA state return has been accepted. BUT not before being rejected at first, because.... I didn't include a valid Federal return with it. Not true! My US Federal return was accepted shortly before my VA return was rejected. And you know TurboTax for Business includes the Federal return along with the state return. So what was the solution? To re-review my Federal return. No problems found. And then to resubmit my VA return - also with NO CHANGES. Two hours later - my VA return was accepted. To repeat, there were no changes to be made to either return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Status still Pending

Just to add a small data point. For those who are waiting for state return to move out of pending status but the federal return has been accepted. And you check where's my refund on the IRS webiste and shows only 1 bar still processing....you might actually have a refund coming this Friday.

I checked my bank account and my fed return is on my upcoming deposits list for this Friday 2/19, but the IRS website shows 1 bar (still processing).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

samanthadegraaff7

New Member

tpost44

New Member

user17643691293

New Member

dacxman

New Member

brittcompliance

New Member