- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

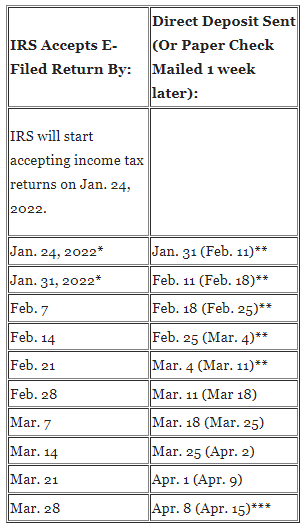

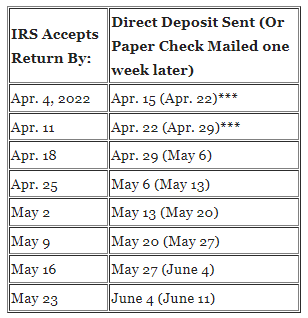

Wait, please wait. The IRS is cross checking stimulus that adds 3 weeks to the normal processing. The IRS says not to file an amended return until the payments are processed and bank cleared from the original. An amended return would just gum up the works for the rest of the year. In addition, the IRS will delay processing by 2-3 weeks if an income tax return has the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), since these credits are often misused. In addition, cross-checking of stimulus payments, etc may cause additional delays.

Start with the chart for my return has no credits and no stimulus then start adding 3 weeks for each incident before you start to get concerned.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 9, 2022

7:30 PM