- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I'll tell you 3 ways to print. If the first 2 don't have...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

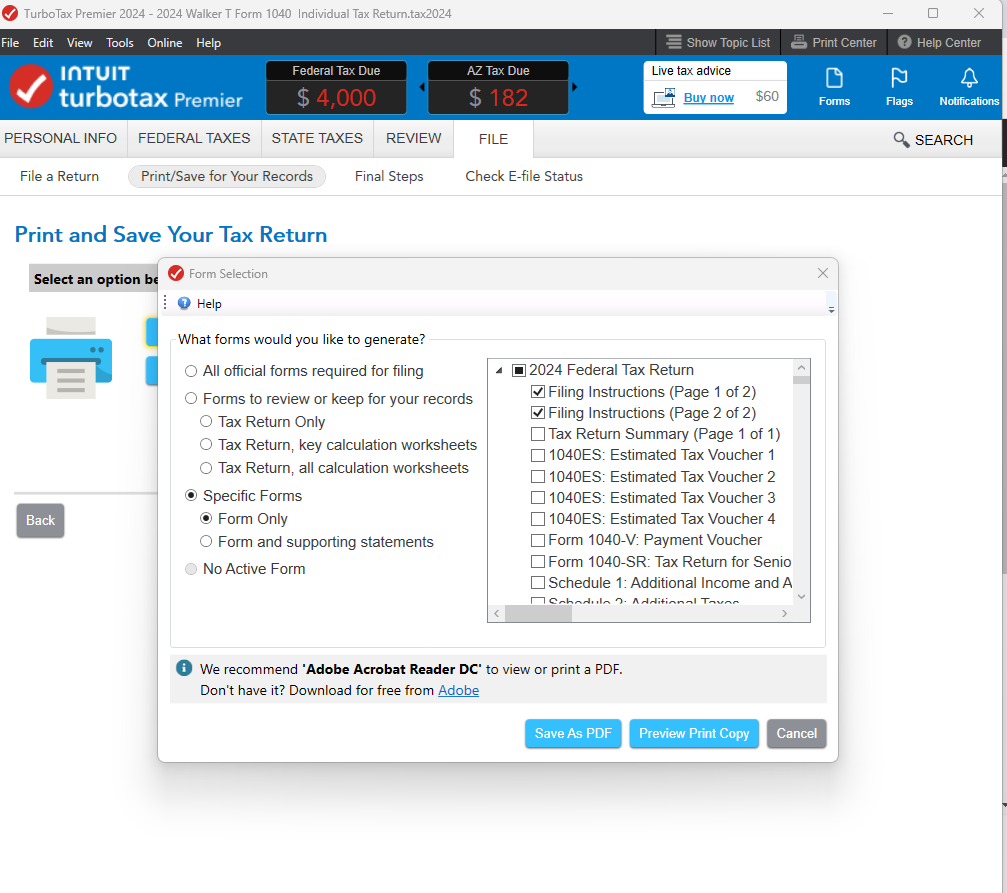

I'll tell you 3 ways to print. If the first 2 don't have the summary pages, you'll need to use the more complicated method.

Log into your account and go the 2016 Tax Timeline

Scroll to "some things you can do".

You should be able to "download/print the PDF", which is a basic version. Does that have the summary pages?

If the regular PDF doesn't have what you need, there should also be a link there for "download all forms and worksheets" . Does that second larger PDF have the summary pages?

If not, try this alternate method which is to open the return and print from the PRINT CENTER:

- In the 2016 Tax Timeline, go to Some things you can do.

- Choose Add a State. (you don't really add one; that's just to get the return to open up.)

- Once the return is open, then click on MY ACCOUNT up at the top.

- Then choose PRINT CENTER.

- Choose to "print/save/view this year's return." You may have a choice for

a PDF "as filed" and one with "all forms for government and worksheets" and "all forms." See if any of those PDFs have the summary pages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

I'll tell you 3 ways to print. If the first 2 don't have the summary pages, you'll need to use the more complicated method.

Log into your account and go the 2016 Tax Timeline

Scroll to "some things you can do".

You should be able to "download/print the PDF", which is a basic version. Does that have the summary pages?

If the regular PDF doesn't have what you need, there should also be a link there for "download all forms and worksheets" . Does that second larger PDF have the summary pages?

If not, try this alternate method which is to open the return and print from the PRINT CENTER:

- In the 2016 Tax Timeline, go to Some things you can do.

- Choose Add a State. (you don't really add one; that's just to get the return to open up.)

- Once the return is open, then click on MY ACCOUNT up at the top.

- Then choose PRINT CENTER.

- Choose to "print/save/view this year's return." You may have a choice for

a PDF "as filed" and one with "all forms for government and worksheets" and "all forms." See if any of those PDFs have the summary pages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

These instructions don't help for those of us with the Desktop software who are having the same issue of NO summary sheet or mailing instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cover page for tax return from Turbo Tax

Try a Manual Update and retry printing your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

smarks68

New Member

smiklakhani

Level 2

user17558059681

New Member

andylang71

New Member

lilbit_countrygrl

New Member