- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: UCE Updates in Already Filed Return (Schedule 1, Line 8)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

I filed my taxes in February before UCE $10,200 exclusion went in to effect. I owed both Federal and State (CT) I already made the payments in February.

- When I download the tax returns from TurboTax today (5/19/2021), it shows UCE - $10,200 on Schedule 1, Line 8. This article says if I see that, then it means my AGI is already recalculated. I do understand that IRS will make the required updates on the Federal return but how is my TurboTax file on record gets updated? I called TurboTax and the lady said IRS makes updates on the TurboTax records. I wasn't convinced that IRS will make updates on TurboTax records. Any idea?

- CT State recommends that I file amended return to account for UCE, but TurboTax is not letting me amend only the State returns. It is automatically filing Federal (Just before click 'Submit' it shows it will transfer the record to IRS and I backed off at that point.). How can I amend only CT State returns?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

Turbo Tax put out a program update for it after you filed. The IRS didn't update your Turbo Tax return. The updated return won't be sent. The IRS will adjust it for you.

See,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

you should get to a screen where you can choose between e-filing and mailing. select mailing for booth returns

I called TurboTax and the lady said IRS makes updates on the TurboTax records. I wasn't convinced that IRS will make updates on TurboTax records. Any idea? yes, that lady misspoke. the IRS has no access to Turbotax files

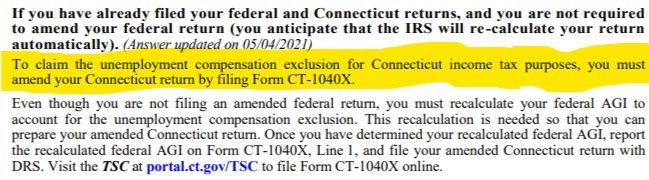

here's what Ct says. by the way, the IRS says it will amend returns filed without the UC exemption and send refunds but it might take all summer to do for everyone

If you're not required to amend your federal return (i.e., you anticipate that the IRS will recalculate your return automatically), don't amend your Connecticut return at this time. The state is waiting for more guidance from the IRS on how recalculations will be reported to taxpayers and state taxing agencies.

.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

Thanks for the clarification @Mike9241 ! I think you were planning to insert a link in 'here is what CT says'; which didn't seem to have come through. I was going by this document on CT Government website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

@VolvoGirl Thank you for your response! Can you please help me understand what you mean by "Turbo Tax put out a program update for it after you filed"? Does it mean that TurboTax updated the tax records on their own for all those who qualify for UCE? If they did that, I would have hoped them to do so by keeping the original record As-Is and by providing a separate updated record.

Now this is my situation:

Federal:

TurboTax Records: Already updated by TurboTax

IRS Records: Will be updated by IRS (Hopefully)

State:

TurboTax Records: Already updated by TurboTax

CT DRS Records: I have to file an Amendment

@VolvoGirl @Mike9241 Does either of you have a link or any other reference which details why TurboTax went ahead and updated the original records to include UCE?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

Don't know why. And here is about amending states

https://ttlc.intuit.com/community/state-taxes/help/do-i-need-to-amend-my-state-return/00/2134732

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

Very good question, which I am still wondering myself.

You must amend against your originally filed return , not a changed return.

When you log in it says "Documents" in the left menu bar.

What does it show in that section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UCE Updates in Already Filed Return (Schedule 1, Line 8)

I see 'Download Tax PDF' and when I download I get the documents with the revised info (UCE, updated AGI etc.). Luckily I had downloaded a PDF of original submission back in February when I filed and hence I have a reference copy.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17727221511

New Member

mccarterjames1

New Member

lmcrowellesq

New Member

business-turbo

New Member

super daddy

Level 1