- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: How can I remove QBI from my return. I do not want to claim it as I just realized I don't hav...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

Yes, you can change the QBI designation for your rental unit if you do not provide 250 hours of "rental services".

To change the QBI designation, while signed in and working in TurboTax:

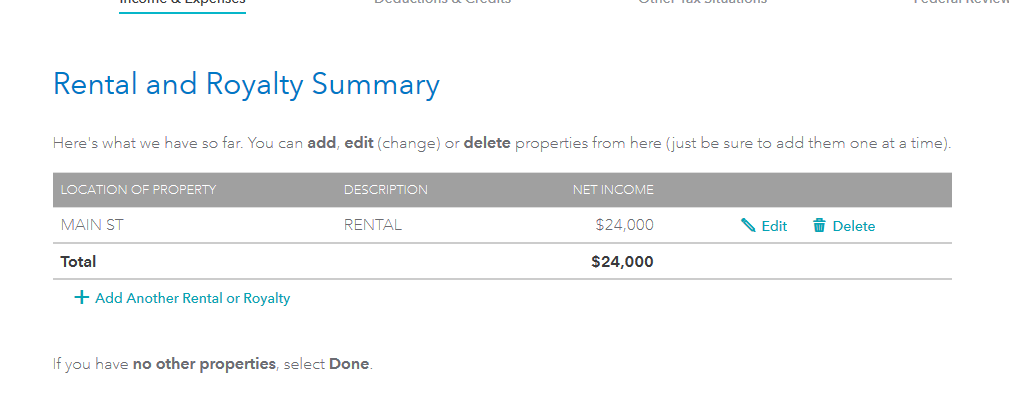

- Click on Federal in the black left-hand menu

- Click on Income and Expenses

- Scroll down to Rentals Royalties and Farm, then Rental Properties and Royalties.

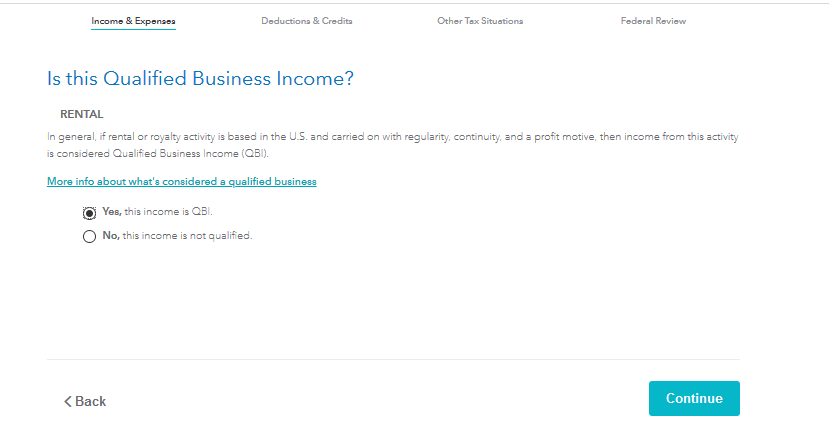

- Scroll through the screens, after the entry screens you will get a screen "Is this a Qualified Business Income". Answer no.

You can find out more about Rentals and QBI designations here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

Hi I have the Premiere Windows desktop version and I am still receiving a QBI deduction similar to the user above. I followed the instructions provided by the expert above and made sure to check "No" for the QBI question. I also made sure to check Schedule E and confirmed that the "No" box was checked for that question in the form as well; however when I get to the Deductions and Credits summary via the Step-by-Step, a "Qualified Business Income Deduction Summary" page appears with a value greater than 0 for a QBI deduction. It says n/a for business amount with a QBI amount and a QBI deduction. Why am I qualifying for this when I answered the question "No"? How do I remove it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

You may need to delete the Form 8995 from your tax return. Please see the steps below:

- Click on the "Forms" mode in the right-hand corner of the screen.

- Scroll down in the column on the left, "Forms in My Return," until you find Form 8995

- Click on the form and then select Delete Form on the bottom of the screen. Select Yes to confirm.

- Click on "Step-by-Step" in the right-hand corner of the screen

- Go back through the steps that DeanM15 provided in the above message to very that "No" is selected for the question "Is this a Qualified Business Income"

- Click on the Review tab to ensure that any errors are corrected.

