- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Previously reported savings bond interest error on TT premier 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previously reported savings bond interest error on TT premier 2023

Hi,

We had savings bond that matured in 2022, and we reported the interest on 2022 1040X, though we cashed in the savings bond in 2023. Since we cashed in the bond in 2023, we received a 2023 1099-INT. I entered the interest in Box 3 of 1099-INT Turbotax form, and checked "Savings Bond interest previously reported". However, SmartCheck (using TT 2023 Premier) gives an error, stating that it "cannot be previously reported bond interest since the program does not support this kind of adjustment to Special Handling Interest."

I saw another post that suggested checking "My accrued interest is included in this Form 1099-INT," but our situation is different than what that poster had done, since we have not been reporting the accrued value as interest each year; we reported it when the bond matured in 2022. If I change the "Adjustments to Interest" to "Other," then the error goes away, but then I am not able to let the IRS know on the Schedule B form that I had reported this savings bond interest previously.

Thank you for any advice!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previously reported savings bond interest error on TT premier 2023

I just had the same thing show up as I tested this.

BUT, it turned out to be an error in the way I entered the interest on the main 1099-INT.

I forgot that....

....On the main 1099-INT, You need to put the Savings Bond interest in box 3 of the main form.

....Then, of course the same amount on the follow-up page about having previously reported those Savings Bond $$. That cleared the problem for me....at least on the desktop software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previously reported savings bond interest error on TT premier 2023

Hi Steam Train,

Thank you for your prompt reply. I double-checked and the savings bond interest has been entered into Box 3 on TurboTax 1099 INT.

More suggestions, please?

Are you able to submit your federal tax return electronically on TT if the error persists, even though the tax form looks correct?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Previously reported savings bond interest error on TT premier 2023

Troubling.....yes. My Desktop Premier (on a Windows computer) doesn't have a problem.

1) make sure the previously reported interest, you enter on the follow-up page, is not greater than box 3 $$ amount.....might even try entering a few $$ less on the follow-up page as the previously-reported $$ amount, in case there is some strange rounding error.

2) Delete the 1099-INT, and re-enter it manually again? make sure the 1099-INT has only the box 3 $$ and the follow-up previously-reported amount, Don't put anything in any of the other boxes...no zero values anywhere.

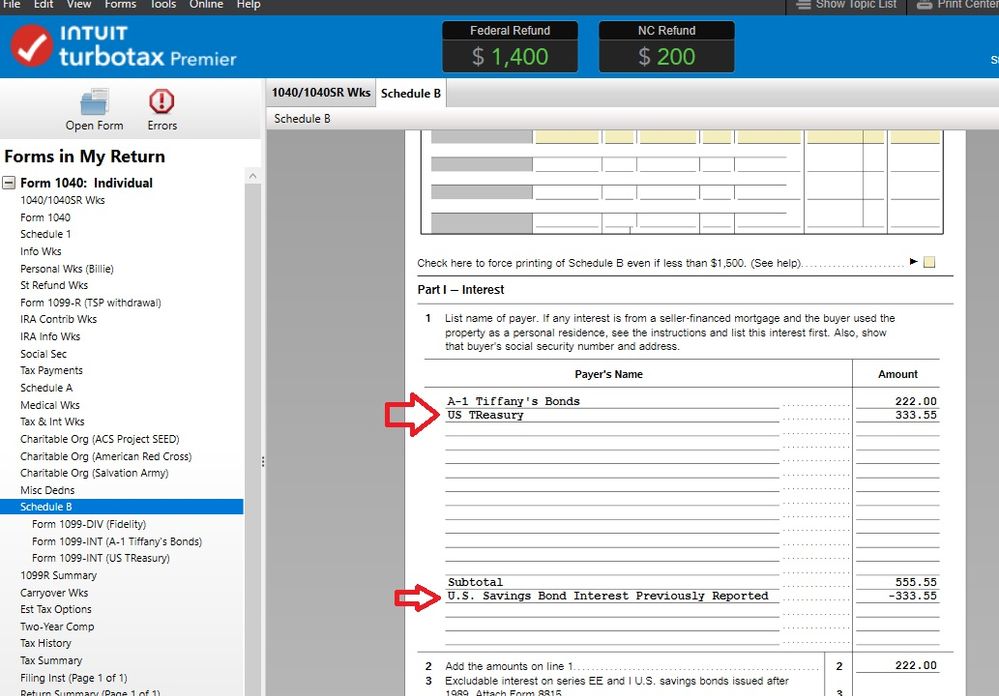

Can you e-file anyhow? Maybe, or maybe not...check your Schedule B in Forms Mode and see if the interest is taken out in the Part 1 Interest area (See picture below)

___________________

Otherwise...I'm clueless as to what to do.,,,other than Customer Support:

What is the TurboTax phone number? (intuit.com)

_____________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ja19584

New Member

saalves2424

New Member

Tax_Lego

Returning Member

yanks772

Returning Member

Mikewithaquestion

Level 3