- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to deal with adjustment made by IRS and 1040X that was filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

My fiancee's tax return fell into the trap of being eligible for additional tax credits/adjustments due to the stimulus act. Specifically, changes made after she had originally filed and received her initial refund were:

1) The amount of unemployment compensation she originally claimed as taxable income was offset by the stimulus changes. This resulted in a decrease initially in her tax liability of $237, bringing her tax liability to $0.

2) Because of Line 1, it also brought her below the income threshold to make her eligible for the EITC, which she was not eligible prior to this change.

3) Her child tax credit also changed due to the above changes.

We e-filed a 1040X for her through TurboTax back in March. On the 1040X, we provided the following info to the IRS in the "Explanation of changes" on the 1040X (I've redacted actual values):

- Lines 1, 3, 5: AGI reduced by $xxxx due to change in Schedule 1

exempting up to $10,200 in unemployment compensation for 2020.

- Line 6: Tax amount reduced due to decrease on Line 5

- Line 7: Credits reduced to prevent credits from exceeding total tax

- Line 14: Due to above changes, EIC credit taken based on now meeting

income thresholds for eligibility

- Line 15: Due to above changes, child tax credit restructured and return

now includes Schedule 8812.

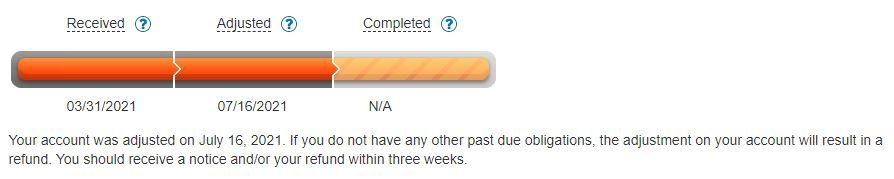

In late July, she received a mailed CP21B from the IRS with a "Decrease in tax" and the notice "We changed your 2020 Form 1040 because of recent tax laws, rulings, or regulations required us to correct your unemployment compensation. As a result, you are due a refund of $xxx.xx". She also received a direct deposit of that amount, plus interest. THIS refund only reflects the amount due solely due to removal of the unemployment from taxable income. In the letter that was received, under "What you need to do", it says if she agrees with the changes made, she should receive a refund in the next few days (which she did receive). And if she did not agree with the changes, to call to review the account with a representative. We're not sure about what happened with the 1040X in regards to the EITC. We have tried calling multiple times, but can not get through at all. When checking her 1040X status online, the below appears -- noting that the "Completed" section is still not filled in and the date says "N/A".

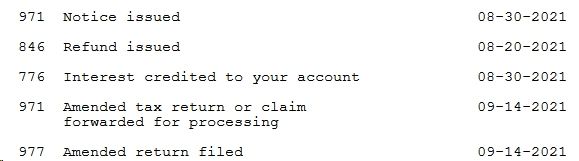

SO -- the question is -- they've received the 1040X and indicated they made an adjustment. However, that adjustment doesn't match what she is now eligible for on the 1040X. We're not sure if this letter was in response to the 1040X - or - if it was part of the automatic recalculation they were doing for the UCE. Are they still processing this? Do we just let things sit for a while to see what happens? Do we file another 1040X and use this now adjusted info from the IRS? I pulled her Record of Account Transcript, which shows the following:

971 Amended tax return or claim forwarded for processing 03-31-2021 $0.00

977 Amended return filed 03-31-2021 $0.00

291 Reduced or removed prior tax assessed 07-26-2021 -$xxx.xx

971 Notice issued 07-26-2021 $0.00

846 Refund issued 07-14-2021 $xxx.xx

776 Interest credited to your account 07-26-2021 -$x.xx

The next question is --- how the heck can I prepare a set of records in TurboTax now with the correct info? I would imagine I would have to enter information manually in forms mode -- and I will likely have to perform some overrides -- but I'm not sure how to do that. Fortunately I do have the full PDF outputs of both the original 1040 return and all worksheets, as well as the 1040X and all worksheets. But for NEXT year, I want to make sure I have all of the correct info to import from this year.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

No problem. The IRS only calculates and refunds the tax withheld foe unemployment. Other that credits, like EITC must be claimed in an amended tax return. Amended returns (1040X) normally take about 4 months to process, but because of COVID delays, this is not a normal year so amended returns can now take 6 months or longer.

If the 1040X was filed in March then do not expect it to be processed until September or later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

my amended return to claim additional credit in this situation was processed within 16 weeks as advertised.

But now they are taking their time sending out the actual check and adjustment letter. Still waiting for that to happen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

So, I'll follow-up with what happened.. I did end up getting in touch with a representative who went over the file. First off -- all of the "Wheres my 1040X?" status messages -- were related to the automated adjustment for the UC. The representative did have additional information related to the actual 1040X that was submitted. It was assigned to an IRS employee on July 23rd, and he expected that it would be completed within 4 weeks or so -- with a mailed check to follow. So, in short -- continue to wait and do not file an additional 1040X -- even though it now says the 1040X was completed.

And to answer my own question -- the updated 1040 in TurboTax should reflect the actual filed return once everyone does their part and the adjustments are made.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

The only thing you need to import (or enter) from last year are any carryover amounts,

such as, Capital Losses in excess of $3,000, large charitable contributions to be deducted,

Net operating loss, prior years basis in IRAs, deferred deduction of payback of 2020 COVID distributions, etc.

Make a note of it rather than rely on TurboTax, you might not even use TurboTax next time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Hi @NewYorkTaxpayer ,

Did you guys get your second check or any other communication based on 1040X?

We are in same boat as you! We got our first check for the Unemployment adjustment and now the status says 'Completed'. But no additional check yet and the IRS Transcript doesn't reflect any of the additional changes we had made.

Thanks for the response!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Same here. No change in transcript and 1040x status page says completed. We’ll give it several more weeks and then call to see if it’s still assigned to someone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

You can check the status of an amended tax return here if the IRS has entered it into the system.

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Yes - but if the IRS made only the UCE adjustment, it shows the amended return as complete on the online tool, despite the fact the amended return is still in process. If you filed a 1040X for additional adjustments, the online tool doesn’t reflect the progress of those. I had to call to confirm that the amended return was actually still in process and they were able to give me more info than shown on transcript or the 1040x status checker (specifically that it had been assigned to a specific agent a week after the online tool says it was “completed” and that it was still being processed)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Hi there again! Any luck so far? I completed 16 weeks last week. Waiting for my 20'th week to call them. As per the message on IRS website, no point in calling before 20 weeks! :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Yes. On 9/21, her transcript shows an entry now for Amended Return Received. Still waiting. Our theory is it will be another 12-16 weeks, but hopefully sooner. Fortunately she is in no rush.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Thank you! I just checked my Record of Accounts and see a new entry on 9/14 for 'Amended Return Filed' whereas my original amended return date was in early July! I think your theory is logical; this is practically a 'new' amendment for IRS and 16 - 20 weeks from this date! Crazy times indeed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

She has the exact same two lines on hers as well.. I was mistaken on the date -- I checked again and it was 9/14 like yours.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with adjustment made by IRS and 1040X that was filed?

Interesting! Then I am pretty sure it is a System update!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chrstnbond

Level 1

actuning7

Returning Member

wesleeolmstead

New Member

lorettavanheel4

New Member

lorettavanheel4

New Member