- Click on the Forms mode again and click on Form 1040 from the column on the left. Scroll down to line 10 on Form 1040 to verify that the amount has been removed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

Hi BarbaraW22 - I actually figured out that we had some Section 199A dividends which was why it was triggering the QBI deduction; it had nothing to do with our rental property which is what I thought originally. I checked another expert's post re: this situation and that helped clear that up. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

So how did you remove that Section 199 dividend? I'm having the same problem but it is coming from a Brokerage fund investment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

Hi - I did not remove the Section 199 dividend because it was legitimate as reported on a 1099-DIV. Originally I thought the QBI was triggered from my Schedule E which is why I wanted to remove it initially. Hope that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

I have a rental property which I initially qualified as QBI but I think this does not really apply so I want to remove QBI qualification. however I do not see this option. I am using Turbo Tax Premier 2019 version. The steps mentioned not sure if they apply to this version I these menu items don't exist.

there is "Rental Properties and Royalties." under Wages & Income.

however I don't get asked ""Is this a Qualified Business Income" question when I review it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

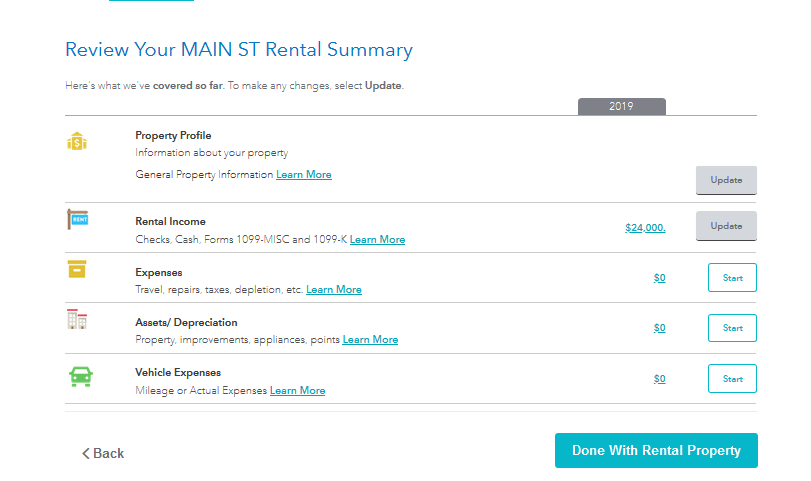

You will have to go back to the Rental entry- and click Edit on the specific Property. On the Summary screen, click Done with rentals. There are a few questions then you will see "Is this Qualified Business Income?" See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

I originally checked that I qualified for QBI but decided I didn't and had difficulty getting out of it. BarbaraW22 answered it correctly for me! I had to go delete the Form 8985 (hope that's the right number she says above) and then go back through the steps for each rental property and it let's you choose again if this qualifies. Thank you BarbaraW22!! I was struggling with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

I'm in same boat, BUT, I claimed QBI in 2018 filing only and not 2019. It was a loss carryforward and so didn't impact my filing amounts either year. I'm working on 2020 and saw it. I don't plan to any more. Can I simply delete the form 8895 in 2020 filing (showing the loss carryforward) and pretend like it never happened, or what's the simplest way to handle this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I remove QBI from my return. I do not want to claim it as I just realized I don't have the 250 hours.

@Anonymous

I think you are saying that you see IRS form 8995 that reports a carryforward from a previous year. if so, the form is holding the carryforward loss so it is available for use on a tax return at a later time.

If the form is removed, does the carryforward continue to re-generate IRS form 8995?

In TurboTax Online, are you able to view the carryforward at Federal / Income & expenses / Other business situations / Net operating loss/QBI carryforward loss?

In the current year, the Qualified Business Income Deduction can be generated from one of two components.

- The QBI component can result from a sole proprietorship, partnership, S corporation, trust or estate. The first component would likely be reported on Schedule C, Schedule E, Schedule F or a K-1.

- The REIT / PTP component can be generated from qualified real estate investment trust (REIT) dividends or qualified publicly traded partnership (PTP) income. The second component could be reported on 1099-DIV or a K-1.

If you can identify the source of the QBI, you can delete the form and re-enter or run through the TurboTax questions to make sure that the correct entry has been made.

See also this IRS Publication.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

robbinslin23

New Member

PCD21

Level 3

jwicklin

Level 1

berniek1

Returning Member

berniek1

Returning Member