- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- IRS sent letter stating they did not receive my Turbotax e-file return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

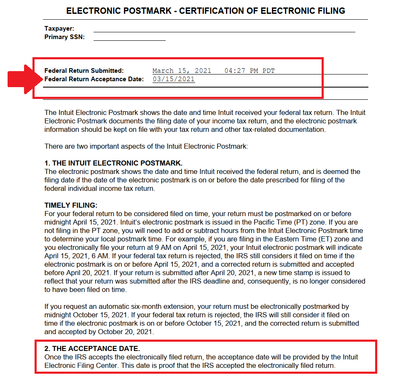

Look at the Electronic Postmark Report included in the tax return when using Print Center and the option for all worksheets. It will have the date/time the tax return was transmitted and the date it was Accepted by the IRS, if accepted.

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

Look for the form below in your PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

How would IRS know you are using TurboTax if they got nothing ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

Read the last paragraph @fanfare

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS sent letter stating they did not receive my Turbotax e-file return.

He didn't say the IRS knew it was Turbo Tax. Just that he sent it from Turbo Tax. I think The IRS must have got a tax due payment but not a retun. Or it's for another year?

For 2020...

You can double check your efile status here

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

When you efile you get back 2 emails. The first email only confirms the transmission. The second email says if the IRS (or state) Accepted or Rejected your efile.

When you log into your account you should also see the status and if it was Accepted or Rejected, Started, Printed, Ready to Mail, etc. What does it say?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

affidler

New Member

a1a00608cab4

New Member

gc121

New Member

47959087b53d

New Member

mickorcz

New Member