- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I accidentally put I didn’t get my stimulus money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

If you filed your 2020 income tax return and entered that you did not get your second stimulus check, you may have to amend your income tax return.

- The IRS has announced that they will begin accepting and processing 2020 individual tax returns on February 12, 2021.

If your return gets rejected, you'll be able to add the stimulus payment and submit the corrected return.

If your return gets accepted:

- The IRS may correct your return and remove the stimulus payment in which case you don't have to amend your return.

- If the IRS does not correct your return to remove the stimulus payment, you'll have to amend your income tax return.

- NOTE: At this time, you're not able to amend a 2020 income tax return. Check the forms availability to see the date you'll be able to amend.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Put it into some bitcoins until they ask about it perhaps

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Wait until you receive your refund -- the IRS might make a correction automatically. Please see IRS Recovery Rebate Credit Q D2 What happens if I claim the incorrect amount? for additional information.

If your refund does contain the stimulus payment you will need to amend your return and send the funds back to the IRS. Please see the instructions contained in these TurboTax Help articles to amend your return:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

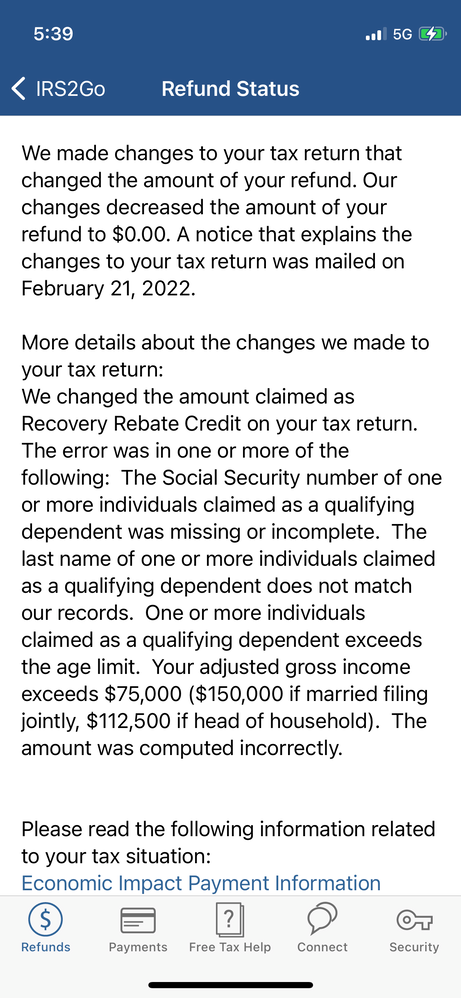

So for 2021 taxes, I accidentally claimed not receiving my 3rd stimulus of 1400 because when I logged into my bank app I could not find it, but then went into the bank and they found it which stinks… my original return was 2984 with the 1400 recovery rebate credit (claimed the rebate by honest mistake), but now the gov’t amended it and says amount of my refund is 0$. What happened to my 1584??? I’m wondering if this is just a stepping stone to them calculating what my actually return should be… shouldn’t be $0 :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

So for 2021 taxes, I accidentally claimed not receiving my 3rd stimulus of 1400 because when I logged into my bank app I could not find it, but then went into the bank and they found it which stinks… my original return was 2984 with the 1400 recovery rebate credit (claimed the rebate by honest mistake), but now the gov’t amended it and says amount of my refund is 0$. What happened to my 1584??? I’m wondering if this is just a stepping stone to them calculating what my actually return should be… shouldn’t be $0 :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Please clarify - Did it say your refund was $0 or your Recovery Rebate was $0? If it says your Recovery Rebate is zero, that is fine because it should be zero since you already received it. They are probably still processing your return and letting you know they have adjusted your recovery rebate to zero.

Also, check Where's My Refund to see if it has any updated information.

Recovery Rebate Credit - it appears the IRS correctly adjusted this to zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Nope it says my new return is $0. 2984 went down to 0$ but should have just been 2984-1400 since the 2984 amount was with the added 1400.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

We cannot see your tax return. However, here is how I assess the IRS statements that you posted.

The Social Security number of one or more individuals claimed as a qualifying dependent was missing or incomplete.

The last name of one or more individuals claimed as a qualifying dependent does not match our records.

One or more individuals claimed as a qualifying dependent exceeds the age limit.

A dependent is disallowed as a qualifying child.

Tests to be a Qualifying Child

- The child must be your son, daughter, stepchild, foster child, brother, sister, half- brother, half- sister, stepbrother, stepsister, or a descendant of any of them.

- The child must be (a) under age 19 at the end of the year and younger than you (or your spouse if filing jointly), (b) under age 24 at the end of the year, a student, and younger than you (or your spouse if filing jointly), or (c) any age if permanently and totally disabled.

- The child must have lived with you for more than half of the year.

- The child must not have provided more than half of his or her own support for the year.

- The child must not be filing a joint return for the year (unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid).

Your adjusted gross income exceeds $75,000.

After a qualifying dependent was removed from the tax return, I suspect that you no longer qualified as Head of Household.

The $1,400 Recovery Rebate Credit was not issued because you had already received the third stimulus check.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

I appreciate everyone’s reply. My social is correct and I’m single with no kids or dependents ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

I would wait until you can either access your transcript or receive a letter from the IRS. It's difficult to wait, but until you know exactly how they changed the tax return you really cannot amend it. And you may not need to amend it.

If you get the correct refund after the $1,400 is removed there is nothing to do. If the IRS does not release the balance of your refund, then you can do an amended tax return to correct the error.

This has been an unprecedented two tax seasons with all the changes taking place before, during and after. It's challenging to everyone and that includes the IRS.

Please update here when you have more details and one of our tax experts will help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

I did the same thing. Did you resolve the situation because contacting the IRS is impossible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

@yinshi22 Do not amend. You just have to wait for the IRS to fix your mistake. By answering incorrectly about the stimulus amount you received you put an amount on line 30 of your Form 1040. The IRS checks that line. They know how much they sent to you. They will reduce your refund by that amount. This will delay your refund so expect a wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I accidentally put I didn’t get my stimulus money

Since it was a mistake they should correct it. They just deducted it from my expected return and now I owe them. It doesn't make sense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tylerr123

New Member

Falloutgirl

New Member

tuffy7999

New Member

Purplemonkey

New Member

RamGoTax

New Member