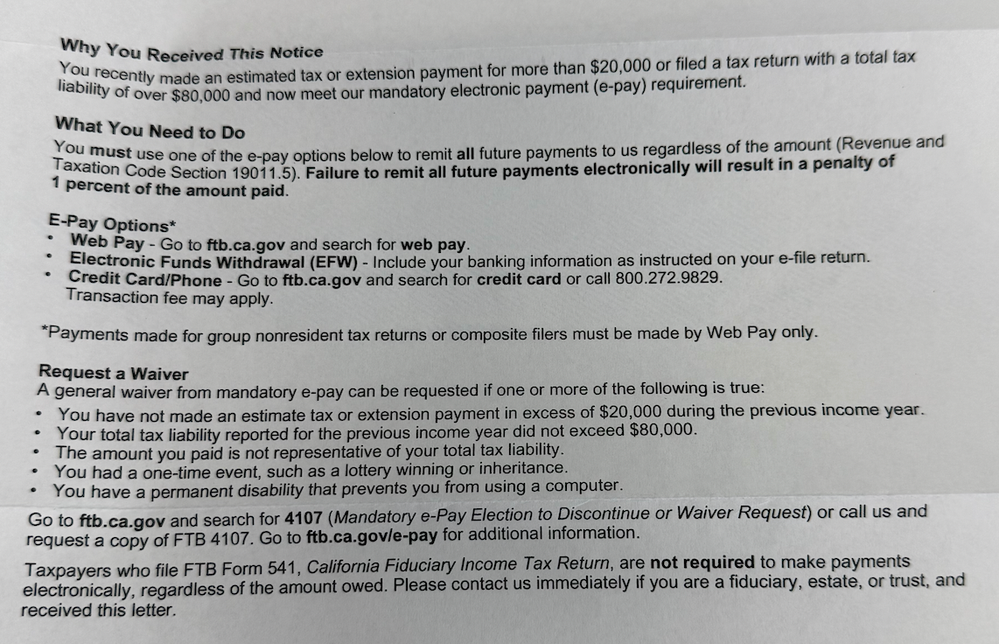

I received a letter from State of California Franchise Tax Board. I have been my taxes via e-file TurboTax. Please confirm if this means that I would need to continue to e-file the same way from next year onwards for 2025 taxes, and if that would be sufficient to satisfy this instruction. I don't need to do anything about it this year, right? I don't send my tax payments via check or mail anyway. Just making sure I follow the intructions accurately. Thank you!

(Just for context: I understand that I got this letter because I owed and paid more than $80k in 2024 taxes. I lost my job recently, so I may not owe that much from next year. But I understand I need to file electronically irrespective of the income. )