- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Should I amend or wait?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend or wait?

Do I need to amend my return if I thought I didn't receive my third stimulus check but realized I did? Should I contact the IRS or just wait for them to contact me? I eFiled on January 30 and it was accepted by the IRS.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend or wait?

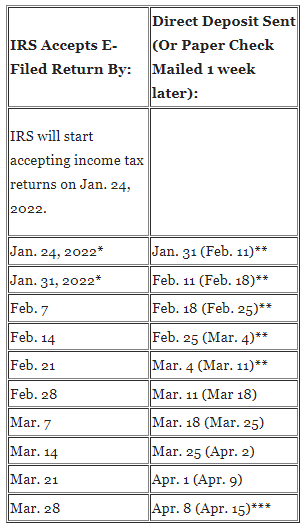

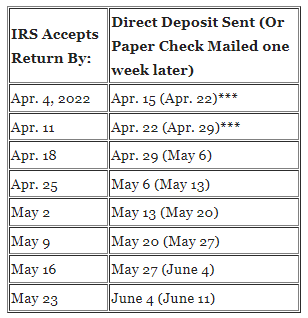

Wait, please wait. The IRS is cross checking stimulus that adds 3 weeks to the normal processing. The IRS says not to file an amended return until the payments are processed and bank cleared from the original. An amended return would just gum up the works for the rest of the year. In addition, the IRS will delay processing by 2-3 weeks if an income tax return has the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), since these credits are often misused. In addition, cross-checking of stimulus payments, etc may cause additional delays.

Start with the chart for my return has no credits and no stimulus then start adding 3 weeks for each incident before you start to get concerned.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I amend or wait?

Thank you!!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jbrooksnw

New Member

gavronm

New Member

dssniezko

New Member

easytrak2002

New Member

cpengert

New Member