- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- MO State Tax Part-Year Resident Income Adjustment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

I moved from TX to MO in 2023. MO allows two different methodologies for determining taxes owed as a Part-Year resident. You may either take the Missouri resident credit (MO-CR), which provides a credit for the taxes paid to another state – This option is available while filing through TurboTax but is not a good option for me since TX does not collect state income tax. There is another, more preferential option for me, which is completing the Missouri income percentage (MO-NRI) that helps determine the percentage of income earned in MO. This functionality does not appear to be available in TurboTax and needs to be added.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

TurboTax follows state tax law and can handle MO part-year returns. Enter the dates of your move in the personal information section, see instruction link below.

TurboTax will allow you to allocate your income between the two states so that you are only taxed on your MO sourced income.

How to allocate income for part-year returns

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

TurboTax follows state tax law and can handle MO part-year returns. Enter the dates of your move in the personal information section, see instruction link below.

TurboTax will allow you to allocate your income between the two states so that you are only taxed on your MO sourced income.

How to allocate income for part-year returns

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

I went back in and it is allowing me to allocate now. Thank you for your assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

Hi @steeleturner , I moved from Tennessee to Missouri this past year and am running into the same issues you had. What was your solution for this? It appears I have my date moved date correctly but it is not allowing me to allocate in Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

MO State Tax Part-Year Resident Income Adjustment

To use the Missouri income percentage, you'll need to make sure you've

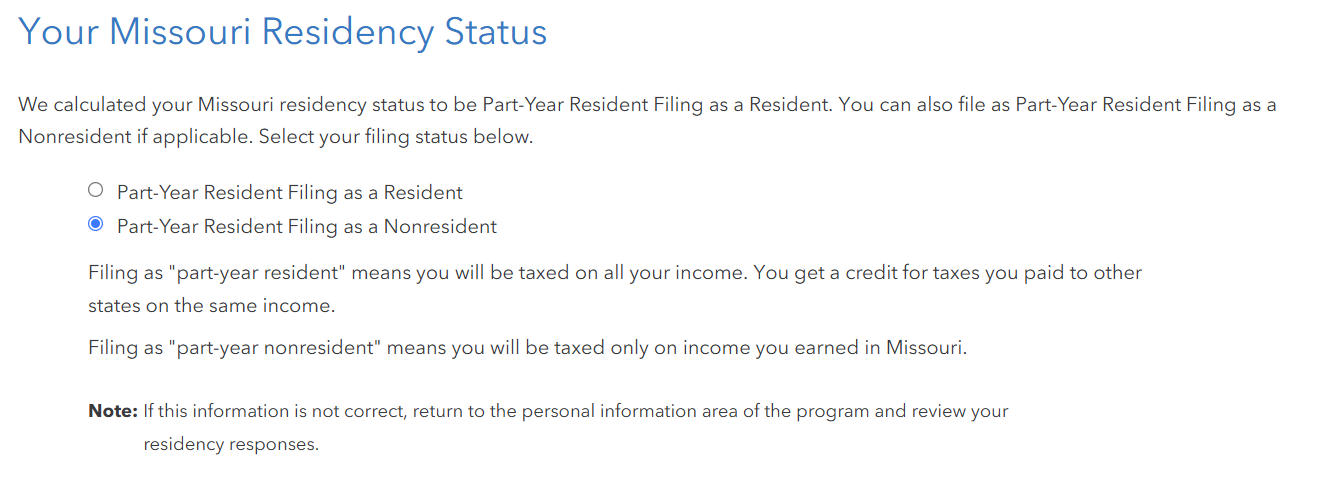

1. When asked about your residency status, choose Part-Year Resident filing as nonresident and click Continue.

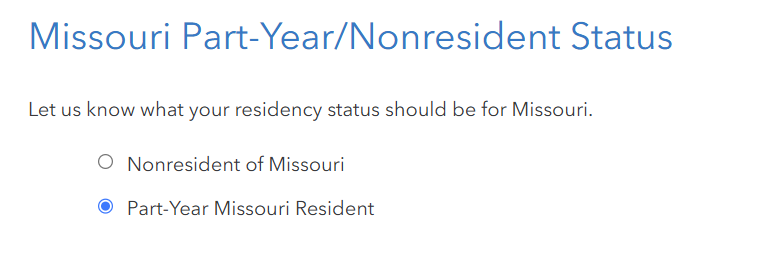

2. Choose Part-Year Missouri Resident and click Continue

3. Make sure your Missouri dates and Tennessee dates are correct on the next two screens. Click Continue.

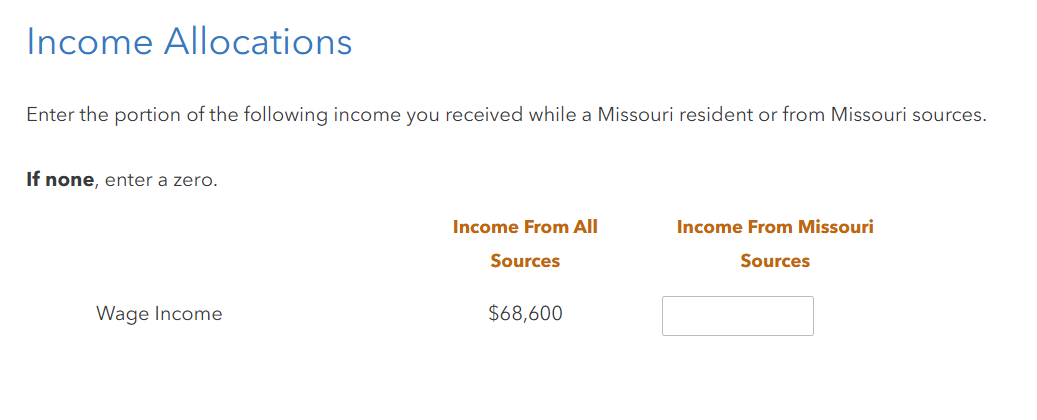

4. Continue through the screens, answering each question appropriately based on your situation. You will eventually get to a series of screens that say Income Allocations. Enter/update the amount of income earned from Missouri sources, as needed.

5. TurboTax will show you your income ratio and Missouri income tax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 2

tsxs2326

New Member

MerryCarpenter22443

New Member

richard-leonard-home

New Member

aww25

Level 1