- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Topic 152 means that your tax returns may require further review and could take longer. Please see Topic 152 for more detailed information.

https://www.irs.gov/taxtopics/tc152

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

I just checked my status and mine is saying the same thing after midnight. The first message was it was still processing with no bars. Mine was accepted 1/25 with dependents and Schedule C for business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

My status says the samething … weird

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Isn’t this considered the PATH message. If so they do this every year eap if you have dependents or are getting an EIC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Mine says this exact thing and i keep getting hung up on my the irs. I filed and was accepted on Jan 26th. My app updated to this message yesterday. First I read that this was an error message. But I'm not sure. I want to know why would it be taking longer to process? Does it mean there is a problem with it? So frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

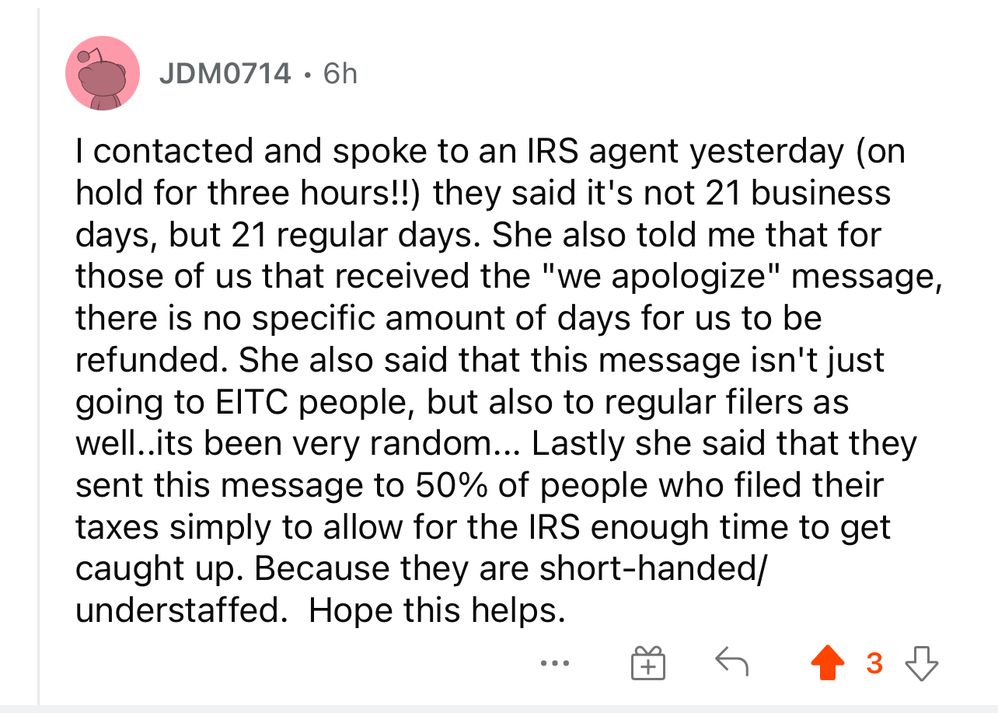

I read in another forum this comment:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Please see the below TurboTax help article for information on why some returns may take longer to process.

Why do some refunds take longer than others?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

I got the same message as well. Filed 1/24. Federal and State got accepted 1/24. Estimated federal refund date 2/14 and when checking my status it said to refer to topic 152. I got my state already deposited into my bank account. It was pending in my bank account on 2/3 and deposited on 2/7. Weird that I got my state before my federal. Hopefully everything is ok with my federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

You should be able to keep track of your return at our tracking guide here.

If it has been over 21 days since your return has been Accepted, please see this Help Article which explains why some refunds take longer than others.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

So you saying that they created that message just to give themselves enough time to get caught up.??🤔

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

The PATH Act, and the Tax Topic 152 message has existed since 2015. It isn't new, but the IRS is behind. Refunds on returns with EIC have started to be issued.

The Protecting Americans from Tax Hikes Act (PATH Act) prevents the IRS from issuing early refunds on any tax return that claims the Earned Income Tax Credit (EIC) and/or Additional Child Tax Credit.

Congress passed the PATH Act because identity thieves frequently claim one or both of these refundable tax credits. The PATH Act gives the IRS extra time to detect fraudulently-filed returns, which helps identity theft victims get their legitimate refunds more quickly.

The IRS usually begins issuing tax refunds on returns with the EIC or Additional Child Tax Credit in late March.

If your return contains either of these credits, you can track its status at the IRS Where's My Refund? site.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

The part about issuing refund with EITC in late March your wrong. They have always been deposited mid February up to the first week of March! Your a tax expert and you don’t know this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

I have the same message. I filed electronically on Jan. 25th. I am single with no EIC or dependents. I was originally told I should get mine by 2/15. I called yesterday and got zero help. I am very discouraged and hope this will process soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was told to refer to topic 152 and provided with this message We apologize, but your return processing has been delayed beyond the normal timeframe. Should I worry?

Did you get any help yet? I got no help was supposed to receive 2/15 as well

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ganar

Level 2

ktmorrison96

New Member

dmae2888

New Member

dylancummings290

New Member

dweik201-gmail-c

New Member