- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Tax Rejection

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

So when I finish filing my taxes, everything is okay now then I was redirected to a free benefit thing so I was curious about so I answer some questions, after that I refile my taxes because they want to... after an hour I received an email saying that my taxes are rejected.. so I sign in and fix it, then afterwards I received an email once again saying that it was rejected... I signed out instead of fixing it again and get an email..

-should I just wait until IRS says it was accepted in the first place?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

You can only e-file your tax return once. If you e-filed it and it was accepted then you are done. You cannot e-file it again. Sounds like you are confused as to whether your return was accepted the first time. Check your e-file status. What does it say?

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If it says accepted, then you are all set and can wait for the IRS to process your return. If it says rejected then post back and tell us EXACTLY--word for word--what the rejection notice says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

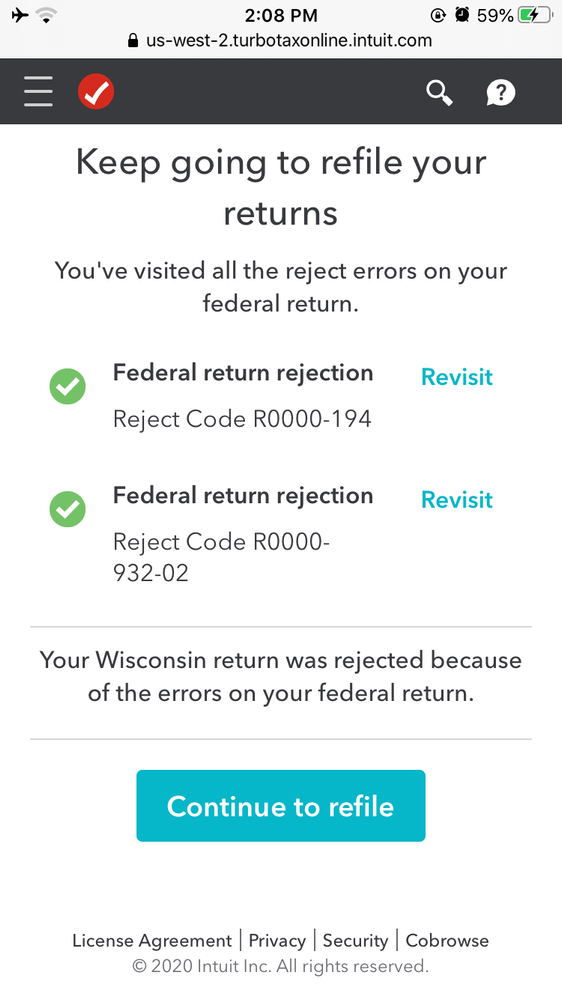

This is what it says after I e-file it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

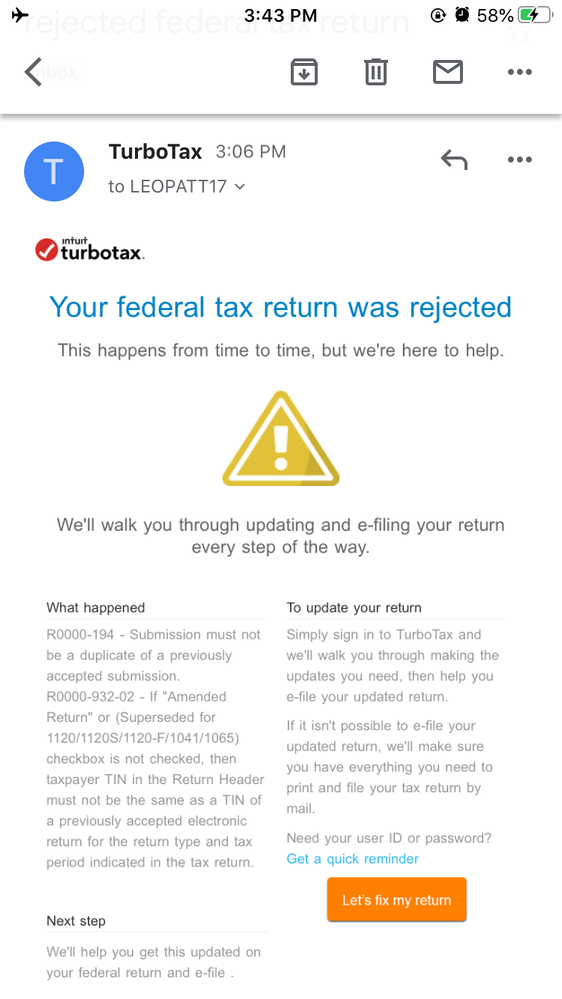

This was the email I received

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Rejection

r0000-194 means someone filed a return using the same SSN as that on your return. the result is that you can no longer e-file federal or state. they must be filed by mail. use a method where you can get proof of delivery. follow TT mailing instructions for necessary attachments, mailing addresses, and other procedures. did you file a non-filers return to get your stimulus payment? if you did do a non-filers return this is the procedure the IRS says you should follow:

If a filer used the Non-Filers tool to register for EIP, they cannot file a subsequent tax return electronically. They must complete a paper Tax Year 2019 Form(s) 1040/1040-SR, print and write “Amended EIP Return” at the top, and mail the return to the IRS.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AliciaW

Returning Member

ylma663338

New Member

fordescort12

Returning Member

AdamBATL

Level 1

danachavez53

New Member