- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

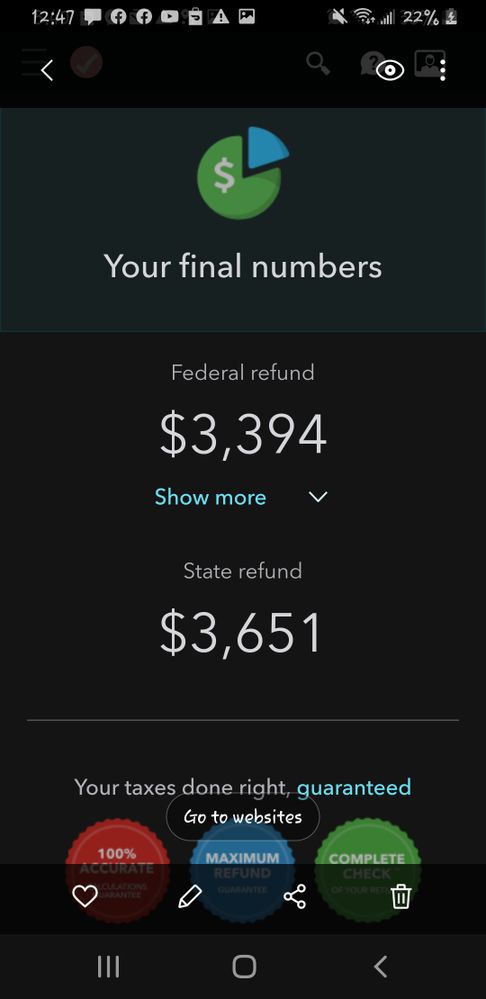

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

See this IRS website for federal tax refund FAQ's - https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

Why is my refund different than the amount on the tax return I filed?

All or part of your refund may have been used (offset) to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. You’ll get a notice explaining the changes. Where’s My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203 - Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unempl... has more information about refund offsets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

No I don't owe child support to past taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

Also how would I know if i qualified for stimulus check as well

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

Do you owe any past tax debt, or student loans? Depending upon your state, it's also possible for your refund to be offset to pay other debts also. Regardless, if your refund was offset, you'll receive a letter from the IRS stating why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

Those are simply the numbers shown after TurboTax finishes calculating your estimated refund. They do not have access to information regarding any kind of offset that may be applied to your refund, so the amount shown wouldn't reflect that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi question is regarding my Federal refund. Turbotax said I would get $3,349 refund & when I filed it was only $269?

Could it be possible something was entered wrong? My income for Lyft was $11,949 & it stated different on my forms. It that cause taxes are not deducted yet

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

OldCarGuy

Level 4

devstaneart3304

New Member

BenedictaIris

New Member

jtbrockwe27

New Member

ejmorgan010698

New Member